Goldman Sachs sees upside for the euro

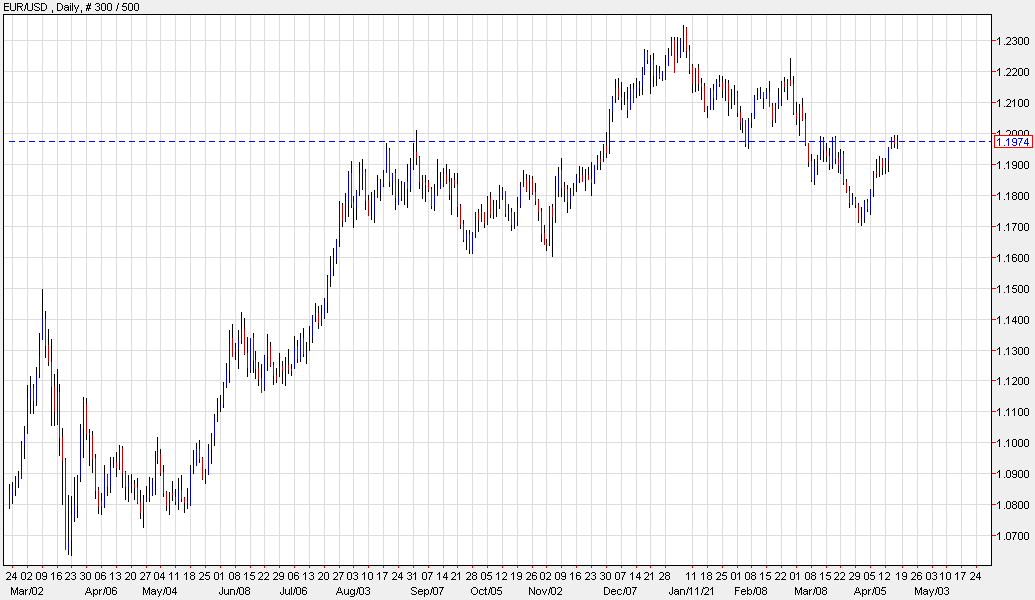

The euro spent the latter part of the week flirting with 1.2000 but unable to break above.

Analysts at Goldman Sachs believe that it’s only a matter of time until it breaks through and runs to 1.2500. They’ve raised their three-month EUR/USD target to that level from 1.2100.

The theme is one I’ve been writing about for awhile: European vaccinations are picking up rapidly and this is likely to be the last real wave of covid-19 in the continent.

“The combination of the rising euro-area growth expectations, solid

equity returns for the region, initial normalization signals from the

ECB, and more stable Fed pricing will extend the recent turn higher in

the euro,” Goldman Sachs analysts write.

With the recommendation, they’ve also issued a trade idea to buy at spot with a 1.2500 target and stop at 1.1750. Their 12-month target is unchanged at 1.2800.