Closed at 0.7744

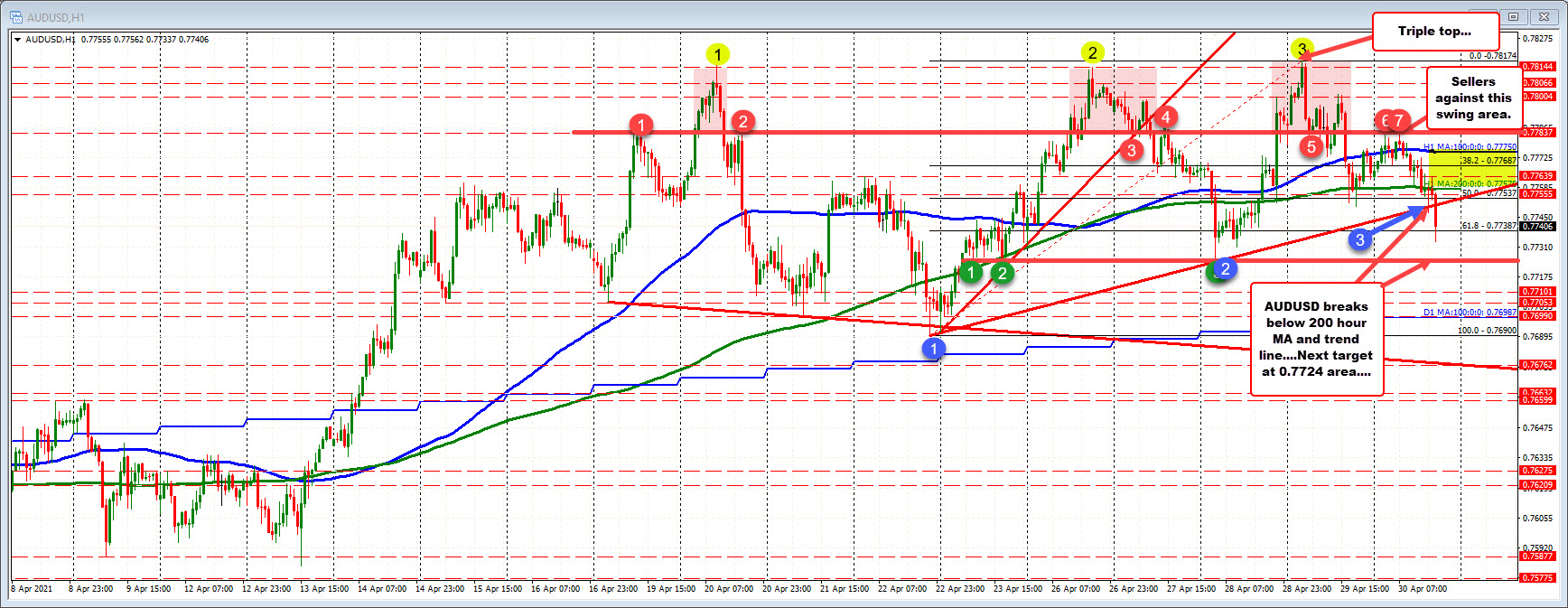

The AUDUSD has cracked below an upward sloping trend line and away from the 100/200 hour MAs today. The pair has also just cracked back below the close from last week at 0.7744. The pair is trading at 0.7737 as I type, after reaching an intraday low at 0.77337.

The next downside target will be at 0.7724 which is near swing lows from April 23 (last Friday), and again on Wednesday (see green numbered circles).

Close risk comes in against the 50% midpoint of the move up from the April 22 low at 0.77537 and the 200 hour MA at 0.7757. If the sellers are to remain in control, staying below those levels would be a good barometer for both buyers and sellers now. Stay below more bearish. Move above more bullish.

The highs today stalled against a swing area going back to April 19 and April 20 at 0.77837. Other swing levels (see red numbered circles) stalled highs and lows near that level since then (including the two high bars today). Even higher, at the highs this week the pair got within pips of the high from last week at the 0.7817 area. The third hold on Thursday, gave sellers the AOK to push lower and the trend has been up and down with a negative bias since that peak. .