Here is what you need to know on Tuesday, June 8:

Bitcoin wallets may not be as secure as first thought as the US gets most of the Colonial ransom back. The cryptocurrency drops again having made a brief attempt at stabilization and reduced volatility last week. A break of $30,000 now looks likely and with it perhaps some further panic selling. Meme stocks were the main beneficiary of the retail switch from Bitcoin to meme names. AMC remains underpinned by a wave or army of supporters despite some compelling dilutive effects and recent insider selling.

Apple (AAPL) unveiled a new version of its operating system on Monday with more emphasis on security and privacy. Apple appears once again to have tapped into the current zeitgeist, this time correctly addressing growing public concerns over privacy and hacking.

If you are reading this then the global website access outage has not affected you as cloud provider Fastly caused multiple outages across numerous operators such as the New York Times.

The dollar is steady at 1.2180, Oil remains just below the $70 psychological level at $68.97 while the US 10-Year is now lower at 1.52%.

European markets are higher led by the FTSE +0.4% while Dax and EuroStoxx are +0.2%.

US futures are higher, the S&P is +0.2%, Dow is flat and Nasdaq is +0.6%.

The Nasdaq remains bullish from a technical perspective so long as it remains above 13,469 short-term and 13,000 on a longer time frame. Note the double bottom from May 12 and 19 with corresponding momentum oscillator divergence.

Wall Street top news

The US recovers nearly all of the Bitcoin ransom paid for the Colonial pipeline hack.

China’s defense ministry says the visit of US Senators on a military plane to Taiwan is a provocation.

Cloud services company Fastly (FSLY) caused global website outages. Shares drop 3% in the premarket.

US Redbook improves to 14.5 year on year from prior 13%.

Wendys (WEN) jumps on board the retail train as the shares surge 26% in the premarket.

SelectQuote (SLQT) shares jump in premarket as the stock is to join the S&P SmallCap 600.

StitchFix (SFIX) shares jump 12% premarket on strong EPS and sales results and increased guidance.

Dada Nexus (DADA) reports 78% year on year volume growth, shares up 11% premarket.

Academy Sports Outdoors (ASO) up 8% premarket on results.

Coupa Software (COUP) shares drop 7% premarket on results and guidance disappointment.

TSLA Chinese deliveries up 29% in May versus April. Shares up 2% premarket.

AMC Report by Insider Score shows increased insider selling in AMC since May 28 but CEO Adam Aron is not one of the sellers.

ETSY announces a $1 billion offering of convertible senior notes (a loan convertible into shares).

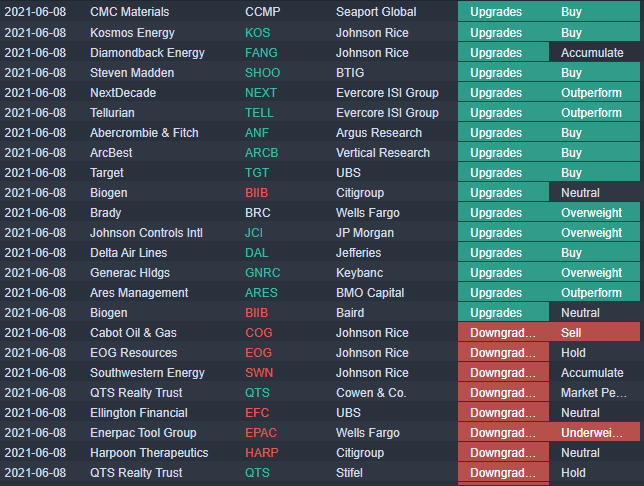

Upgrades, downgrades, premarket movers

Source: Benzinga