Yen remains generally weak in early US session today. But buying focuses against the Japanese currency has somewhat turned from Dollar to Sterling and Canadian. Both the Pound and Loonie were lifted slightly be better than expected GDP data. On the other hand, Dollar’s rally is losing some momentum. Traders are turning their attention to US President Joe Biden’s infrastructure plan, estimated at the scale of USD 3-4 trillion.

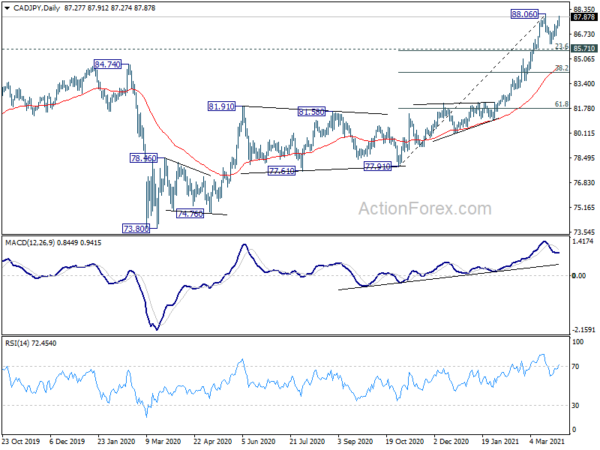

Technically, 152.52 resistance in GBP/JPY is in focus. Firm break there will confirm resumption of whole up trend from 123.94, for 156.59 long term resistance. CAD/JPY is also set to retest 88.06 high. Firm break there will resume larger rise from 73.80, towards corresponding resistance at 91.62.

In Europe, currently, FTSE is down -0.03%. DAX is down -0.08%. CAC is down -0.11%. Germany 10-year yield is down -0.0077 at -0.289. Earlier in Asia, Nikkei dropped -0.86%. Hong Kong HSI dropped -0.70%. China Shanghai SSE dropped -0.43%. Singapore Strait Times dropped -0.80%. Japan 10-year JGB yield rose 0.0052 to 0.098.

US ADP jobs grew 517k, strongest since last Sep

US ADP employment grew 517k in March, below expectation of 550k. By company size, small businesses added 174k jobs, medium businesses added 188k, large businesses added 155k. By sector, goods-producing jobs grew 80k, service-providing grew 437k.

“We saw marked improvement in March’s labor market data, reporting the strongest gain since September 2020,” said Nela Richardson, chief economist, ADP. “Job growth in the service sector significantly outpaced its recent monthly average, led with notable increase by the leisure and hospitality industry. This sector has the most opportunity to improve as the economy continues to gradually reopen and the vaccine is made more widely available. We are continuing to keep a close watch on the hardest hit sectors but the groundwork is being laid for a further boost in the monthly pace of hiring in the months ahead.”

Canada GDP grew 0.7% mom in Jan, expecting 0.5% mom growth in Feb

Canada GDP grew 0.7% mom in January, above expectation of 0.5% mom. That’s the ninth consecutive monthly increase. Yet, total economic activity remained about -3% below February 2020 level, before the pandemic. Good-producing industries were up 1.5% mom while services-producing industries were up 0.4% mom. 20 industrial sectors were nearly evenly split between expansions and contractions.

Preliminary information suggests an approximate 0.5% increase in real GDP for February. Retail trade, construction, and real estate and rental and leasing all contributed to the growth, while manufacturing offset some of the increase.

ECB Lagarde: We have exceptional circumstances to deal with at the moment

ECB President Christine Lagarde said in a Bloomberg TV interview, “We have exceptional circumstances to deal with at the moment and we have exceptional tools to use at the moment, and a battery of those. We will use them as and when needed in order to deliver on our mandate and deliver on our pledge to the economy.”

“Given the exceptional situation that we are facing we are using maximum flexibility” with the EUR 1.85T PEPP purchases program, she added. The March 2022 deadline of the program was not “set in stone”, and policy makers will give “sufficient early notice to avoid the anxiety, the tantrum, or any of those movements” that have happened in the past.

Overall, Lagarde said, “we have an economic situation overall which in this part of the world, Europe, is really marked by uncertainty. What monetary policy has to do and what the ECB has to do is to provide as much certainty as possible.”

