- US dollar bulls take a breather and the euro advances.

- All eyes are now turning to the US NFPs on Friday.

EUR/USD is currently trading at 1.2057 and higher by some 0.45% on the day travelling between a low of 1.1993 and a high of 1.2071.

The dollar dropped to its lowest point in three days as global market risk appetite improved ahead of a key US jobs report that may provide clues on when the Federal Reserve will dial back monetary stimulus.

The safe-haven US dollar was last down 0.35% at 91.944 against a basket of peer currencies as measured by the DXY.

The greenback had rebounded from a one-month low over the past week, boosted by economic data that has largely supported the case for a rapid recovery from the pandemic.

The markets are weighing whether a lift in inflation might force the Federal Reserve’s hand.

“The USD is likely to continue to respond to the debate about whether or not the Fed’s view that inflation will be transitory is correct,” Rabobank strategist Jane Foley said earlier this week.

With several forecasters predicting a one-million-plus increase in nonfarm payrolls, “the USD may continue to find a good level of support in the near-term,” with the currency strengthening to $1.19 per euro over a one-month horizon, she said.

So far, however, the central bank’s Chair, Jerome Powell, has argued the labour market is far short of where it needs to be to start talking of tapering asset purchases. The Fed has continued to advocate for a lower for longer policy and that it will not raise its benchmark Fed funds rate through 2023.

