Gold has been extending its gains, benefiting from the persistent drop in US Treasury yields. Returns on ten-year US debt has remained below 1.60%, making the yieldless precious metal more attractive. Moreover, it seems that the XAU/USD bulls are lifting their heads, with fresh interest.

How is gold positioned on the technical charts?

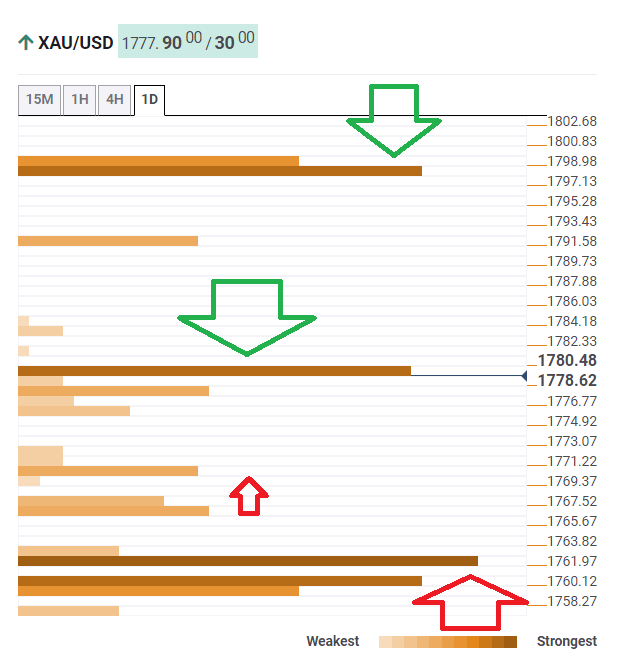

The Technical Confluences Detector is showing that XAU/USD is struggling at the $1,779 level, which is the convergence of the Pivot Point one-week Resistance 2, the Bollinger Band 1h-Upper and the previous 4h-high.

The upside target is $1,798, which is a juncture of lines including the PP one-month R2 and the PP one-week R3.

Looking down, some support awaits at $1,770, which is where the previous daily high meets the Simple Moving Average 10-1h.

A significant cushion awaits at $1,761, which is the confluence of the PP one-week R1, the Fibonacci 23.6% one-day and the previous monthly high.

XAU/USD resistance and support levels

Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Learn more about Technical Confluence