Forex news for North American trade on July 9, 2021:

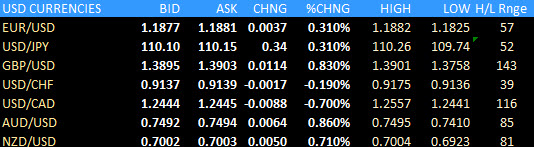

Markets:

- Gold up $6 to $1808

- US 10-year yields up 7.2 bps to 1.32%

- WTI crude up $1.71 to $74.65

- S&P 500 up 49 points to 4369

- AUD leads, JPY lags

For a holiday-shortened week at a time of year that can be absolutely dead, this one had plenty of twists and turns. Friday was no different as the week-long bid in the US dollar vanished in a broad set of retracements that erased so of this weeks gains, and in some cases (cable is one) the dollar gains disappeared altogether.

The dollar was soft coming into New York trade but softened further as Treasury yields steadily rose. The mood in stocks also improved right into the close for another record.

The news front was quiet with nothing of consequence in the US but Canadian jobs were strong, aside from full time work. The drops in unemployment and rising participation were particularly notable. The loonie strengthened on the release but only kept pace with AUD and NZD on the day, in spite of oil gains.

The eye-opener was cable, which finishes the day up 113 pips and flirting with 1.3900, which is the weekly high. UK GDP earlier wasn’t strong but the bid has been relentless. The lone pullback came into the London fix when it was slammed 50 pips lower in seconds. It took a few hours to recoup that loss but it did and more.

All eyes will be on the soccer pitch at the open on Monday as the England-Italy game kicks off just before New Zealand trade. Boris has floated the idea of a bank holiday if England wins. Have a great weekend.