Dollar holds firmer even as the reflation trade pauses for breath

Equities are looking more tepid as tensions are stirring after the rout in the bond market yesterday. Treasuries may be finding some mild relief for now but sentiment remains on a knife’s edge as we look towards North American trading.

The dollar firmed yesterday on the back of higher yields and is so far keeping that momentum going in trading today, gaining modest ground across the board.

EUR/USD is holding near the lows around 1.2065 while GBP/USD is looking to crack below near-term support from its 100-hour moving average currently:

Elsewhere, commodity currencies are also struggling with AUD/USD falling back to 0.7740 from 0.7770; although, USD/CAD is only slightly higher at 1.2706 (testing its 200-hour moving average still) as the loonie hangs on amid higher oil prices.

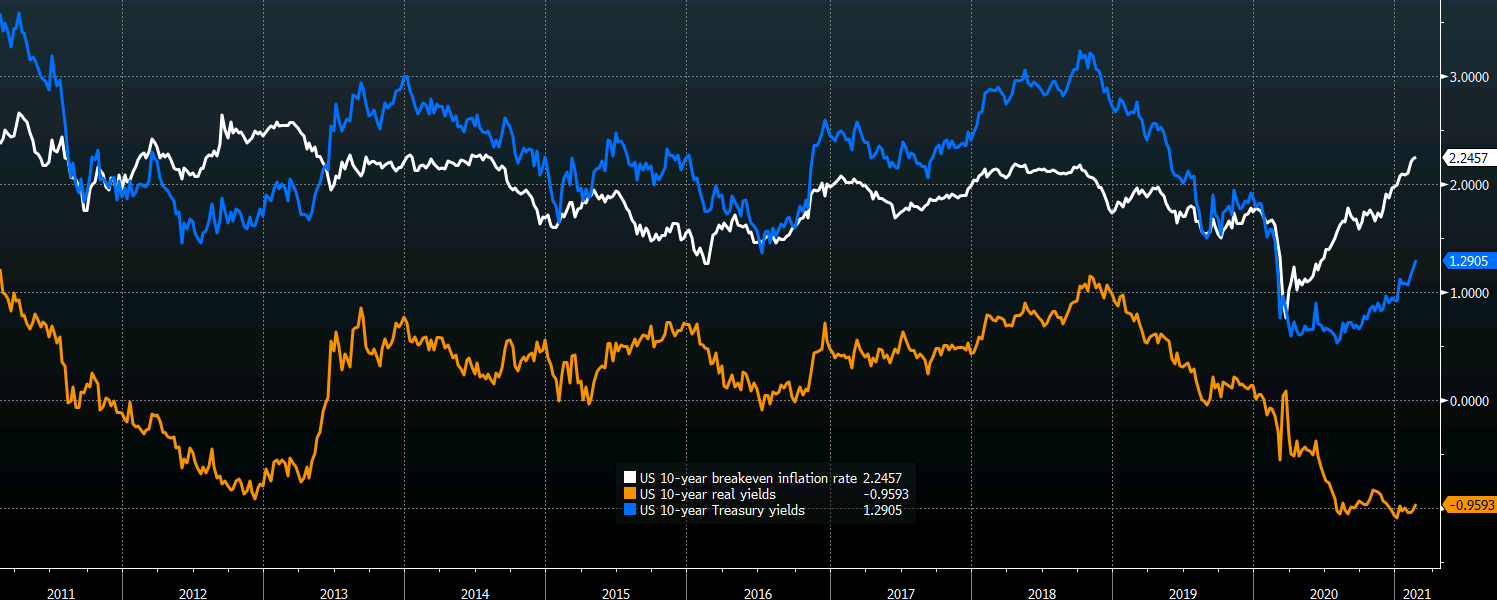

It is still all about the reflation theme and the bond market remains the key spot to watch in trading this week. Breakevens are at the highest since 2014 but real yields are still keeping rather depressed, though at least back above -1% currently: