Forex news for North American trading on July 2, 2020

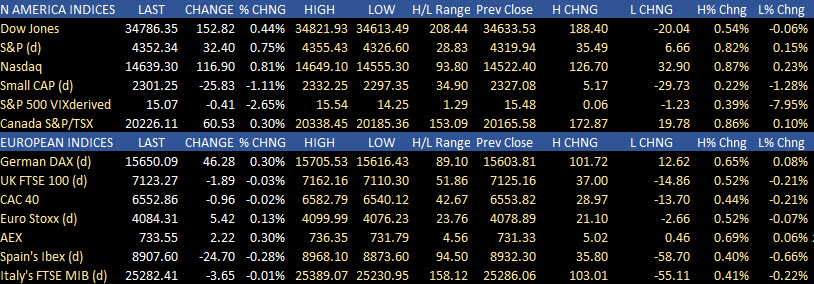

In other markets as the week comes to a close shows:

- Spot gold is trading up $10.69 or +0.6% at $1787.29.

- Spot silver is up $0.44 or 1.69% $26.45

- WTI crude oil futures are trading down nine cents or -0.11% at $75.15

- Bitcoin is trading down $293 or -0.9% at $33,105

The US jobs report for June was released and showed a greater than expected 850k jobs added vs 700K estimate May was revised to 583K vs 559K. The April report was revised slightly lower to 269K vs 278K.

The unemployment rate came in and 5.9% versus 5.7% estimate and 5.8% last month.

The U6 unemployment rate dipped to 9.8% versus estimate of 10.2%.

The participation rate remains low at 61.6%.

Average hourly earnings increase by 0.3% versus 0.5% last month and the average workweek decline to 34.7 hours from 34.9 hours.

Service jobs added 642,000 led by a gain of 343,000 in leisure and hospitality, 99,000 in trade transportation and utilities and 72,000 in professional business services.

Government jobs on the state and local level increase by 193K. Federal jobs fell by -5K in the current month.

Goods producing jobs added just 20K

Overall, although the nonfarm jobs was much higher-than-expected, the market was not scared of a faster Fed taper (tightening is 2022 at the earliest). The expectations for June 2022 tightening of 1/4% remain at 50% while October 2022 was also steady at 100%.

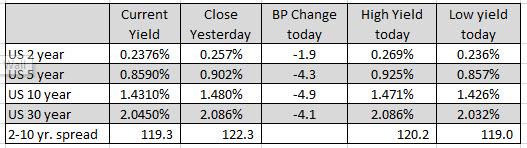

US yields moved lower with the tenure yield down -4.9 basis points to 1.431%. The 30 year yield fell -4.1 basis points to 2.045%. The 2-10 year spread continue to contract to 119.3 basis points from 122.3 basis points at the close yesterday

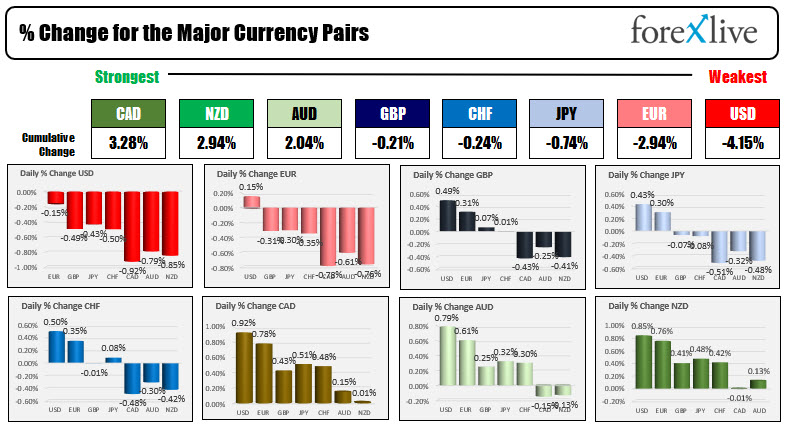

In the forex market, the USD was the weakest of the majors with the greenback declining versus all the major currencies. The biggest movers were versus the risk/commodity currencies. The USD fell by -0.92% vs the CAD, -0.85% vs the NZD and -0.79% vs the AUD. The dollar fared the best vs the EUR (down -0.15%).

Ranking the strongest to weakest, the CAD was the strongest and the USD was the weakest of the majors

The not so scary jobs number helped to push stocks higher (once again). The S&P index is up for seven consecutive days, and closed at a successive new all-time high for the seventh consecutive day as well. The NASDAQ index closed at a record high for the second consecutive day and was up for a five trading days this week. The Dow industrial average joined the record close party, by closing at a record for the first time since May 7.

European shares closed mixed with modest gains/losses.