March 2021 non-farm payrolls highlights

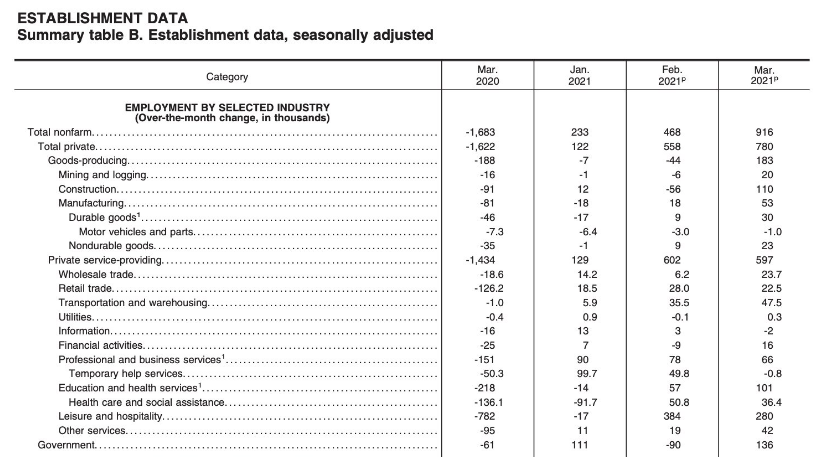

- Prior was 379K

- Unemployment rate 6.0% vs 6.0% expected

- Prior unemployment rate 6.2%

- Participation rate 61.5% vs 61.5% expected (was 62.8% pre-pandemic)

- Prior participation rate 61.4%

- Underemployment rate 10.7% vs 11.1% prior

- Average hourly earnings -0.1% m/m vs +0.1% expected

- Average hourly earnings +4.2% y/y vs +4.5% expected

- Average weekly hours 34.9 vs 34.7 expected

- Two month net revision +156K

- Change in private payrolls +780K vs +643K expected

- Change in manufacturing payrolls +53K vs +35K expected

- Long-term unemployed at 4.2m vs 4.1m prior

- The employment-population

ratio, at 57.8% vs 57.6% prior - Full report

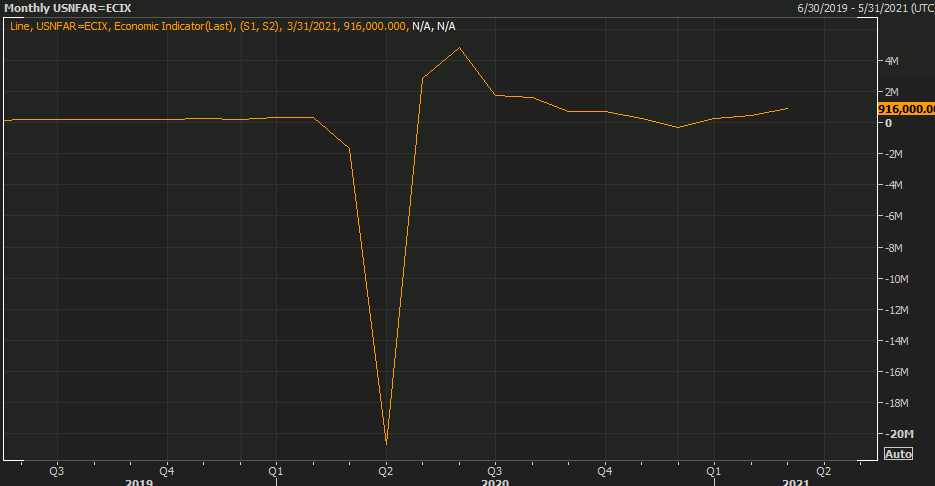

This report lands on Good Friday into a thin market and we saw some strong, quick pops in the US dollar. The unemployment rate was in line with estimates but given the uptick in the participation rate, that’s good news.

There’s nothing to dislike in this report and it should continue to lift USD/JPY and USD/CHF. I don’t see it changing much from the Fed’s perspective; we’ll need quite a few of these kinds of reports to sop up all the slack in the workforce.

The leisure and hospitality sector was the biggest driver with 280K jobs but that’s not as much as you would think with the big headline. That means there’s more re-hiring that hasn’t yet taken place and will keep the numbers high for months to come. Otherwise, the job gains were broad-based.