Eurozone CPI jumped to 1.3% yoy in Mar, but core CPI slowed to 0.9% yoy

Eurozone CPI jumped to 1.3% yoy in March, up from 0.9% yoy, above expectation of 0.9% yoy. However, CPI core dropped to 0.9% yoy, down from 1.1% yoy, missed expectation of 1.1% yoy.

Energy is expected to have the highest annual rate in March (4.3%, compared with -1.7% in February), followed by services (1.3%, compared with 1.2% in February), food, alcohol & tobacco (1.1%, compared with 1.3% in February) and non-energy industrial goods (0.3%, compared with 1.0% in February).

France CPI jumped to 1.1% yoy in Mar, consumer spending flat in Feb

France CPI accelerated to 1.1% yoy in March, up from February’s 0.6% yoy. This increase in inflation should result from the acceleration in the service prices and from a marked rebound of those of the energy.

Consumer spending was flat in February, below expectation of 1.3% mom rise. The increase in manufactured goods purchases (+3.4%) was offset by a drop in energy expenditure (-3.1%) and food consumption (-2.2%).

UK Q4 GDP finalized at 1.3% qoq, contracted -9.8% in a 2020 as a whole

UK GDP growth was finalized 1.3% qoq in Q4, revised up from 1.0% qoq. The level of GDP was still -7.3% below it’s Q4, 2019 level, prior to the impact of the coronavirus pandemic. Over the year as a whole, GDP contracted -9.8% in 2020, slightly revised from first estimate of -9.9% decline. That is the largest annual fall in UK GDP on record.

Also released, current account deficit widened to GBP -26.3B in Q4, versus expectation of GBP -34.8B.

Japan industrial production dropped -2.1% mom in Feb, more contraction expected in Mar

Japan industrial production dropped -2.1% mom in February, worse than expectation of -1.3% mom. In addition to pandemic restrictions, production was disrupted by the 7.3-earthquake off the coast of eastern Japan on February 13.

Manufacturers surveyed by the Ministry of Economy, Trade and Industry expected output to drop another -1.9% mom in March, followed by 9.3% mom rebound in April. But the actual figure could be worse as the impact of the March 19 fire at a Renesas Electronics chip-making plant was not reflected in the forecasts yet.

China PMI manufacturing rose to 51.9, PMI non-manufacturing rose to 56.3

China official PMI Manufacturing rose to 51.9 in March, up from 50.6, above expectation of 51.0. That’s also the highest level in 2021. 17 of the 21 industries saw expansion in the month. New order index rose 2.1 pts to 53.6. New export orders rose 2.4 pts to 51.1. PMI Non-Manufacturing jumped to 56.3, up from 51.4, above expectation of 52.6. PMI Composite rose to 55.3, up from 51.6.

“After the Lunar New Year, the recovery of production accelerated, and the manufacturing industry rebounded significantly in March,” said Zhao Qinghe, a senior statistician at the NBS. “As the results of pandemic controls being consolidated, consumer demand continues to be released, and the service industry accelerated its recovery.”

Suggested reading on China: China’s Economic Activities Expanded Strongly in March. Trade Frictions and Pandemic Remain Key to Outlook.

New Zealand ANZ business confidence dropped to -4.1, demand overshoot wanes

New Zealand ANZ Business Confidence dropped to -4.1 in March, comparing to preliminary reading at 0, and down from February’s 7. Own Activity Outlook dropped to 16.6 (prelim. at 17.4), down from 21.3. Export intentions dropped to 4.5, down from 5.1. Investment intentions dropped to 11.9, down from 15.6. Employment intentions rose to 14.4, up from 10.6. Pricing intentions rose to 47.3, up from 46.2.

ANZ said: “The March snap lockdowns make Business Outlook data a little harder to interpret. However, it is consistent with our view that as the demand overshoot wanes and the tourists are missed more and more, the economy will go largely sideways this year. The quicker cooling we now expect in the housing market plays into this theme as well. The vaccine rollout and the subsequent border re-opening will be game-changers, though it won’t be click-of-a-switch stuff. But there’s a path to the new normal, whatever precisely that looks like, and we’re on it. We’ll be keeping an eye on construction for possible bumps in the road.”

From Australia, private sector credit rose 0.2% mom in February. Building permits jumped 21.6% mom in February.

