German Dax has back to back declines after 4 consecutive record closes last week

The European major indices are ending the day mostly lower. Italy’s FTSE MIB bucked the trend with a modest gain. The German Dax fell for the second consecutive day after closing at record levels for the first four days of last week’s trading.

The provisional closes are showing:

- German Dax, -0.3%

- France’s CAC, -0.2%

- UK’s FTSE 100, -0.2%

- Spain’s Ibex, -0.1%

- Italy’s FTSE MIB, +0.15%

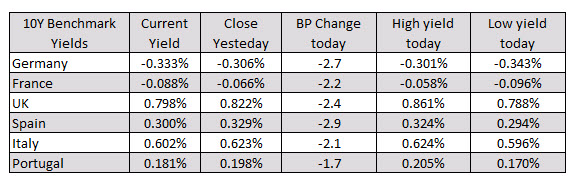

In the European debt market, the benchmark 10 year yields all fell around 2 to 3 basis points on the day.

In other markets as European traders look to exit:

- Spot gold is trading up $3.20 or +0.18% at $1730.31. The price is traded above and below the unchanged level for the New York session

- spot silver is trading up $0.28 or 1.1% at $26.20

- WTI crude oil futures are trading down $0.28 or -0.43% at $65.33. That is off earlier lows at $64.13

- the price of bitcoin is now down over $4000 or -6.7% to $56,210. The low price reached $54,568. The high price extended up to $60,746.

In the US stock market, the major indices have been moving above and below the unchanged level. Currently,

- S&P index is down 1.56 points or -0.04% at 3941.87

- NASDAQ index is up 20 points or 0.15% at 13339.50

- Dow industrial average is up 27 points or 0.08% of 30806

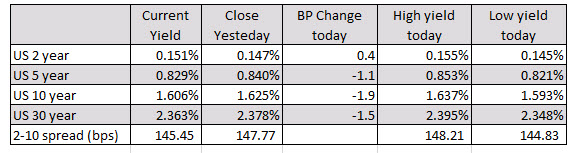

In the US that market, yields are mostly lower with the exception of the two year yield which is up +0.4 basis points. Yields were modestly higher at the start of the New York session.

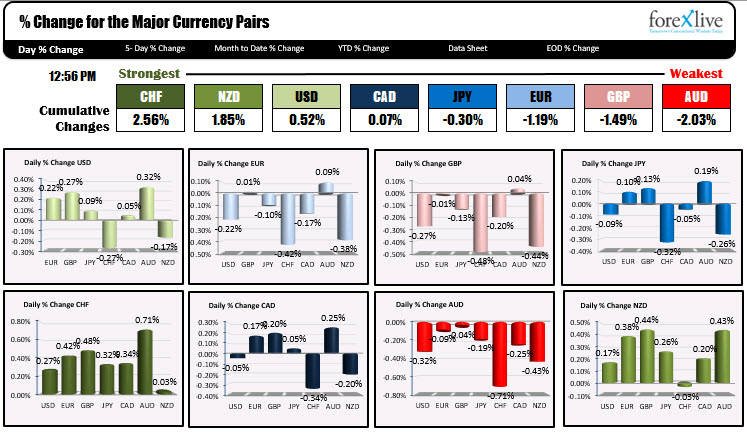

In the forex, the order of the strongest are changing at the top of the board, but the AUD remains the weakest of the majors (was the weakest at the start of the day too). The strongest is the CHF now. The CHF started the strongest at the start of the day, but the NZD took over around the time of the stock opening. Now the CHF is back on top. The USD is still mixed with the largest gains vs the AUD.

In the forex, the order of the strongest are changing at the top of the board, but the AUD remains the weakest of the majors (was the weakest at the start of the day too). The strongest is the CHF now. The CHF started the strongest at the start of the day, but the NZD took over around the time of the stock opening. Now the CHF is back on top. The USD is still mixed with the largest gains vs the AUD.

For those wondering, US changed clocks this weekend. So. the time difference between London and the US is now 4 hours (for a few weeks at least).