Gold hasn’t been doing much in trading this week

Even with the ebb and flow in the dollar, gold has managed more sideways action if anything else in the market this week. Treasury yields retreated from the highs last week but has kept above 1.60%, so that still leaves some potential headwind for gold.

Although not breaking further above 1.75%, Treasury yields settling into a higher range still isn’t quite good news for gold even as the Fed continues to maintain its policy stance.

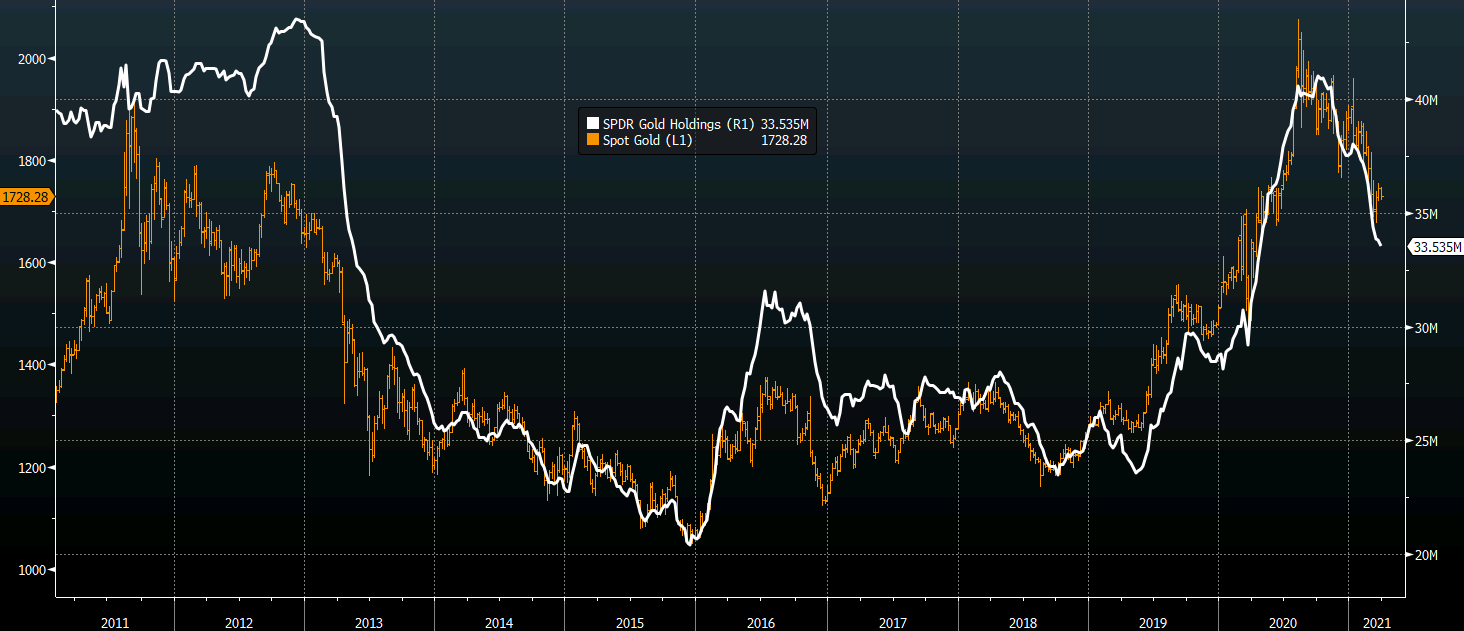

Evidently, ETF positioning supports that argument as gold is still failing to attract investor appetite after everything else that has happened this month.

Price action shows that gold is bouncing around between some support around $1,721-24 while upside is also limited around the swing region closer to $1,740-45 and centering around the key hourly moving averages.

That suggests a lack of conviction on both sides of the play as buyers and sellers are weighing up the outlook for the bond market and gold appetite in general.

That said, as much as Treasury yields may be keeping calmer until there economic data supports the argument for the next shove higher, gold may still fail to find a solid reason to turn around this year unless ETF buying returns.

For now, investor appetite remains rather weak so even the pullback in 10-year real yields from -0.58% to -0.66% this week isn’t providing much comfort for gold.