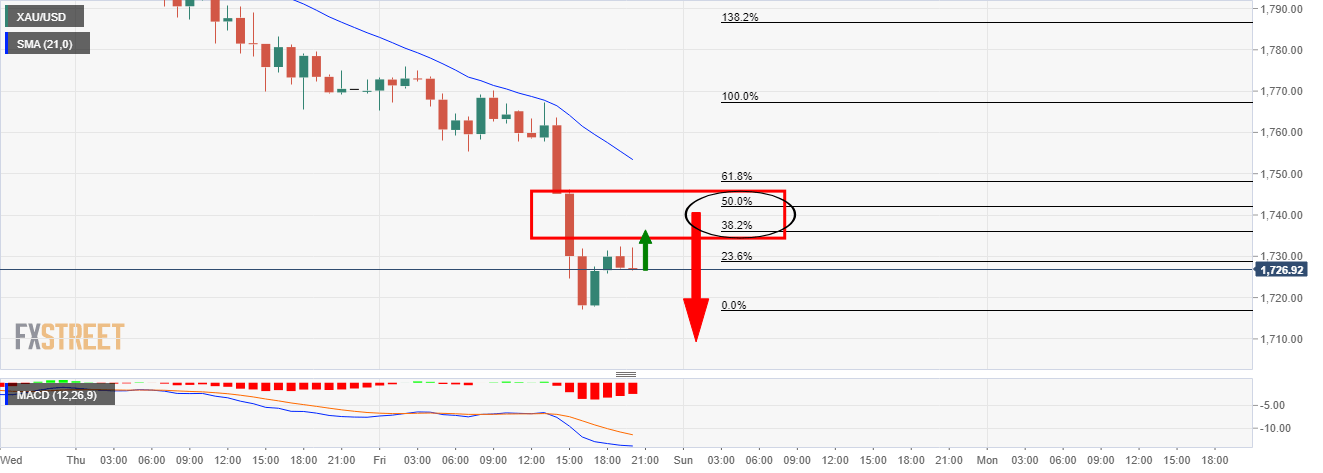

Gold Price Analysis: XAU/USD corrrects to the 50% mean reversion target

Gold prices have corrected a significant portion of the latest bearish impulse. Failures at this resistance could lead to a fresh downside impulse. As per the prior analysis for the open on Monday, The Chart of the Week: Gold correcting towards critical resistance from fresh bear cycle lows, the price has corrected to the 50% mean reversion point of the latest bearish impulse.

Markets Outlook: Markets suffering from a case of “blues and twos”

Higher US yields continue to pressure gold, which remains mired in a downtrend that began in August, with gold ETF and futures speculative positioning both coming off from the top to about 80% of the last year’s range. Technical trends kicked in when gold gapped down to $1,756.30 from $1,765/66, then triggered stop losses in a cascading effect as the rise in US bond yields triggering inflows into USD is the most forceful headwind for precious metals.

#shorts #crypto #forex #trading #patterns

#shorts #crypto #forex #trading #patterns