- XAG/USD trades in a relatively tight range on Monday.

- Near-term technical outlook remains neutral with a slight bullish bias.

- Next key resistance for silver aligns at $26.60.

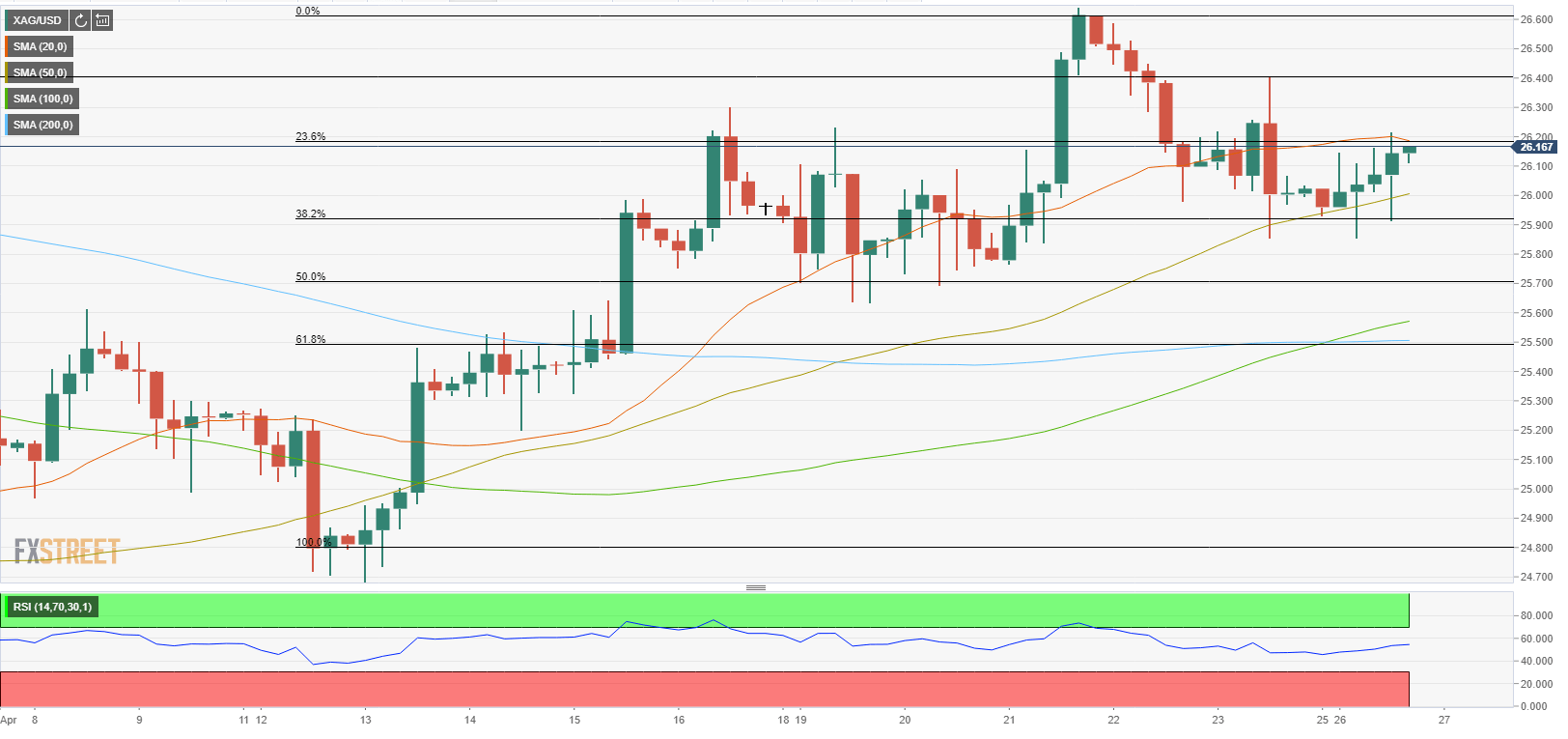

The XAG/USD pair climbed to its highest level since early March at $26.64 on Thursday and staged a deep technical correction on Friday. At the start of the new week, silver seems to be having a difficult time making a decisive move in either direction and was last seen gaining 0.5% on a daily basis at $26.14.

Silver technical outlook

On the four-hour chart, the Relative Strength Index (RSI) indicator is moving sideways a little above 50, suggesting that silver remains neutral with a slight bullish bias in the short term.

The initial resistance is located at $26.20, where the Fibonacci 23.6% retracement of the latest uptrend meets the 20-period SMA. If silver manages to close a four-hour candle above that level, it could target $26.40 (Apr. 23 high) ahead of $26.60 (Apr. 21 high).

On the downside, supports are located at $26.00 (psychological level/50-period SMA), $25.90 (Fibonacci 38.2% retracement) and $25.70 (Fibonacci 50% retracement).