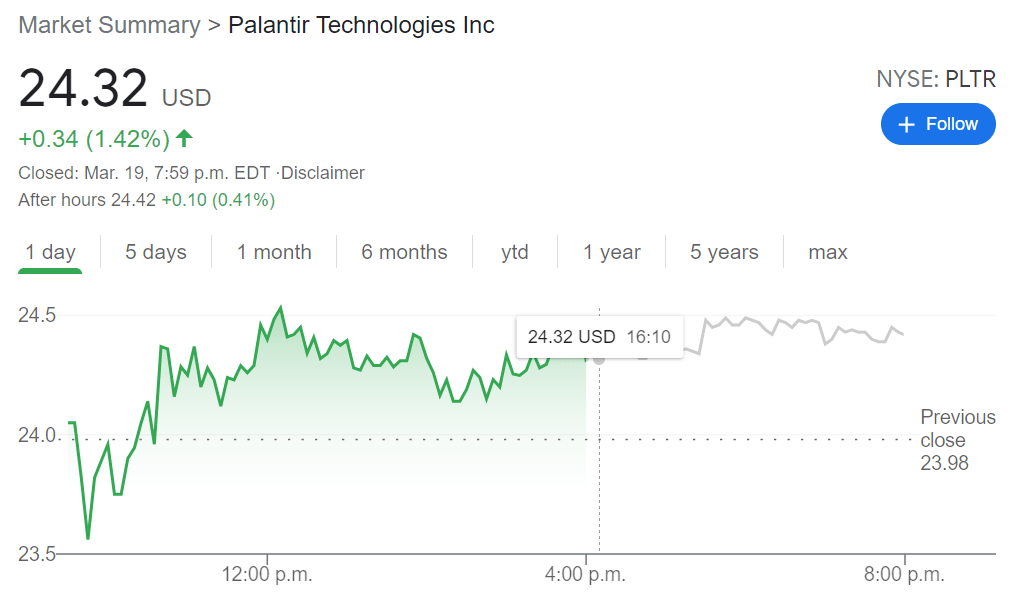

- NYSE:PLTR gained 1.42% to close the trading week on a positive note.

- Palantir CEO Alex Karp stirs up Wall Street with some controversial takes.

- Palantir continues to trade under the guise of a meme stock, but it may be a sleeping giant.

Update March 23: Palantir Technologies (NYSE: PLTR) have closed Monday’s session with a minor drop of 0.41% to close at $24.22. The Denver-based data analytics company has been drifting alongside broader markets, which highly anticipate critical testimonies later in the day. Federal Reserve Chair Jerome Powell and Treasury Secretary Janet Yellen will appear before Congress and will talk about the current state of the economy, inflation and other topics. A vast $3 trillion infrastructure plan is eyed.

NYSE:PLTR has been one of the most heavily debated stocks since it went public via a direct listing in September of 2020. Other than GameStop (NYSE:GME), Palantir may be the most polarizing company in FinTwit circles, and much of the discussion does not even touch on the firm’s mysterious business. On Friday, Palantir reversed the downward momentum that had followed the stock all week, as it added 1.42% to close the trading session at a price of $24.32. Shars are still down over 45% since Palantir hit an all-time high of $45,00 back in late-January.

Stay up to speed with hot stocks’ news!

During a recent CNBC interview, Palantir CEO Alex Karp made some comments that were sure to ruffle some feathers on Wall Street. Karp was quite clear about supporting long-term retail investors over institutional investors, which he attributes to why Palantir chose a friendlier direct listing rather than a traditional IPO. He went on to state that short-term traders should look away from Palantir as the company has a long-term vision for success and is not a stock to be day traded. CEOs that have shareholders in mind generally gain favor amongst retail investors, so Palantir should continue to be a popular stock to own.

PLTR Stock forecast

Palantir gained its momentum as a stock that Redditors gravitated towards due to its mysterious business and anti-corporate behavior. Sure Palantir nearly trades at 200 times 2021 profit projections, but the company is also estimating that its revenues will grow to $4 billion by 2025. So, not only is it a popular stock for investors to follow, but its forward-looking growth means that it is positioned for a great long-term investment.

Previous updates:

Shares in Palantir are just in the green on Monday as broader markets and technology share rebound from last week’s drubbing. Palantir shares are trading at $24.45 up 0.5% on Monday. Stephen Cohen is reported to have sold 140,455 shares in an SEC filing last week.