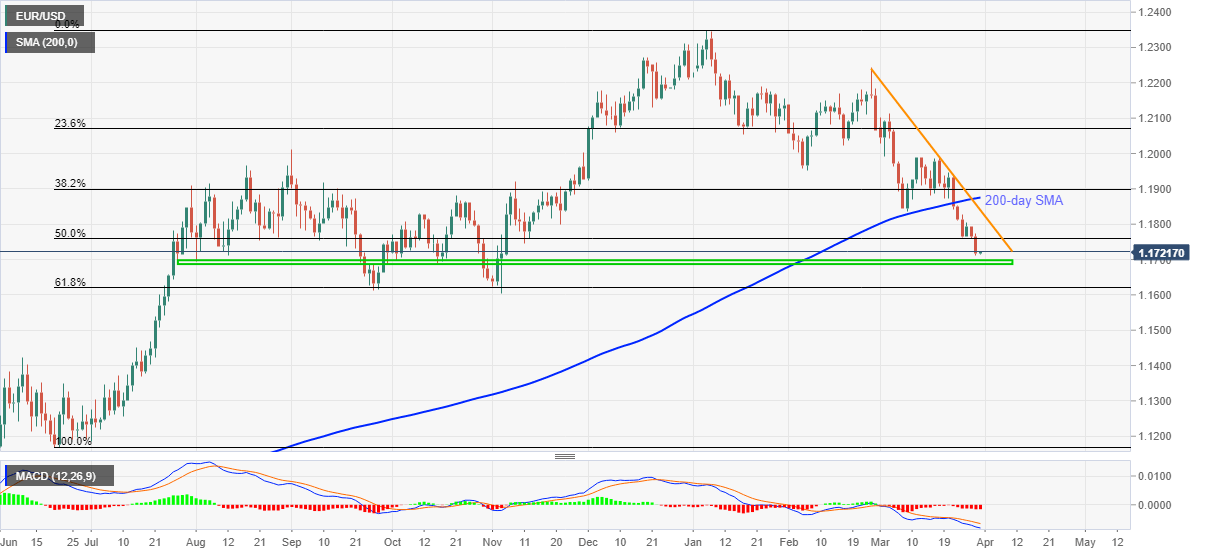

- EUR/USD bears catch a breather around low marked on November 05, 2020.

- Bearish MACD, sustained trading below 200-day SMA favor sellers.

- Multiple bottoms since late-July add to the downside filters.

- Five-week-old falling trend line also becomes important resistance.

EUR/USD picks up bids to 1.1722 while consolidating the recent losses during Wednesday’s Asian session. Even so, the quote keeps the previous day’s downside break of 50% Fibonacci retracement level of June 2020 to January 2021 upside.

Other than the clear trading below the key Fibonacci retracement level, 200-day SMA breakdown and a downward sloping trend line from February 25, coupled with the bearish MACD, also favor EUR/USD sellers.

However, an eight-month-long horizontal area around 1.1700-1685 restricts the pair’s immediate downside ahead of the 61.8% Fibonacci retracement level and November 2020 bottom, respectively around 1.1620 and 1.1600.

Meanwhile, a corrective pullback beyond 50% Fibonacci retracement level of 1.1758 will aim to regain the 1.1800 threshold.

Though, any further upside past-1.1800 will be challenged by the stated resistance line and the early month lows near 1.1835-40. Also likely to question the EUR/USD run-up is the 200-day SMA level of 1.1875.

Overall, EUR/USD bears have some room to the south before confronting the key support.

EUR/USD daily chart

Trend: Further weakness expected