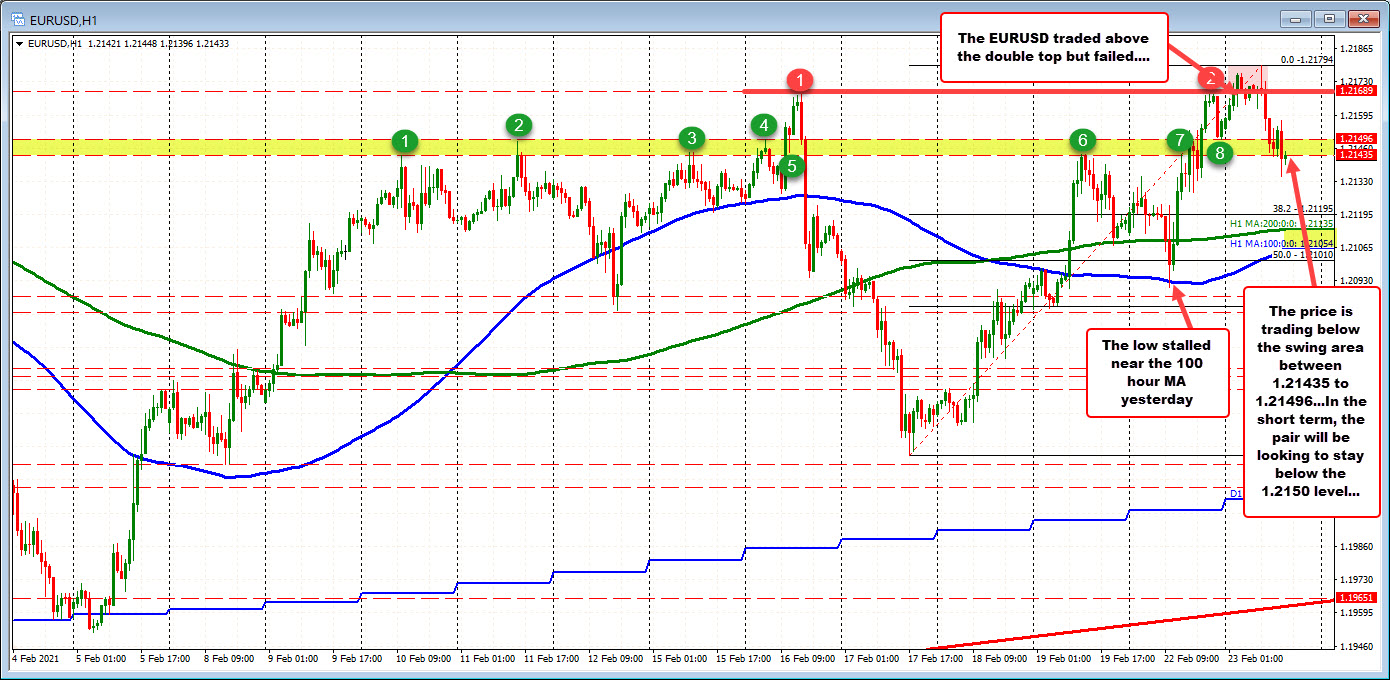

Watch 1.2150 for close resistance if the sellers are to keep intraday control.

The EURUSD traded to the highest level since January 25 today and in the process broke above the double top from February 16 and yesterday’s trading at 1.2169. However, the move higher was erratic with fits and starts in the Asian session. The high price did reach 1.21794, but that was only about 10 basis points higher than the double top level.

In the European session, the price finally gave up and rotated to the downside. Support at a swing area between 1.21435 to 1.21496 (see green numbered circles) initially stalled the fall. However, the last 2 hourly bars have seen a move below that swing area. The low price for the day has reached 1.21348.

With the market failing on the break above, and falling back below the swing area, the sellers are trying to take control after the move higher from the February 17 low (3 days of gains). In the short-term, staying below 1.21496 (call it 1.2150), keeps the sellers more in control. A move back above muddies the water for the bias intraday (it tilts a little more to the bullish side again).

If the sellers can remain in control, the 38.2% retracement of the move up from the February 17 low comes in at 1.21195. The 200 hour moving average comes in at 1.21135 (green line in the chart above).