- Gold has something to offer for both the bulls and the bears.

- The daily and weekly outlook is in contrast to that of the monthly out look at this juncture.

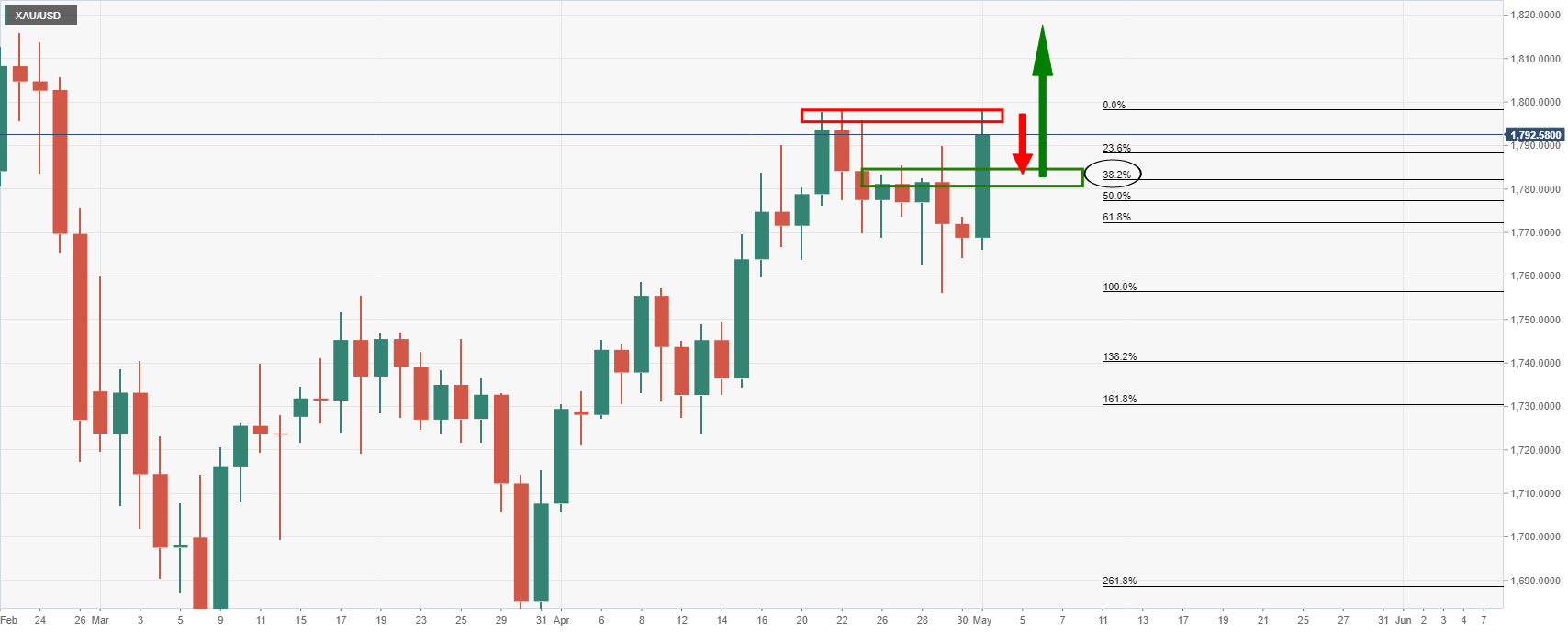

As per the prior analysis, Gold Price Analysis: Bulls back in town through critical resistance, we have seen the pullback that the bulls were looking for, offering a discount to target higher highs in what is expected to be a weaker US dollar environment in the medium and longer-term.

Prior analysis

As illustrated, the price did indeed go to test the resistance but burst right through it, against the grain of the longer-term charts.

A correction to the old resistance would be expected to hold at least to the structure if not just slightly above it near the 38.2% Fibo.

Live market

The price has dropped further than anticipated, which is a bonus for the bulls, clearing out stale stops in what will be presumed to be the foundations for an extension to the upside.

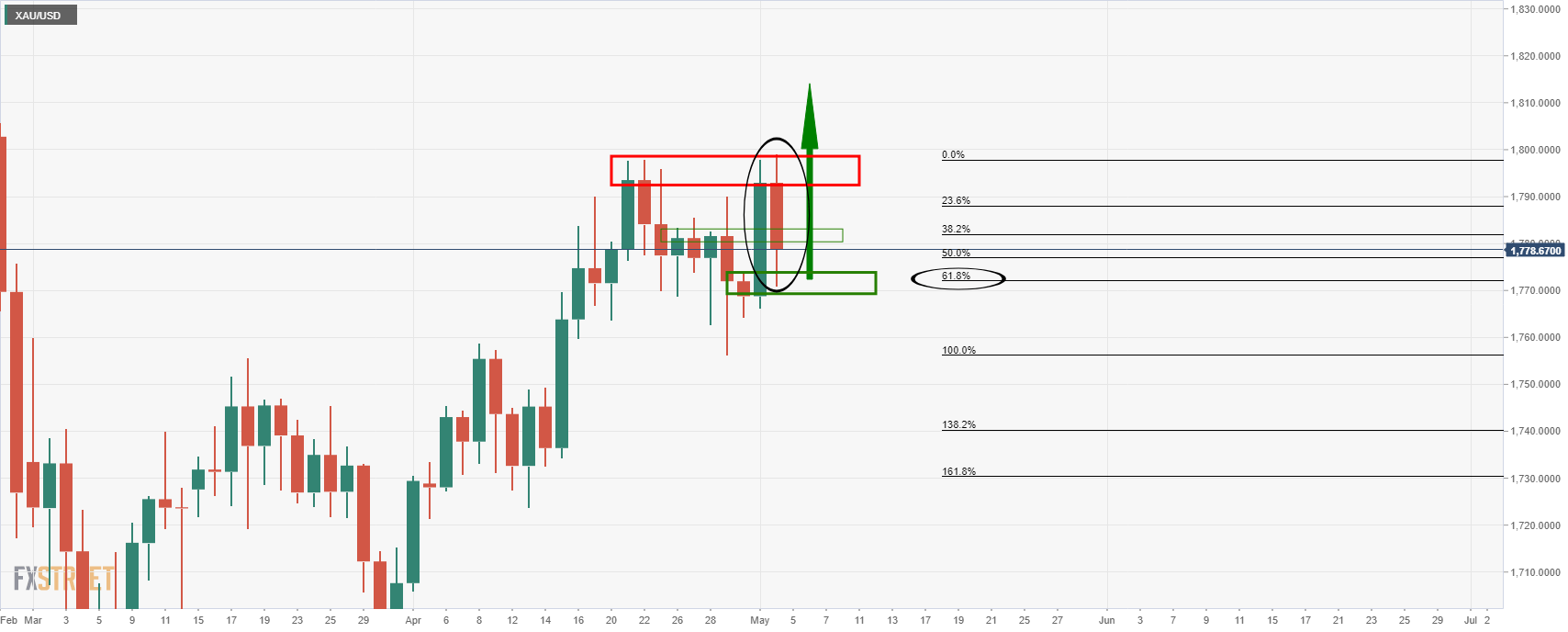

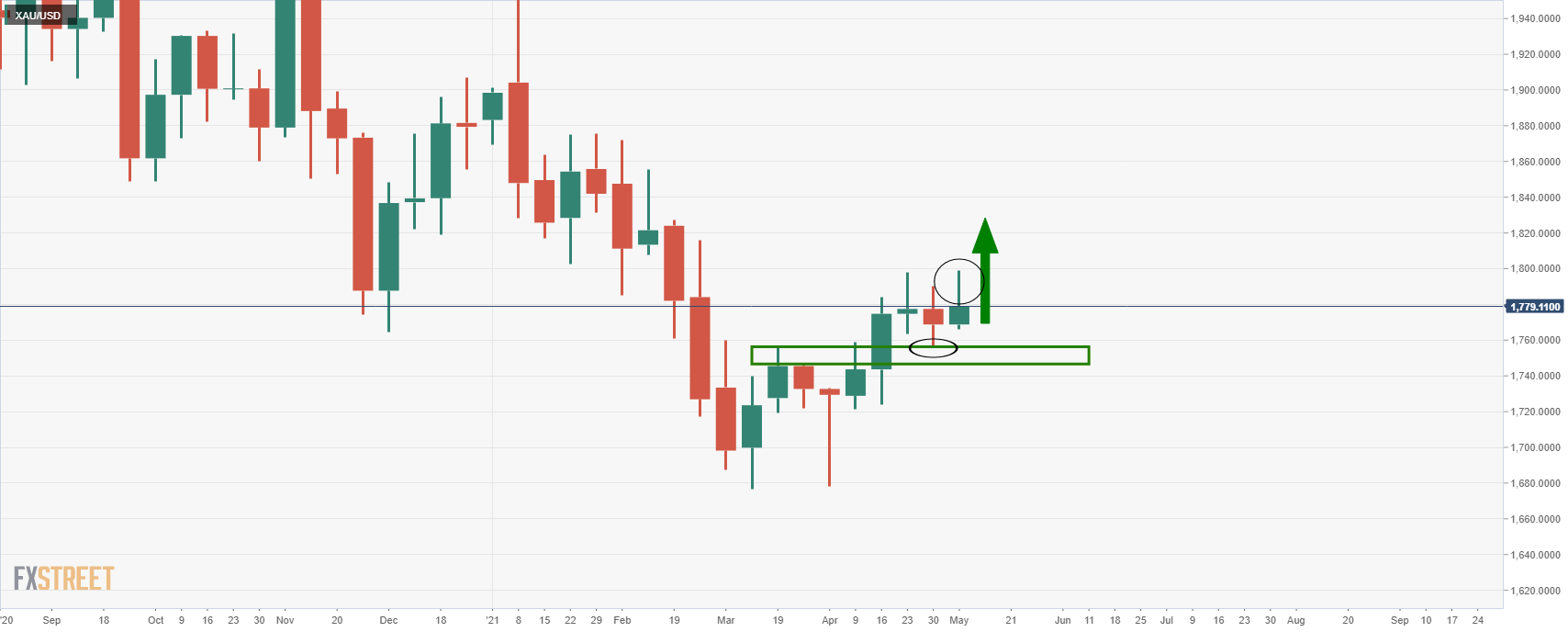

The weekly chart is also a bullish supporting factor:

The W-formation was completed with the test of the neckline so an upside continuation can be expected.

The week, so far, is looking bullish as well with the wick that is expected to be filled in on the daily time frame.

