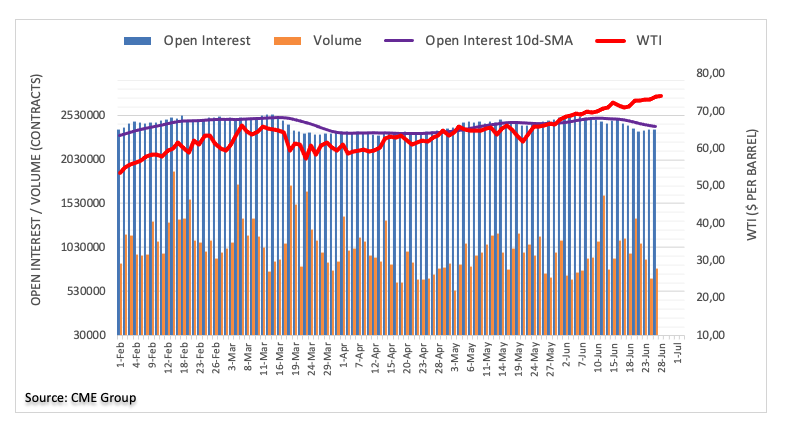

Investors trimmed their open interest positions by around 3.3K contracts at the end of last week, as per advanced prints from CME Group. On the flip side, volume reversed three consecutive daily drops and increased by nearly 122K contracts.

WTI clinches new 2021 highs

The rally in the West Texas Intermediate remains well and sound and prices navigate in new YTD highs well above the $70.00 mark per barrel. Overbought conditions – as per the daily RSI – and shrinking open interest on Friday keep calling for a near-term corrective downside.

This article was originally published by Fxstreet.com. Read the original article here.