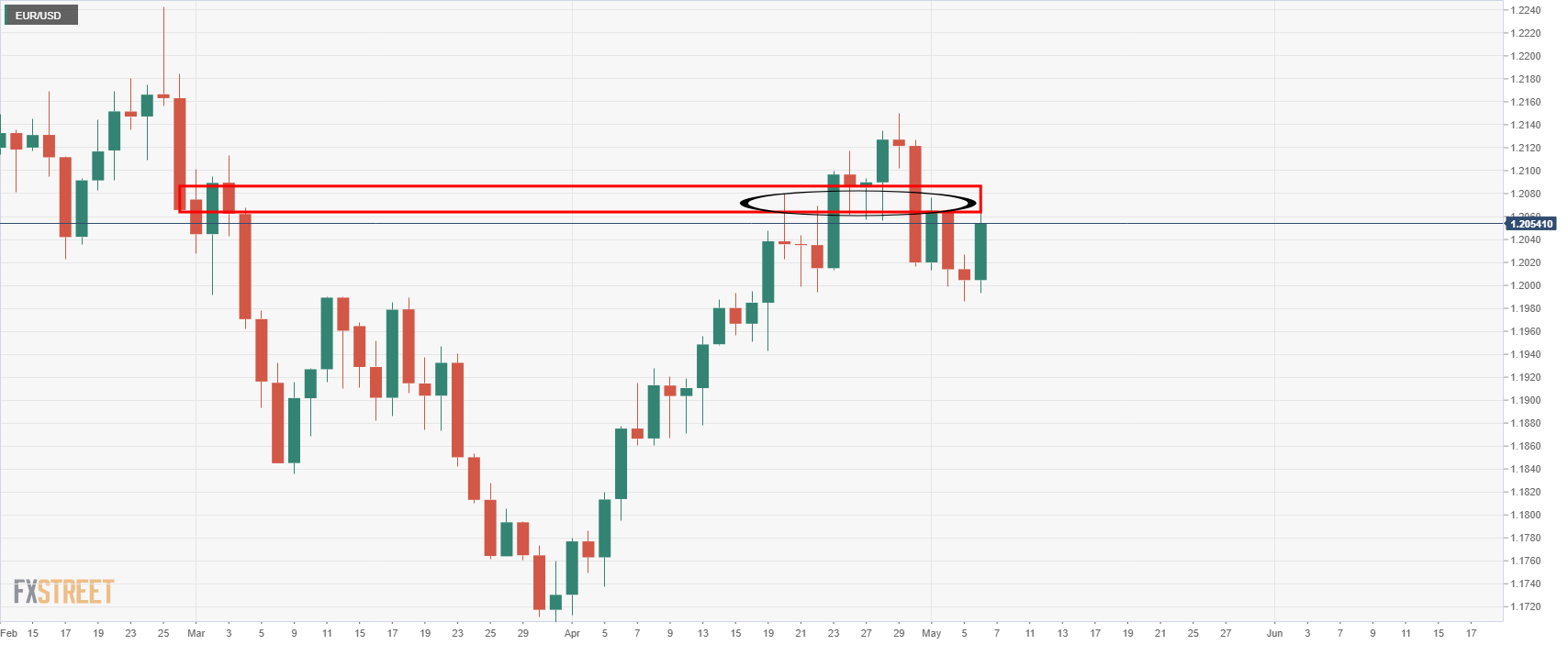

EUR/USD technical analysis

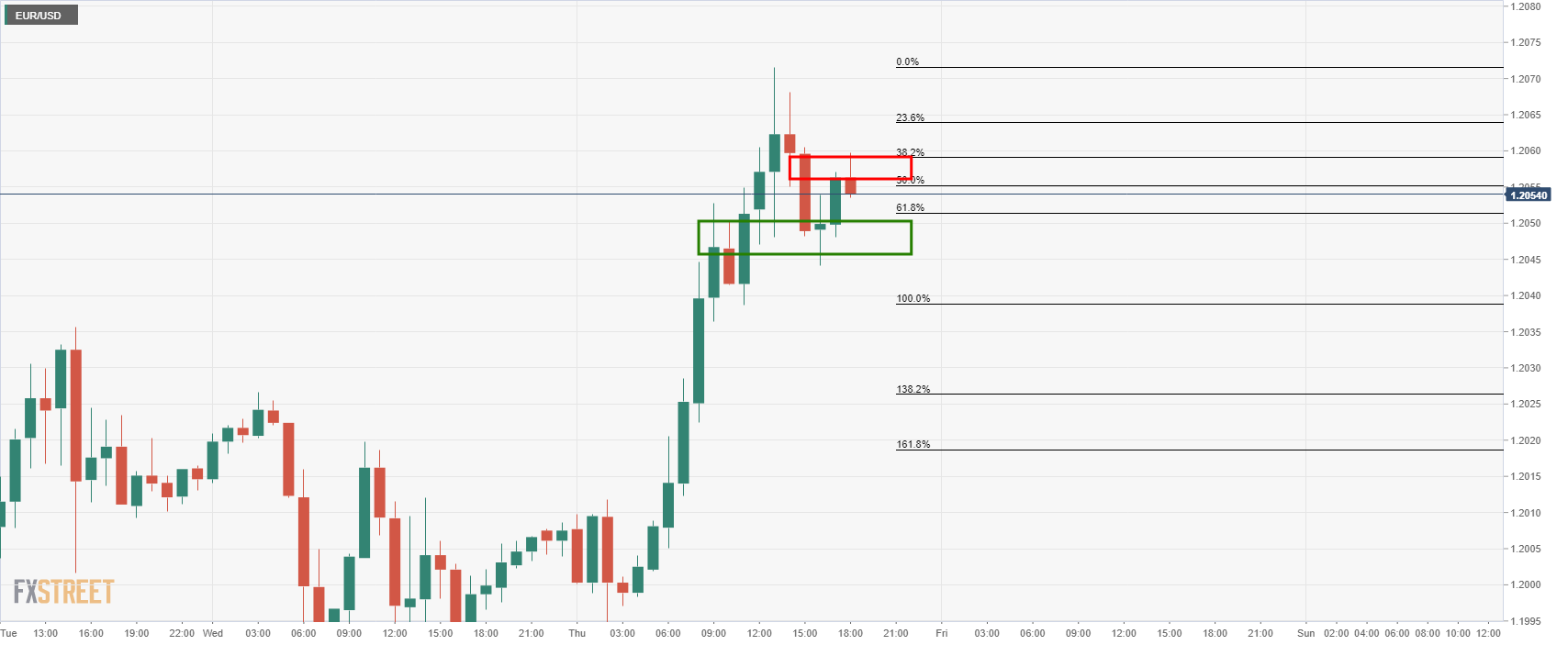

As can be seen, the bulls have come back for more on the hourly chart, but are facing a wall of daily resistance that may prevent an extension head of the Non-Farm Payrolls event: