Rebounds higher

The USDCHF – for the first time since March 1 - traded below its 200 day moving average yesterday at 0.9086 but could only get to 0.90813 (a later session low reached 0.90796). The pair traded below its 200 day moving average on a number of different occasions since the first run lower including a number of times in trading today. However, the lows could not extend below the low from yesterday (it pretty much equaled it).

The last few hours have seen sellers give up, and cover pushing the price higher. The pair is trading that new session highs and extending what was a 19 pip trading range in the early Monday morning session. The pairs ranges now is a whopping 31 pips which is still well below the 56 pip average over the last 21 trading days.

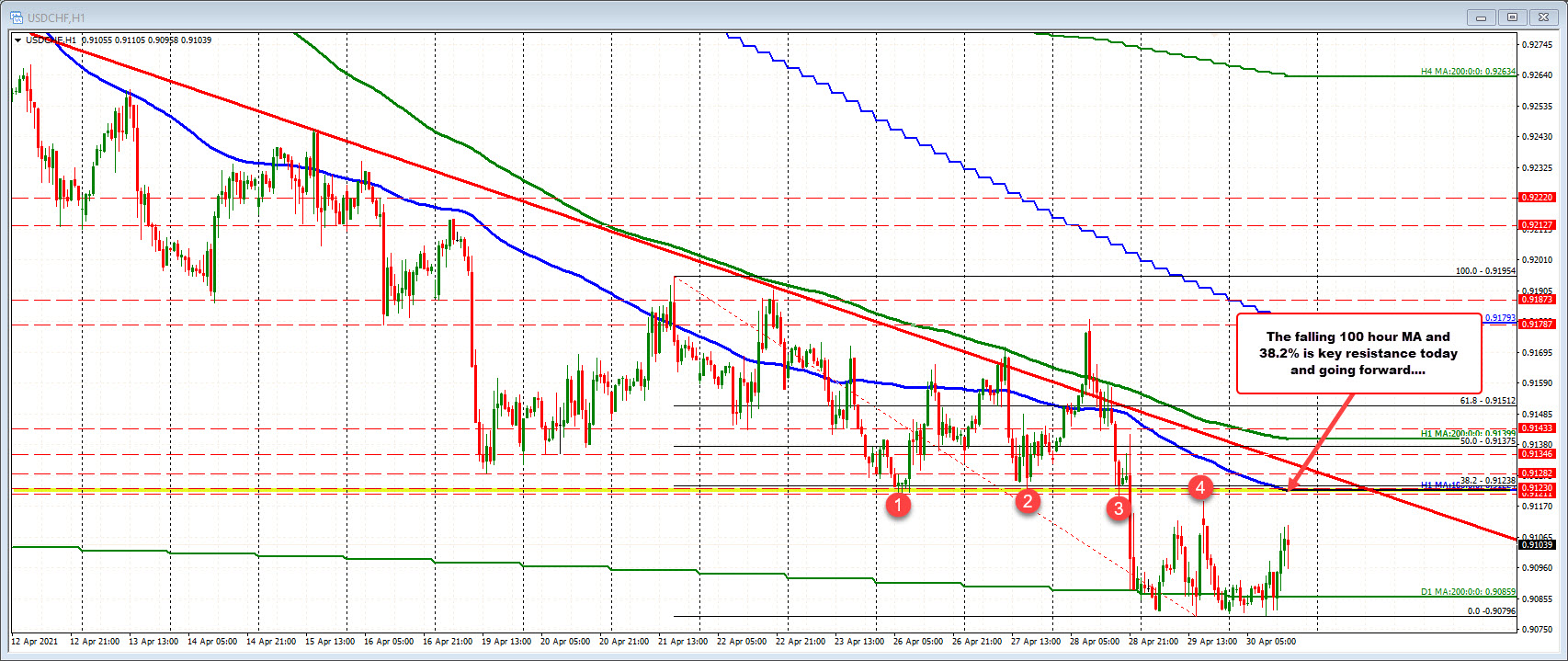

If the pair is build on the topside, it has to stay above the 200 day MA today. The upside target is at the falling 100 hour MA at 0.9122. The 38.2% of the move down from last week’s high comes in near the 100 hour MA at 0.91238. Getting above those levels is key if the buyers are to build off the 200 day MA. A move back below the 200 day MA should lead to more selling.