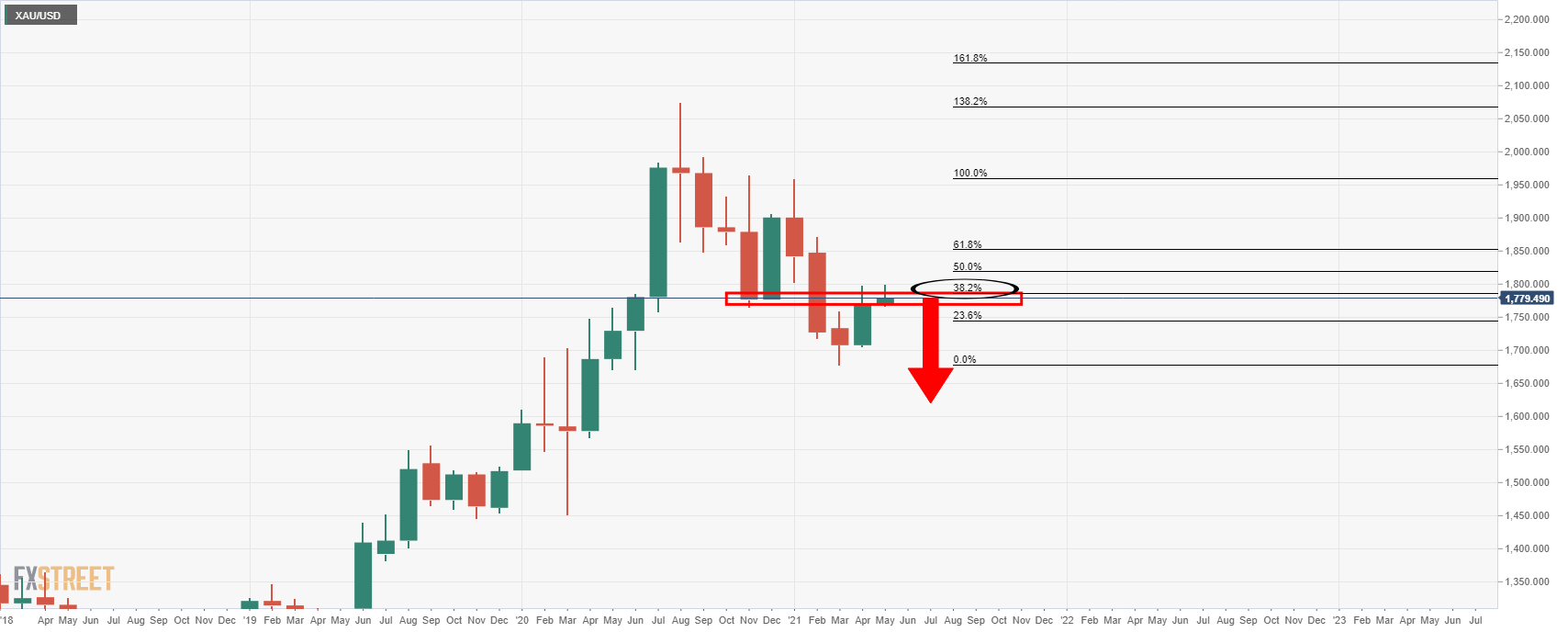

Meanwhile, however, the following is an illustration of a bearish bias on the longer-term time frames:

Monthly chart

The 38.2% Fibo retracement was made this week and bears can be looking for a down side opportunity depending on the daily ad weekly price action.