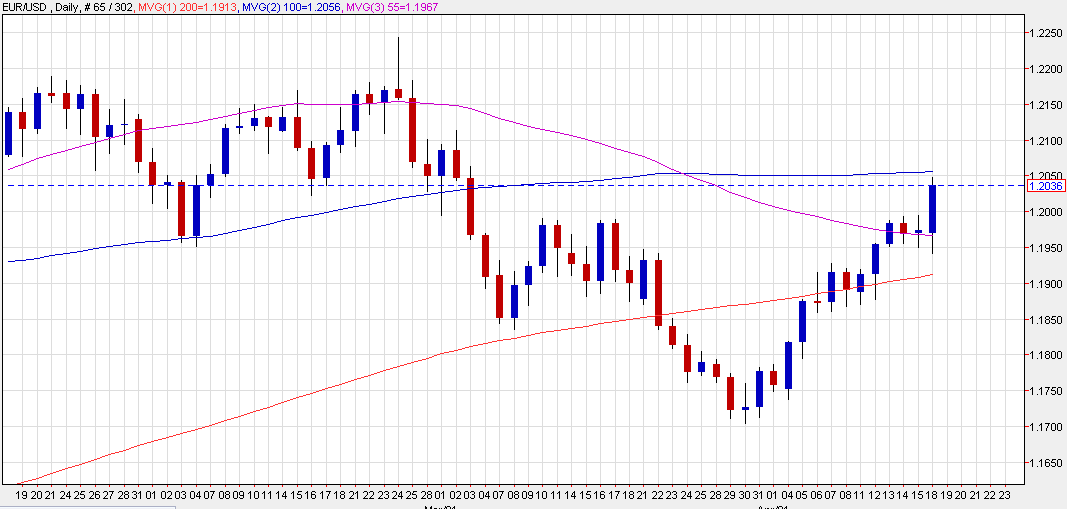

EUR/USD up a half-cent

The euro spent the latter half of last week trying and failing to break above 1.2000 but earlier today it finally made its move after a dip to 1.1940 was rejected.

It climbed more than 100 pips from its intraday low in a straight-line move to 1.1943. Since then it has back-and-filled near the highs of the day and last traded at 1.1936.

Goldman Sachs on the weekend upgraded its assessment of the euro and recommended buying it with a target at 1.2500.

The economic calendar for the eurozone is light early in the week but on Thursday, all eyes will be on the ECB decision. It’s early for any shifts in policy but Lagarde may tee-up a reduction in bond purchases. She will try to couple that with some anti-euro jawboning but actions speak louder than words.

There isn’t a lot to dislike here.

This article was originally published by Forexlive.com. Read the original article here.