Dollar softens quite notably in early US session as markets await FOMC rate decision. Though, Swiss Franc and Euro appear to be slightly weaker. On the other hand, Kiwi and Aussie are strengthening mildly but Canadian Dollar shrugs off stronger than expected consumer inflation data. Sterling also firms up mildly earlier today, but lacks follow through buying.

FOMC statement and economic projections are the main focuses for the rest of the day. Fed is unlikely to start talking about tapering for now. however, the economic forecasts could firstly unveil policymakers’ view on how “transitory” the surge in inflation would be. Also, the latest dot plots would show how many of them pull ahead their expectations on rate hikes.

Here are some previews on FOMC:

In Europe, at the time of writing, FTSE is up 0.03%. DAX is down -0.16%. CAC is up 0.07%. Germany 10-year yield is down -0.0105 at -0.240. Earlier in Asia, Nikkei dropped -0.51%. Hong Kong HSI dropped -0.70%. China Shanghai SSE dropped -1.07%. Singapore Strait Times dropped -1.11%. Japan 10-year JGB yield rose 0.0012 to 0.050.

Canada CPI rose to 3.6% yoy in May, highest since 2011

Canada CPI accelerated to 3.6% yoy in May, up from 3.4% yoy, above expectation of 3.5% yoy. That’s the largest increase since May 2011. Excluding gasoline, CPI rose 2.5% yoy. Looking at some details, prices rose in every major component on a year-over-year basis. Shelter prices rose 4.2% yoy, largest since September 2008. Durable goods prices rose 4.4% yoy, largest since 1989.

CPI common rose to 1.8% yoy, up from 1.7% yoy, matched expectations. CPI median rose to 2.4% yoy, up from 2.3% yoy, matched expectations. CPI trimmed rose to 2.7% yoy, up from 2.3% yoy, above expectation of 2.4% yoy.

Also released, Canada wholesale sales rose 0.4% mom in April, versus expectation of -1.0% mom.

From the US, housing starts rose to 1.57m in May, versus expectation of 1.64m. Building permits dropped to 1.68m, versus expectation of 1.73m. Import price rose 1.1% mom, versus expectation of 0.7% mom.

Ifo lowers Germany GDP forecast to 3.3% in 2021, upgrades to 4.3% in 2022

The Ifo institute lowers Germany growth forecast for 2021 to 3.3%, down from March forecast of 3.7%. 2022 GDP growth is now estimated to be 4.3%, upgraded from prior projection of 3.2%. Unemployment rate is expected to drop from 5.9% in 2020 o 5.8% in 2021, and then 5.2% in 2022. CPI is expected to accelerate from 0.5% in 2020 to 2.6% in 2021, but slowed to 1.9% in 2022.

“With falling infection rates and progress in vaccination against Covid-19, the existing economic restrictions should gradually be lifted,” it said. “There are no longer any obstacles to an economic recovery in trade and contact-intensive services by the end of 2021.” However, “in the short term, bottlenecks in the supply of intermediate products will have a dampening effect, so the manufacturing boom is likely to cool somewhat in its further course.”

UK CPI jumped to 2.1% in May, core CPI rose to 2.0%

UK CPI accelerated to 2.1% yoy in May, up from 1.5% yoy, above expectation of 1.8% yoy. Core CPI jumped to 2.0% yoy, up from 1.3% yoy, above expectation of 1.3% yoy. RPI also jumped to 3.3% yoy, up from 2.9% yoy, above expectation of 2.4% yoy.

ONS Chief Economist Grant Fitzner said: “The rate of inflation rose again in May and is now above 2% for the first time since the summer of 2019. This month’s rise was led by fuel prices which fell this time last year, but have jumped this year thanks to rising crude prices. Clothing prices also added upward pressure as the amount of discounting fell in May.”

Also released, PPI input came in at 1.1% mom, 10.7% yoy versus expectation of 1.1% mom, 9.0% yoy. PPI output was at 0.5% mom, 4.6% yoy, versus expectation of 0.4% mom, 4.5% yoy. PPI output core was at 0.4% mom, 2.7% yoy, versus expectation of 0.2% mom, 2.9% yoy.

Japan exports rose 49.6% yoy in May, imports rose 27.9% yoy

Japan exports rose 49.6% yoy to JPY 6261B in May. That’s the largest rise since 1980. Imports rose 27.9% yoy to JPY 6448B. Trade surplus came in at JPY 187B, comparing with JPY 857B a year ago.

Looking at some details, exports to China rose 23.6% yoy to JPY 1393B. That was led by growth in chip production equipment, hybrid cars, and scrap copper. Exports to the US rose 87.9% yoy to JPY 1104B. Cars and auto parts led the growth to US-bound exports.

In seasonally adjusted terms, exports rose 0.0% mom to JPY 6860B. Imports rose 0.7% mom to JPY 6817B. Trade surplus narrowed to JPY 43B, down from JPY 84B.

Westpac: RBA unlikely to rate until 2025 to hike rates

Australia Westpac-MI leading index dropped eased from 2.86% to 1.47% in May. That’s the six-month annualized growth rate , which indicates the likely pace of economic activity relative to trend, three to nine months into the future. The index has moderated form just under 5% six months ago.

Westpac said that given the “improved pulse” of economic data as signalled by the leading index, “it seems unlikely that the Board would expect to have to wait until 2025 before it achieves the objectives necessary to justify the first cash rate increase since November 2010.” Also, it expects RBA to not extend the yield curve target from April 2024. RBA would decide to maintain the policy of AUD 5B of asset purchases per week, without setting a final target, to allow maximum flexibility.

