First look at the support target finding buyers

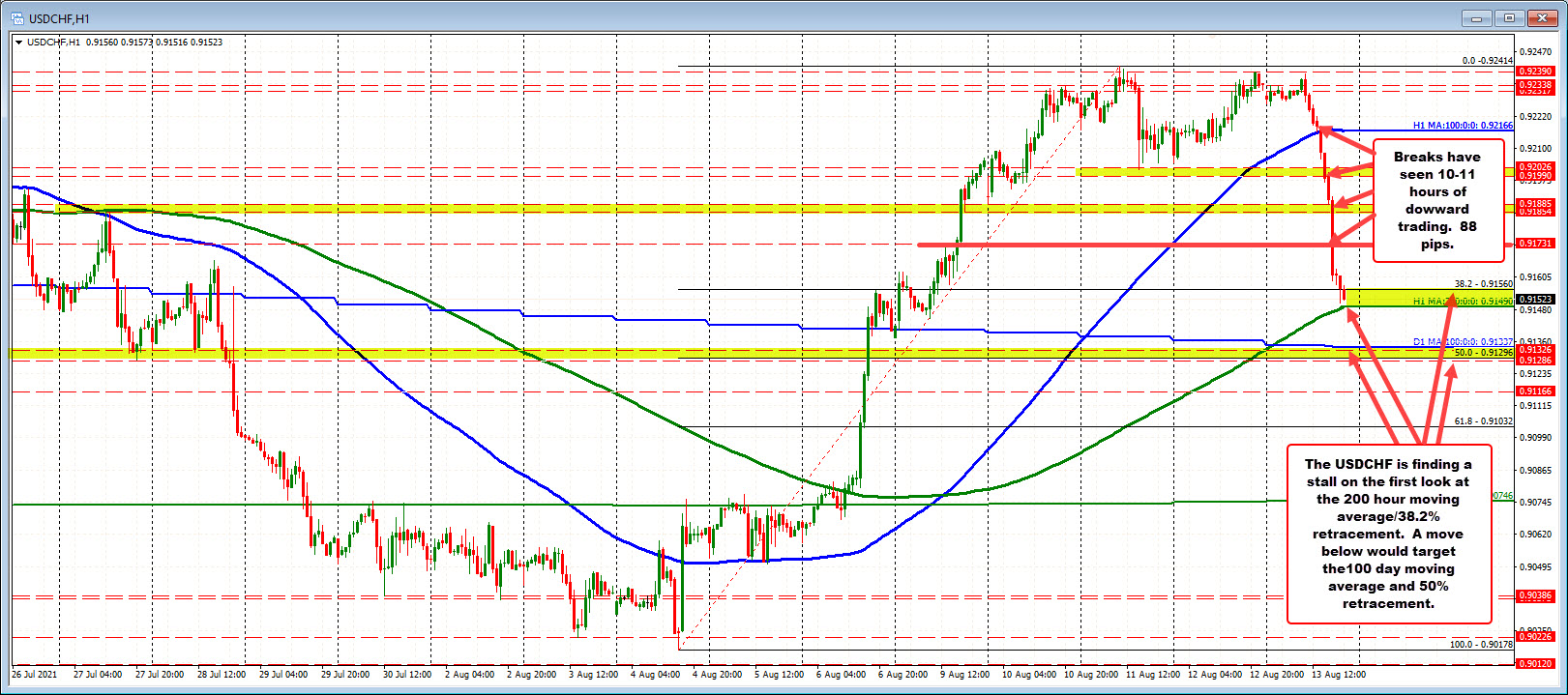

The USDCHF has moved steadily lower (trending) over the last 10/11 hours of trading. The move took the price from the near the high for the week near 0.92414 (the high was at 0.9238 today), to a low of 0.91508 (about 88 pips). The average trading range over the last month has been around 53 pips.

The test of the dual support area is giving sellers some cause for pause (profit taking). Dip buyers may also lean against that level in hopes that the selling is overdone and a quick bounce might ensue with limited risk (sell on a break of the 200 hour MA).

If there is a bounce, traders will look at the 0.9173 level as a potential target area that would give the dip buyers some comfort.

This article was originally published by Forexlive.com. Read the original article here.