The forex markets are very quiet today, with most major pairs and crosses staying inside yesterday’s range. Dollar is paring some post FOMC minutes gains, while Sterling is also soft. On the other hand, Australian and New Zealand Dollar are both recovering mildly. As for the week, Euro is currently the strongest one,m followed by Yen and the Pound. Kiwi is the worst, followed by Aussie and Dollar.

Technically, after some volatility this week, Dollar’s near term outlook stays bearish for now. The levels to note include, 1.2050 support in EUR/USD, 1.4004 support in GBP/USD, 0.7687 support in AUD/USD. 0.9092 resistance in USD/CHF and 1.2201 resistance in USD/CAD. As long as these levels hold, we’d expect Dollar’s sell-off to come back sooner or later.

In Europe, at the time of writing, FTSE is up 0.45%. DAX is up 0.87%. CAC is up 0.83%. Germany 10-year yield is up 0.011 at -0.095. Earlier in Asia, Nikkei rose 0.19%. Hong Kong HSI dropped -0.50%. China Shanghai SSE dropped -0.11%. Singapore Strait Times rose 0.18%. Japan 10-year JGB yield rose 0.0084 to 0.084.

US initial jobless claims dropped to 444k, lowest since March 2020

US initial jobless claims dropped -34k to 444k in the week ending May 15, below expectation of 450k. That’s also the lowest level since March 14, 2020. Four-week moving average of initial claims dropped -30.5k to 505k, lowest since March 14, 2020. Continuing claims rose 111k to 3751k. Four-week moving average of continuing claims rose 25k to 3681k.

Also from the US, Philadelphia Fed manufacturing index dropped to 31.5 in May, down from 50.2, below expectation of 40.8.

From Canada, ADP jobs rose 351.3k in April. New housing price index rose 1.9% mom in April.

Released earlier in European session, Germany PPI rose 0.8% mom, 5.2% yoy in April, versus expectation of 1.0% mom, 4.5% yoy. Eurozone current account surplus dropped to EUR 17.8B in March.

Australia employment dropped -30.6k, but not clear JobKeeper impact

Australia employment dropped -30.6k in April worse than expectation of 15k rise. Full-time jobs rose 33.8k while part-time jobs dropped -64.4k. Total employment was 45.9k, or 0.4%, higher than March 2020 level. But unemployment rate dropped to 5.5%, down from 5.7%, better than expectation of 5.5%. Participation rate dropped -0.3% to 66.0%.

“We have not seen large changes in the indicators that would suggest a clear JobKeeper impact, such as an increase in people working reduced or zero hours for economic reasons or because they were leaving their job. We also haven’t seen large net flows out of employment across many population groups,” Bjorn Jarvis, head of labour statistics at the ABS said.

Also from Australia, consumer inflation expectations rose to 3.5% in May, up from 3.2%.

Japan exports jumped 38% yoy in Apr, fastest in more than a decade

Japan’s exports rose 38.0% yoy to JPY 7181B in April. That’s the fastest growth in more than a decade since 2010, as led by US bound shipments of cars and parts. Also, Chinese demand for chip-making equipment was also a boost. Exports to China jumped 33.9% yoy while exports to the US rose 45.1% yoy. Imports rose 12.8% yoy to 6925B. Trade surplus came in at JPY 255B.

In seasonally adjusted terms, exports rose 2.5% mom to JPY 6856B. Imports rose 7.5% mom to JPY 6791B. Trade surplus narrowed to JPY 65B.

Also from Japan, machine orders rose 3.7% mom in March, below expectations of 6.4% mom.

EUR/USD Mid-Day Outlook

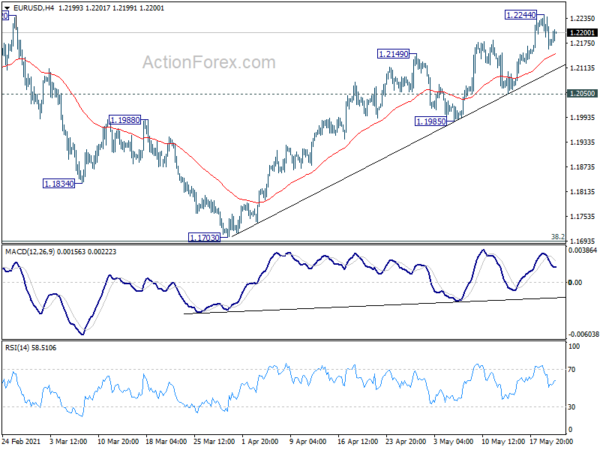

Daily Pivots: (S1) 1.2142; (P) 1.2194; (R1) 1.2227; More….

EUR/USD is staying in consolidation from 1.2244 and intraday bias remains neutral. Further rise is expected as long as 1.2050 support holds. On the upside, break of 1.2244 will target a test on 1.2348 high. Decisive break there should confirm resumption of up trend from 1.0635. Next target is 1.2555 key long term resistance zone. However, break of 1.2050 will delay the bullish case. Intraday bias will be turned back to the downside to extend the consolidation pattern from 1.2348 with another falling leg.

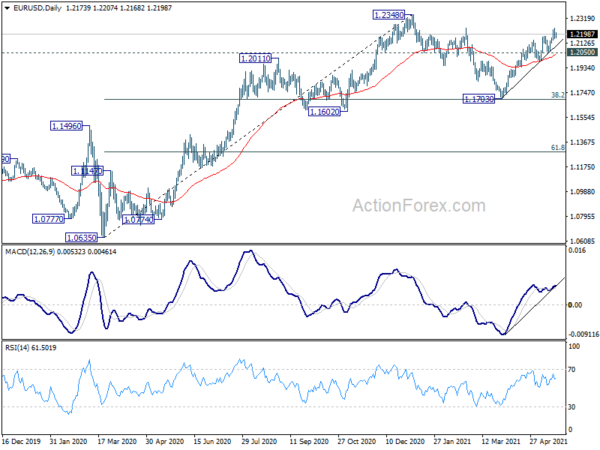

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally could be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516). This will remain the favored case as long as 1.1602 support holds. Reaction from 1.2555 should reveal underlying long term momentum in the pair.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Trade Balance (JPY) Apr | 0.07T | 0.07T | 0.30T | 0.37T |

| 23:50 | JPY | Machinery Orders M/M Mar | 3.70% | 6.40% | -8.50% | |

| 01:00 | AUD | Consumer Inflation Expectations May | 3.50% | 3.60% | 3.20% | |

| 01:30 | AUD | Employment Change Apr | -30.6K | 15.0K | 70.7K | 77.0K |

| 01:30 | AUD | Unemployment Rate Apr | 5.50% | 5.60% | 5.60% | 5.70% |

| 06:00 | EUR | Germany PPI M/M Apr | 0.80% | 1.00% | 0.90% | |

| 06:00 | EUR | Germany PPI Y/Y Apr | 5.20% | 4.50% | 3.70% | |

| 08:00 | EUR | Eurozone Current Account (EUR) Mar | 17.8B | 24.3B | 25.9B | |

| 12:30 | CAD | ADP Employment Change Apr | 351.3K | 634.8K | 266.7K | |

| 12:30 | CAD | New Housing Price Index M/M Apr | 1.90% | 1.40% | 1.10% | |

| 12:30 | USD | Initial Jobless Claims (May 14) | 444K | 450K | 473K | 478K |

| 12:30 | USD | Philadelphia Fed Manufacturing May | 31.5 | 40.8 | 50.2 | |

| 14:30 | USD | Natural Gas Storage | 60B | 71B |