The low today was lower than yesterday’s but above the low on Wednesday

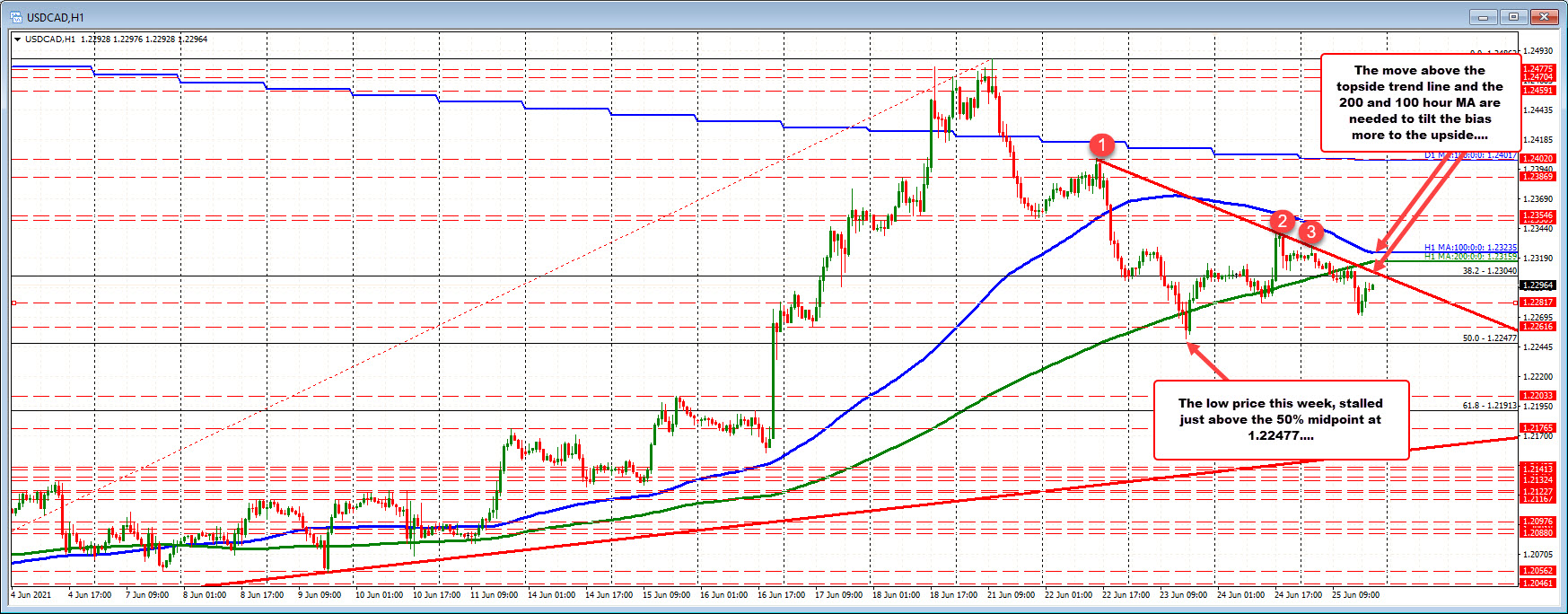

The USDCAD reached its high this week on Monday at 1.24863. That high was also the highest level since April 26, and took out the high from last week at 1.24801. However, that new high was only 6 pips above the April high before stalling. As a result, the buyers turned to sellers and the price drifted lower.

The move lower reach day bottom on Wednesday at 1.22516. That low was just above the 50% retracement of the June trading range at 1.22477 (the low for the month was on June 1).

The corrective move from the low on Wednesday has taken the price back above the 200 hour moving average, but could not extend to the 100 hour moving average (blue line). Today, the price moved back below the 200 hour moving average and it remains below.

Going forward, a move back above the downward sloping trendline cuts across at 1.2306. Just above that is the 200 hour moving average of 1.23159 followed by the 100 hour moving average of 1.23235.

If the buyers are to take more control, getting back above those levels would be eyed.

The downside the obvious hurdle to get below to increase the bearish bias would be the 50% midpoint at 1.22477.

Moving above the moving averages or below the 50% retracement may take until next week. However the technical levels are set. Traders can look for the next shove.