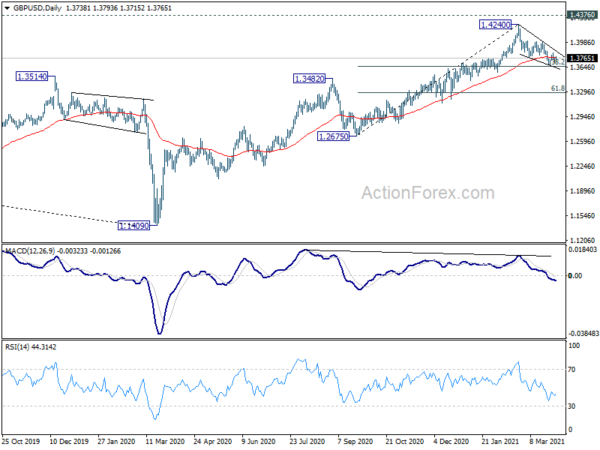

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.3703; (P) 1.3743; (R1) 1.3780; More….

GBP/USD recovers mildly today but stays inside range of 1.3669/3846. Intraday bias remains neutral first. We’re still slightly favoring the case that corrective pull back from 1.4240 has completed with three waves down to 1.3669, ahead of 38.2% retracement of 1.2675 to 1.4240 at 1.3642. On the upside, break of 1.3846 will extend the rebound to 1.4000 resistance and then 1.4240 high. However, sustained break of 1.3642 will turn bring deeper fall to 1.3482 resistance turned support.

In the bigger picture, rise from 1.1409 medium term bottom is in progress. Further rally would be seen to 1.4376 resistance and above. Decisive break there will carry larger bullish implications and target 38.2% retracement of 2.1161 (2007 high) to 1.1409 (2020 low) at 1.5134. On the downside, break of 1.3482 resistance turned support is needed to be first indication of completion of the rise. Otherwise, outlook will stay cautiously bullish even in case of deep pullback.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Industrial Production M/M Feb P | -2.10% | -1.30% | 4.30% | |

| 00:00 | NZD | ANZ Business Confidence Mar | -4.1 | 0 | ||

| 00:30 | AUD | Private Sector Credit M/M Feb | 0.20% | 0.30% | 0.20% | |

| 00:30 | AUD | Building Permits M/M Feb | 21.60% | 5.10% | -19.40% | |

| 01:00 | CNY | NBS Manufacturing PMI Mar | 51.9 | 51 | 50.6 | |

| 01:00 | CNY | Non-Manufacturing PMI Mar | 56.3 | 52.6 | 51.4 | |

| 05:00 | JPY | Housing Starts Y/Y Feb | -3.70% | -4.80% | -3.10% | |

| 06:00 | GBP | GDP Q/Q Q4 F | 1.30% | 1.00% | 1.00% | |

| 06:00 | GBP | Current Account (GBP) Q4 | -26.3B | -34.8B | -15.7B | |

| 06:45 | EUR | France CPI M/M Mar P | 0.60% | 0.70% | 0.00% | |

| 06:45 | EUR | France CPI Y/Y Mar P | 1.40% | 1.30% | 0.80% | |

| 06:45 | EUR | France Consumer Spending M/M Feb | 0.00% | 0.70% | -4.60% | -4.90% |

| 07:55 | EUR | Germany Unemployment Change Feb | -8K | -5K | 9K | -37K |

| 07:55 | EUR | Germany Unemployment Rate Feb | 6.00% | 6.00% | 6.00% | |

| 08:00 | CHF | Credit Suisse Economic Expectations Mar | 66.7 | 55.5 | ||

| 09:00 | EUR | Eurozone CPI Y/Y Mar P | 1.30% | 0.90% | 0.90% | |

| 09:00 | EUR | Eurozone CPI Core Y/Y Mar P | 0.90% | 1.10% | 1.10% | |

| 12:15 | USD | ADP Employment Change Mar | 517K | 550K | 117K | |

| 12:30 | CAD | Industrial Product Price M/M Feb | 2.60% | 2.50% | 2.00% | |

| 12:30 | CAD | Raw Material Price Index Feb | 6.60% | 5.30% | 5.70% | |

| 12:30 | CAD | GDP M/M Jan | 0.70% | 0.50% | 0.10% | |

| 13:45 | USD | Chicago PMI Mar | 60.3 | 59.5 | ||

| 14:00 | USD | Pending Home Sales M/M Feb | -2.60% | -2.80% | ||

| 14:30 | USD | Crude Oil Inventories | -1.3M | 1.9M |