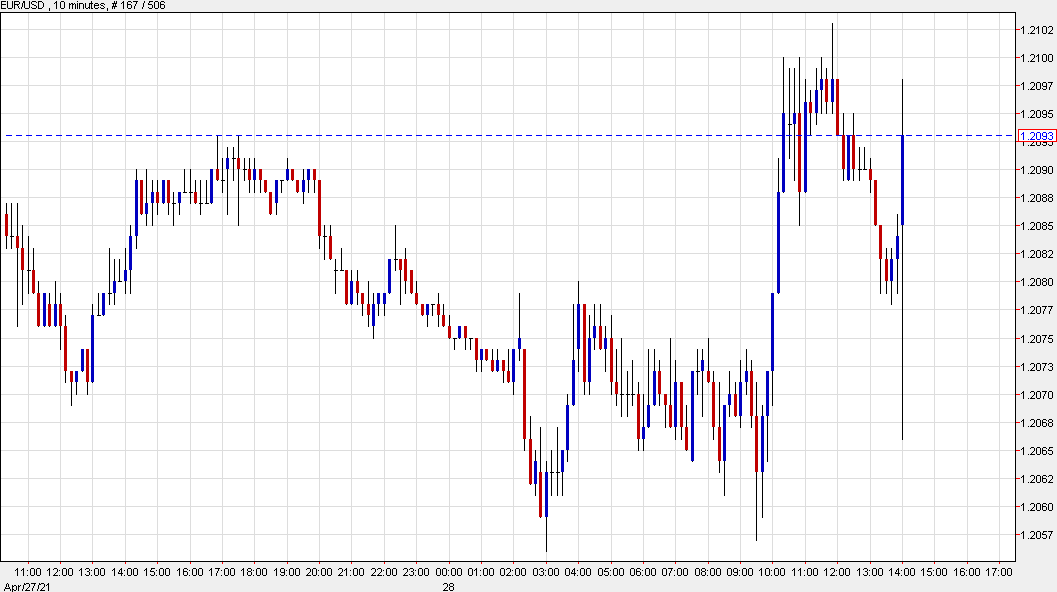

Initial reaction is USD selling

There isn’t much to digest in the FOMC decision. There were no actions or changes to guidance. Powell will take questions shortly but if the statement is any indication, he’s not going to offer anything new.

The early market reaction is modest US dollar selling. Some of that is a continuation of what we saw in the run-up to the decision. Then in the short-time before it there was some squaring up. Now it looks to have resumed.

There’s not much temptation to wade into positions until after Powell.

The Fed funds futures market is pricing in the first hike in March 2023.

This article was originally published by Forexlive.com. Read the original article here.