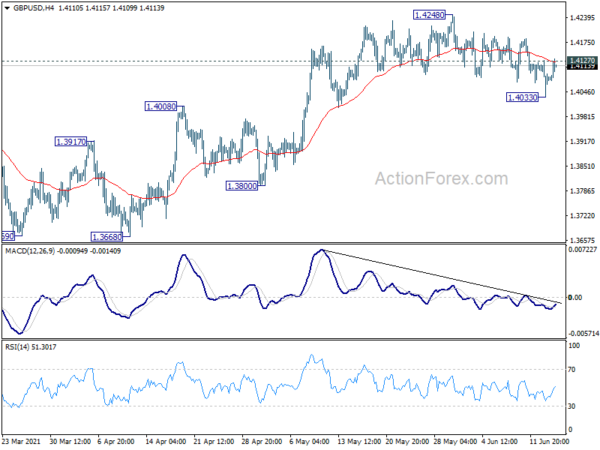

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.4036; (P) 1.4083; (R1) 1.4131; More…

Intraday bias in GBP/USD is turned neutral with today’s recovery and break of 1.4127 minor resistance. On the downside, break of 1.4033 will target 1.4008 resistance turned support. Sustained break there should confirm that consolidation pattern from 1.4240 has started the third leg. On the upside, though, break of 1.4248 will resume larger up trend from 1.1409.

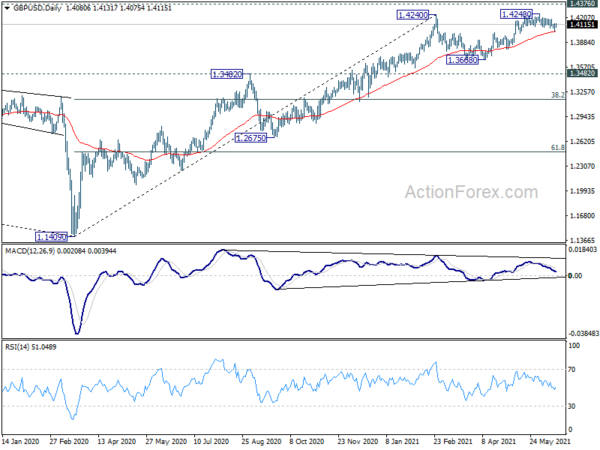

In the bigger picture, as long as 1.3482 resistance turned support holds, up trend from 1.1409 should still continue. Decisive break of 1.4376 resistance will carry larger bullish implications and target 38.2% retracement of 2.1161 (2007 high) to 1.1409 (2020 low) at 1.5134. However, firm break of 1.3482 support will argue that the rise from 1.1409 has completed and bring deeper fall to 1.2675 support and below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Current Account (NZD) Q1 | -2.90B | -2.35B | -2.70B | -2.59B |

| 23:50 | JPY | Trade Balance (JPY) May | 0.04T | 0.24T | 0.07T | 0.08T |

| 23:50 | JPY | Machinery Orders M/M Apr | 0.60% | 2.70% | 3.70% | |

| 00:30 | AUD | Westpac Leading Index M/M May | -0.10% | 0.20% | ||

| 06:00 | GBP | CPI M/M May | 0.60% | 0.60% | 0.60% | |

| 06:00 | GBP | CPI Y/Y May | 2.10% | 1.80% | 1.50% | |

| 06:00 | GBP | Core CPI Y/Y May | 2.00% | 1.30% | 1.30% | |

| 06:00 | GBP | RPI M/M May | 0.30% | 0.20% | 1.40% | |

| 06:00 | GBP | RPI Y/Y May | 3.30% | 2.40% | 2.90% | |

| 06:00 | GBP | PPI – Input M/M May | 1.10% | 1.10% | 1.20% | |

| 06:00 | GBP | PPI – Input Y/Y May | 10.70% | 9.00% | 9.90% | 10.00% |

| 06:00 | GBP | PPI – Output M/M May | 0.50% | 0.40% | 0.40% | |

| 06:00 | GBP | PPI – Output Y/Y May | 4.60% | 4.50% | 3.90% | 4.00% |

| 06:00 | GBP | PPI Core Output M/M May | 0.40% | 0.20% | 0.50% | |

| 06:00 | GBP | PPI Core Output Y/Y May | 2.70% | 2.90% | 2.50% | |

| 07:00 | CNY | Retail Sales Y/Y May | 12.40% | 14.00% | 17.70% | |

| 07:00 | CNY | Industrial Production Y/Y May | 8.80% | 8.90% | 9.80% | |

| 07:00 | CNY | Fixed Asset Investment YTD Y/Y May | 15.40% | 16.80% | 19.90% | |

| 12:30 | CAD | Wholesale Sales M/M Apr | 0.40% | -1.00% | 2.80% | 3.20% |

| 12:30 | CAD | CPI M/M May | 0.50% | 0.40% | 0.50% | |

| 12:30 | CAD | CPI Y/Y May | 3.60% | 3.50% | 3.40% | |

| 12:30 | CAD | CPI Common Y/Y May | 1.80% | 1.80% | 1.70% | |

| 12:30 | CAD | CPI Median Y/Y May | 2.40% | 2.40% | 2.30% | |

| 12:30 | CAD | CPI Trimmed Y/Y May | 2.70% | 2.40% | 2.30% | |

| 12:30 | USD | Housing Starts May | 1.57M | 1.64M | 1.57M | 1.52M |

| 12:30 | USD | Building Permits May | 1.68M | 1.73M | 1.76M | 1.73M |

| 12:30 | USD | Import Price Index M/M May | 1.10% | 0.70% | 0.70% | |

| 14:30 | USD | Crude Oil Inventories | -2.1M | -5.2M | ||

| 18:00 | USD | Fed Interest Rate Decision | 0.25% | 0.25% | ||

| 18:30 | USD | FOMC Press Conference |