Decent US dollar move, but certainly nothing sensational

The US dollar caught a quick bid after a roundly-stronger March non-farm payrolls report. The US added 916K jobs in the month, besting the +660K consensus estimate.

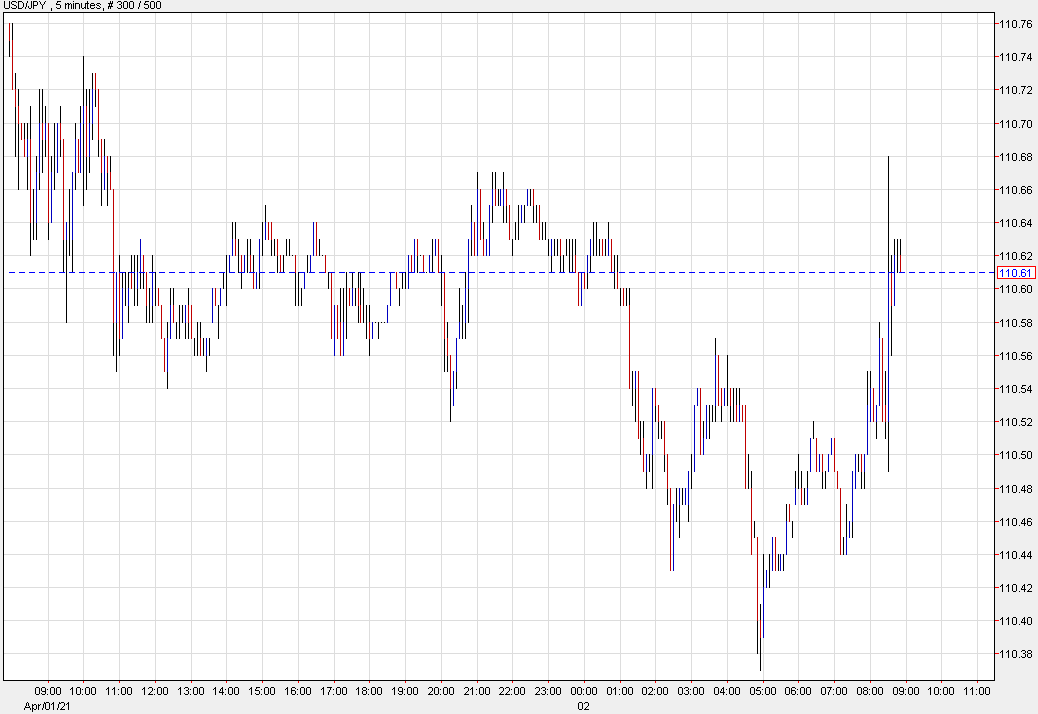

USD/JPY jumped to a high of 110.68 from 110.55 on the data and there were similar USD kneejerk moves higher across the board. Overall though, the market was restrained, owing to holidays in Europe and North America.

Bonds also sold off with US 10-year yields up 2.2 bps to 1.68%. US equities will remain closed today but S&P 500 futures rose by 18 points.

I think this report will add more fuel to the dollar fire on Monday, particularly in USD/JPY and USD/CHF, which benefit from yield differentials. The US dollar fell against CAD on the report and is flat against the antipodeans. I think that’s generally the right idea, as the Canadian economy continues to piggyback on strong US reopening demand.

This article was originally published by Forexlive.com. Read the original article here.