The USD is higher ahead of ADP, weekly claims, ISM services and Non farm productivity

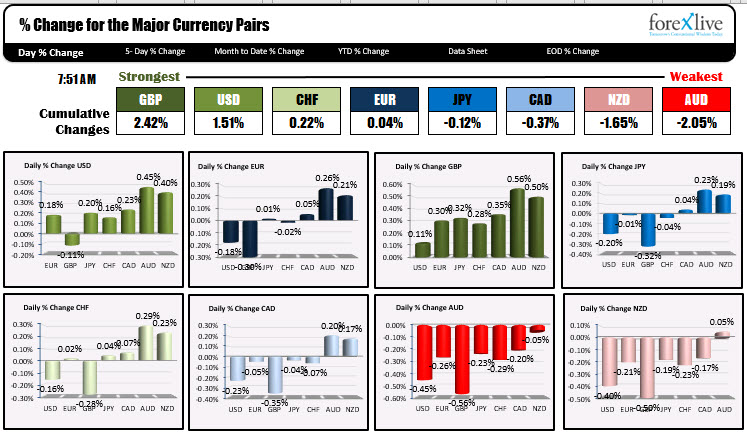

As North American traders enter for the day, the GBP is the strongest and the AUD is the weakest of the majors. The USD is stronger (sans the GBP) as traders await the ADP employment report at 8:15 AM ET (650K estimate versus 742K last month), the initial claims data at the bottom of the hour (another post pandemic low expected at 387K), nonfarm productivity for the first quarter, in US nonmanufacturing ISM at 10 AM (estimate 63.2).

There is a lot to chew on by the market. The European service PMI data was strong with UK recording its biggest jump in activity in 24 years as pubs reopened.

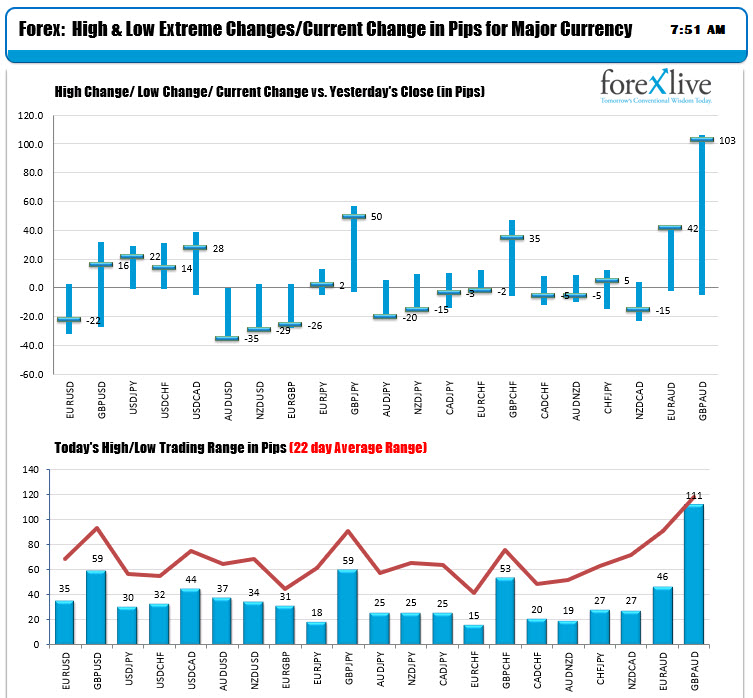

The ranges and changes are still showing some modest trading ranges. The largest mover was the GBPUSD with a 59 PIP trading range (and recovered from earlier declines). THe EURUSD remains negative and nearer it’s lows after a modest 35 PIP trading range. The USDJPY and USDCHF have much more modest ranges (30 and 32 pips) and have traded higher versus yesterday’s close for most the day. AUDUSD, NZDUSD, EURGBP (all of the AUD pairs are trading near lows to start the session.

In other markets:

- Spot gold is trading down to $60.33 or -0.86% at $1892.05

- Spot silver is trading down $0.41 or -1.47% at $27.76

- WTI crude oil futures are trading down $0.20 or -0.28% at $68.64

- Bitcoin is trading up $919 or 2.44% of $38,661. The high price reached $39,489.82. The low price extended to $37,184.88

In the premarket for US stocks, the major indices (implied by the futures) are trading lower (and moving lower). AMC is also marginally lower after AMC said that they would potentially look to liquidate 11.5 million shares and warned investors about excessive speculation

- Dow industrial average down -240 points

- NASDAQ index down -146 points

- S&P index down -34 points

In the European equity markets, the major indices are lower as well. Yesterday German DAX close that another record.

- German DAX, -0.7%

- France’s CAC, -0.66%

- UK’s FTSE 100, -1.2%

- Spain’s Ibex, -0.88%

- Italy’s FTSE MIB -0.6%

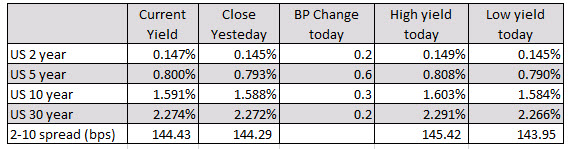

In the US debt market, the yields are marginally higher.

In the European debt market, the benchmark 10 year yields are also higher after a few days of declines: