Euro finally breaks through 1.2 handle against Dollar, as the greenback’s selloff resumes today and accelerates broadly. Nevertheless, Euro is overwhelmed by others, in particular Sterling, which is the strongest for now, followed by Swiss Franc. Commodity currencies are somewhat lagging behind too, partly as they’re facing some pressure against Yen. Overall, the Dollar bearish tone is set up well, and will likely continue.

Technically, EUR/USD’s break of 1.1988 resistance adds to the case that correction from 1.2348 has already completed at 1.1703. Further rally would be seen back to 1.2242/2348 resistances zone. Similarly, GBP/USD’s break of 1.3917 resistance should indicate completion of correction from 1.4240 at 1.3668. Further break of 1.4000 should confirm and target a rest on 1.4240 high. A focus now is USD/JPY’s reaction 38.2% retracement of 102.58 to 110.95 at 107.75. Sustained break there will negate near term bullishness in the pair, and extend the whole pattern from 101.18 with another falling leg.

In Europe, currently, FTSE is down -0.09%. DAX is down -0.15%. CAC is up 0.35%. Germany 10-year yield is up 0.035 at -0.224. Earlier in Asia, Nikkei rose 0.01%. Hong Kong HSI rose 0.47%. China Shanghai SSE rose 1.49%. Singapore Strait Times rose 0.25%. Japan 10-year JGB yield dropped -0.0044 to 0.086.

Bundesbank: Germany economic output decreased in Q1

In the monthly report, Bundesbank said Germany economic output decreased in Q1. Stricter and longer-lasting restrictions increased the losses in many service sectors.

Industrial production fell in February as “supply bottlenecks for preliminary products must have played an important role in the decline.” Automotive industry was “particularly hard hit”. However, there was no renewed demand problem, as incoming orders “rose significantly again” in February, and have now “recovered considerably from the slump in the previous year”.

BoE and Treasury to create a Central Bank Digital Currency Taskforce

BoE and UK Treasury announced to jointly create a Central Bank Digital Currency (CBDC) Taskforce today, to “coordinate the exploration of a potential UK CBDC”. The Taskforce will be co-chaired by BoE Deputy Governor for Financial Stability Jon Cunliffe, and Treasury’s Director General of Financial Services, Katharine Braddick.

BoE also noted there was not decision yet on whether to introduce a CBDC. But it will “engage widely with stakeholders on the benefits, risks and practicalities of doing so”.

Additionally, a CBDC Engagement Forum is created to “engage senior stakeholders and gather strategic input on all non-technology aspects of CBDC.” A CBDC Technology Forum is created to “engage stakeholders and gather input on all technology aspects of CBDC from a diverse cross-section of expertise and perspectives.”

Japan exports surged 16.1% yoy in March, imports rose 5.7% yoy

Japan’s exports rose 16.1% yoy in March to JPY 7378B, as led by exports of autos, plastics and non-ferrous metals. That’s the first double-digit annual growth in more than three years. Though, the growth rate was skewed by the low base effect due to the pandemic. Exports to China was up 37.2% yoy, to US up 4.9% yoy, to EU up 12.8% yoy. Imports rose 5.7% yoy to 6714B. Trade surplus came in at JPY 663.7B.

In seasonally adjusted term, exports rose 4.3% mom to JPY 6524B. Imports dropped -0.7% mom to 6226B. Trade balance turned to JPY 298B surplus.

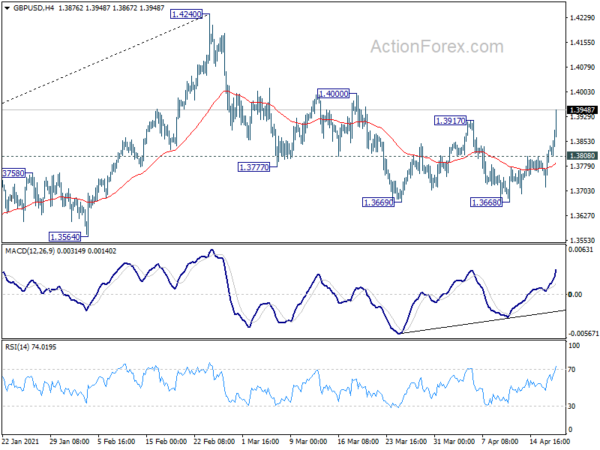

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.3758; (P) 1.3800; (R1) 1.3882; More…

GBP/USD’s break of 1.3917 resistance suggests that correction from 1.4240 has completed at 1.3668 already. Intraday bias is back on the upside for 1.4000 resistance first. Firm break there will confirm and pave the way to retest 1.4240 high. On the downside, below 1.3808 minor support will turn bias to the downside to resume the correction instead.

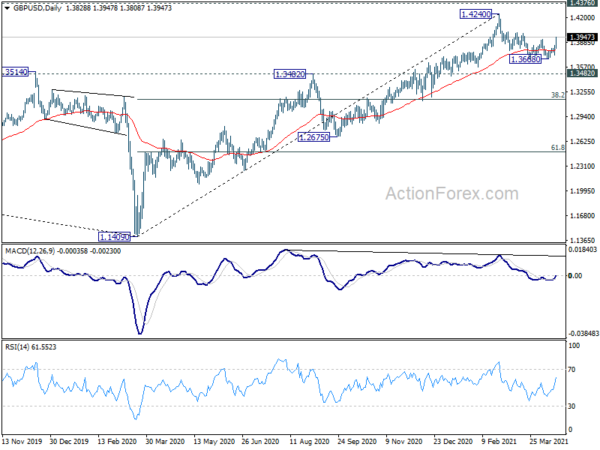

In the bigger picture, as long as 1.3482 resistance turned support holds, up trend from 1.1409 should still continue. Decisive break of 1.4376 resistance will carry larger bullish implications and target 38.2% retracement of 2.1161 (2007 high) to 1.1409 (2020 low) at 1.5134. However, firm break of 1.3482 support will argue that the rise from 1.1409 has completed and bring deeper fall to 1.2675 support and below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | Rightmove House Price Index M/M Apr | 2.10% | 0.80% | ||

| 23:50 | JPY | Trade Balance (JPY) Mar | 0.30T | 0.20T | -0.04T | -0.01T |

| 4:30 | JPY | Industrial Production M/M Feb F | -1.30% | -2.10% | -2.10% | |

| 8:00 | EUR | Eurozone Current Account (EUR) Feb | 25.9B | 31.2B | 30.5B |