Gold up $18

I think the reflation trade is about to come back to life as infrastructure comes into focus and Powell emphasizes patience on tapering/raising rates.

The bond market also offering a helping hand with 30-year yields giving it all back today, down 5.5 bps to 1.98%.

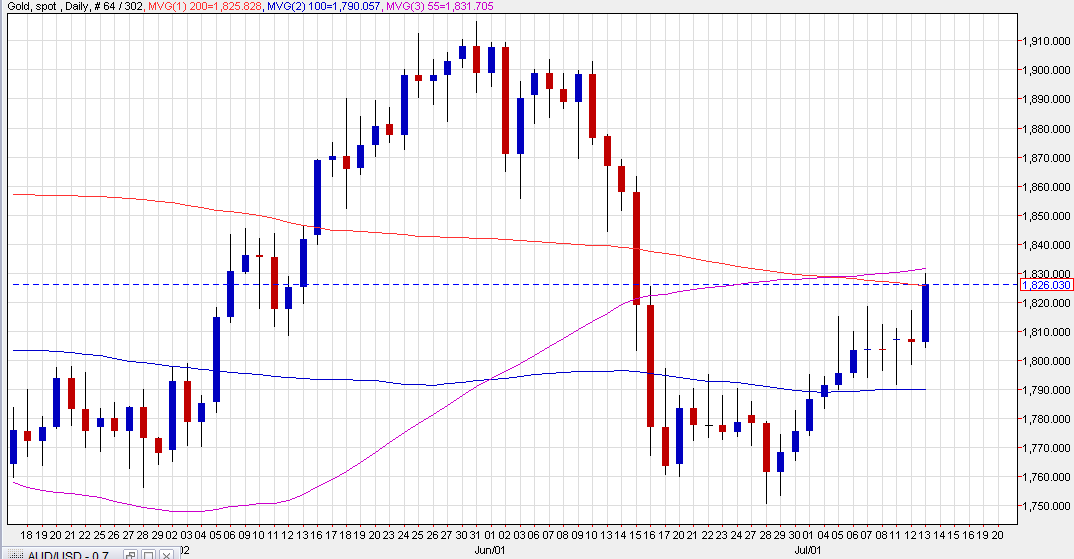

Technically, it’s stalled out right at the confluence of the 200-day moving average and the 55-dma but the larger feature for me on the chart is the break higher today after a week of doji stars. It will take some help (perhaps strong retail sales on Friday?) but there is plenty to like in the chart.

This article was originally published by Forexlive.com. Read the original article here.