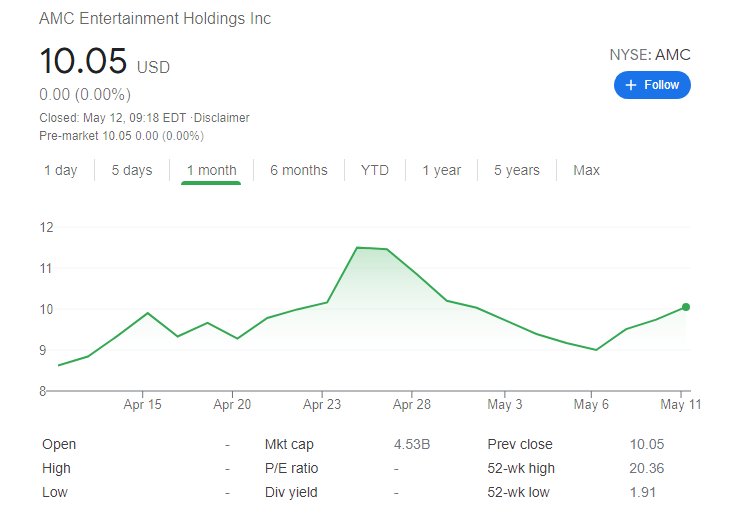

- AMC just cannot stop going up, nearly 3% on Wednesday.

- AMC shares trade through $10, for four straight days of gains.

- AMC outperforms the broader market by 6% on Wednesday.

Update: Another day of gains for AMC as it notches for straight days of gains now. While everything else comes crashing down AMC rises nearly 3%. breaking $10 and turning increasingly bullish on the chart. TRuly an impressive performance. Tuesday saw a lot of meme stocks rally as retail money exited Bitcoin and returned to meme stocks. Wednesday however was an ugly day, with the Nasdaq slipping nearly 3% and meme stocks suffering even heavier falls.

The drive for five is alive as AMC is up slightly in Thursday’s premarket.

An unexpected day, given what had preceded it on Monday. The Nasdaq suffered on Monday, and Tuesday saw traders come in to see heavy losses overnight in Europe and Asia. US futures all pointed lower but a wave of enthusiasm flowed into retail interest meme stocks and they strongly outperformed the broader market indices. All three main US indices closed in the red but all meme stocks closed higher – GameStop, AMC, COIN, PLTR PLUG NIO, and others.

AMC stock news

AMC announced results on May 6.

EPS was $-1.42 versus a forecast of $-1.26. Revenue was $147.4 million versus a $153.6 million forecast. So a surprise, but not really a surprise, given the background that we are all too familiar with. AMC shares rallied on Friday and again on Monday as meme traders focused on the bullish comments from CEO Adam Aron. Well, if the CEO isn’t bullish then who can be? Conference calls post-earnings releases always tend to err on the side of bullishness. Aron alluded to the Reddit, r/wallstreetbets crowd by thanking the new retail investors and making a donation to the Diane Fossey Gorilla Fund, which has been popular with Reddit investors who refer to themselves as “apes”. A noble act that is showing the benefits of the retail traders banding together. The CEO Adam Aron said that AMC was in a great position as 7 million cinema goers attended AMC theatres in Q1. Not a bad figure you might think but 7 million cinema-goers in Q1 still equated to a loss.

In case you are not familiar with AMC, here is a quick rehash of the story so far. You could make a movie out of this one. Oh wait, they are! Well, GameStop is the leading star, AMC is the best supporting cast.

AMC is a global cinema chain and, as a result, has struggled during the global pandemic as most of these cinemas have been closed for the better part of a year. The company narrowly avoided bankruptcy through the interest of retail traders. By strongly backing it, these retail traders allowed AMC to raise capital and debt, meaning it could survive the pandemic.

AMC stock forecast

AMC had been outperforming pretty much everything for the last few sessions. While the Nasdaq tanked on Monday, AMC still rose 2.4% and turned bullish on the short-term charts by breaking above the 9-day moving average.

As of now, AMC is sitting above all key moving averages – 9, 21, 50 and 100-day. The Directional Movement Index is now crossed into a buy signal, although a weak one as the underlying trend identifier ADX is low. The Moving Average Convergence Divergence (MACD) is looking to crossover, keep an eye to confirm the trend.

It is always easier to trade with the trend so keep an eye on the key levels. If AMC breaks lower below the 9 and 21-day support at $9.86-9.75, then it’s all hands on deck as things could get ugly. A break of support at $8.95 from the triangle and old lows would have a stretched target of under $2. The size of the entry of the triangle is the target of a breakout. AMC though should see support in the $5-6 consolidation area. This would be a buy area to look for a bounce.

Given the fundamentals and heavy debt load, it is hard to get too bulled up on this one. But for now, the chart is bullish as long as AMC hold above $9.86. The first target for bulls is the top of the triangle at $11.30, then the high from April 27 at $12.22. A breakout of the triangle would have an ultimate target of nearly $20.

| Support | Resistance |

| 9.86 | 11.30 |

| 9.75 | 12.22 |

| 9.50 | 14.54 |

| 8.95 | 17.25 |

| 6 | 20.36 |

| 5.47 |

At the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Errors and omissions excepted.