The broad conditions for equity buyers remain in place. Easy central bank monetary policy and broad fiscal stimulus mean conditions are suitable for further equity gains. However, investors need to be aware that markets have been trading at elevated levels and are struggling to make new highs despite strong Q2 earnings.

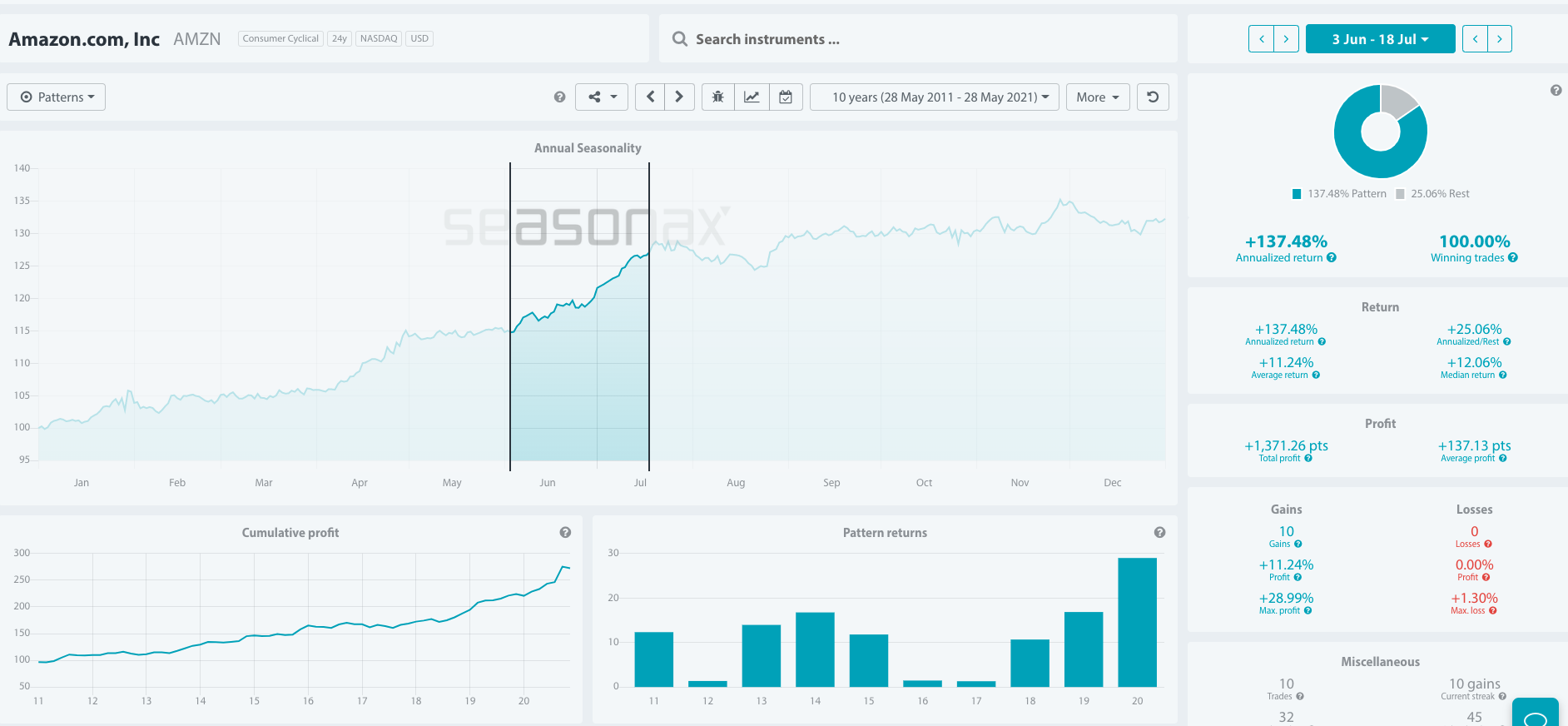

Will Amazon move higher in keeping with its very strong seasonal pattern this year? Over the last 10 years, Amazon has gained in value ten times between June 03 and July 18. The largest gain was in 2020 with a huge 28.99% profit.

Online activity has been elevated during lockdowns with high levels of consumer demand restricted to online shopping channels. Will this demand be enough to keep Amazon’s strong seasonal pattern going for the eleventh year?

Major trade risks

-

The main risk to this trade is from any risk-off tones which will weigh on equity prices.

-

A fast rise in US inflation could result in bond tapering which would potentially weaken Amazon share price if US interest rates are expected to rise.