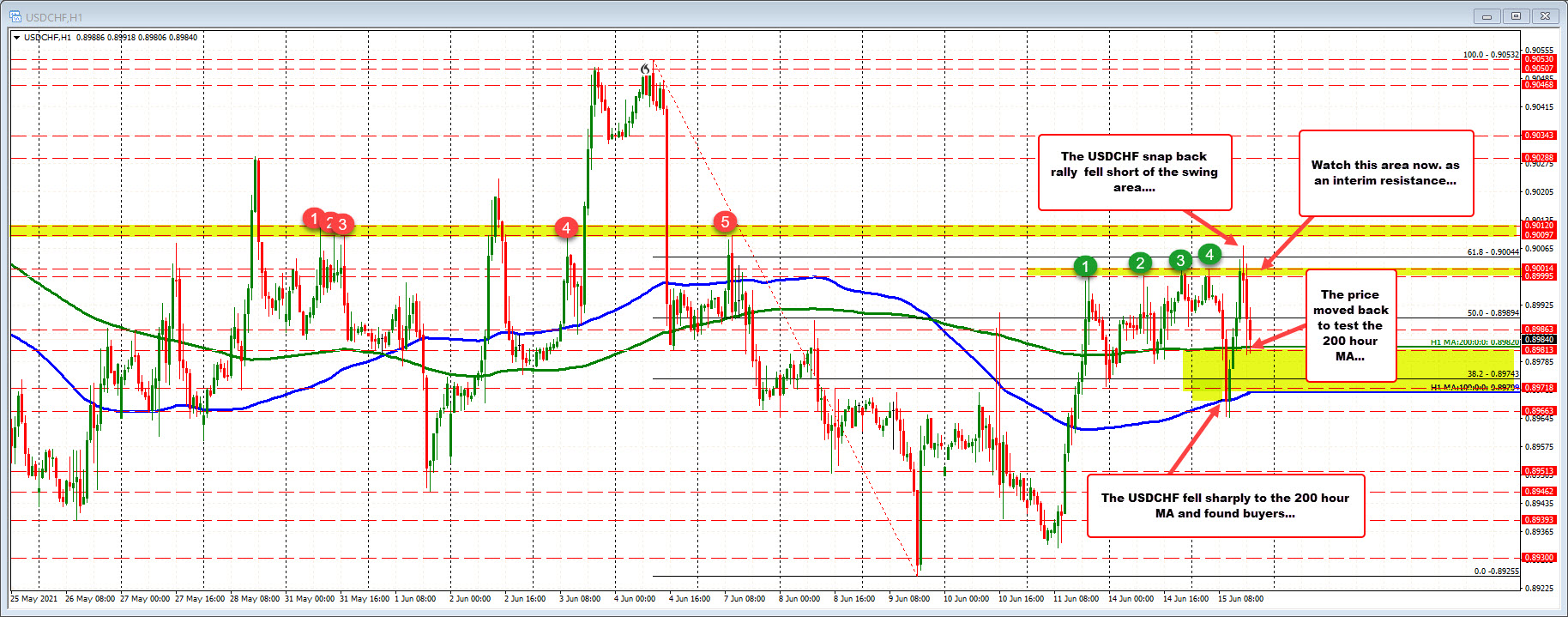

Price back toward the 200 hour MA

The USDCHF has had a wild and volatile up and down trading day.

The initial move was to the downside. That run saw the price cracked below its 200 hour moving average (green line currently at 0.8982) and then the 100 hour moving average near 0.8969. The price low extended to 0.8965 before rebounding back higher and snapping back. The move took the price back above the:

- 100 and 200 hour moving averages (blue and green lines)

- 50% retracement of the move down from the June 4 high at 0.8989, and the

- Prior high for the day at 0.9001

The volatility has traders sprinting one way, sprinting the other way, and turning around and sprinting the other way once again. Will the activity tire the traders? On corrections watch 0.9000 area (see green numbered circles) as resistance.

On a break back below the 200 hour moving average (green line at 0.89819), the 100 hour moving average becomes the focus once again at 0.89712.