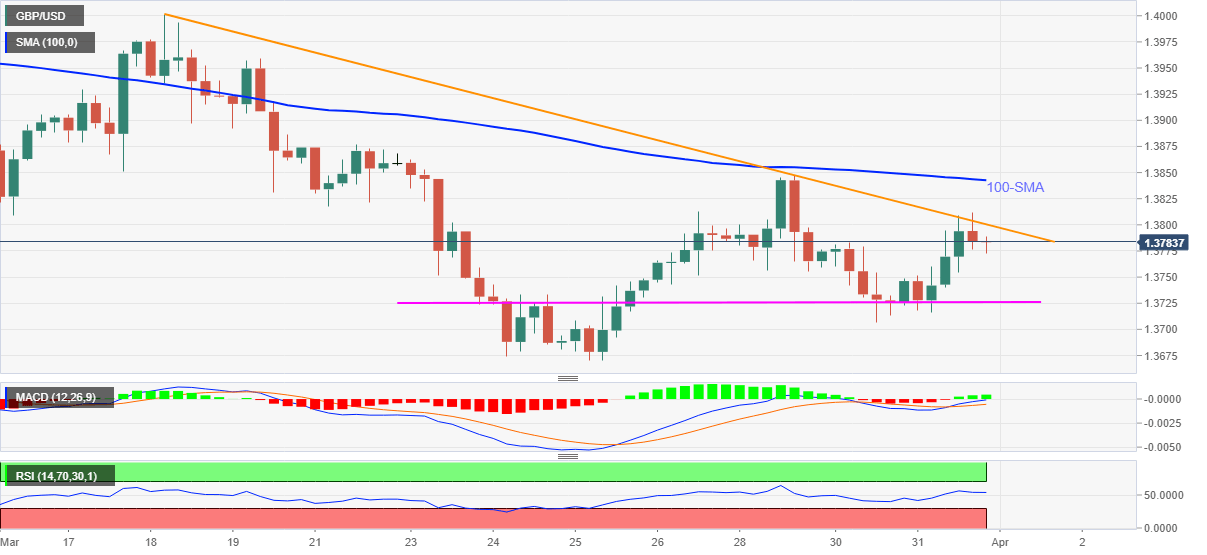

- GBP/USD seesaws in a choppy range after easing from 1.3812.

- Bullish MACD, upbeat RSI and sustained trading beyond immediate horizontal support favor bulls.

- 100-SMA adds to the upside filters, March low offers extra challenge for bears.

Having snapped a two-day losing streak the previous day, GBP/USD cools down to 1.3785, staying inside a 10-pip range, during Thursday’s Asian session. In doing so, the quote justifies pullback from a downward sloping trend line from March 18.

However, strong MACD and RSI joins the cable’s sustained trading above a short-term horizontal area around 1.3730 keeps buyer hopeful.

It should be noted that a clear break of the immediate resistance line, at 1.3800, needs to cross the 100-SMA level of 1.3842 to convince GBP/USD bulls.

Meanwhile, a downside break of 1.3730 will have the previous month’s low around 1.3670 as an extra hope of a bounce.

Overall, GBP/USD is consolidating losses from late February but the road to recovery is bumpy.

GBP/USD four-hour chart

Trend: Further recovery expected