Silver trades at the highs for the day ahead of North American trading

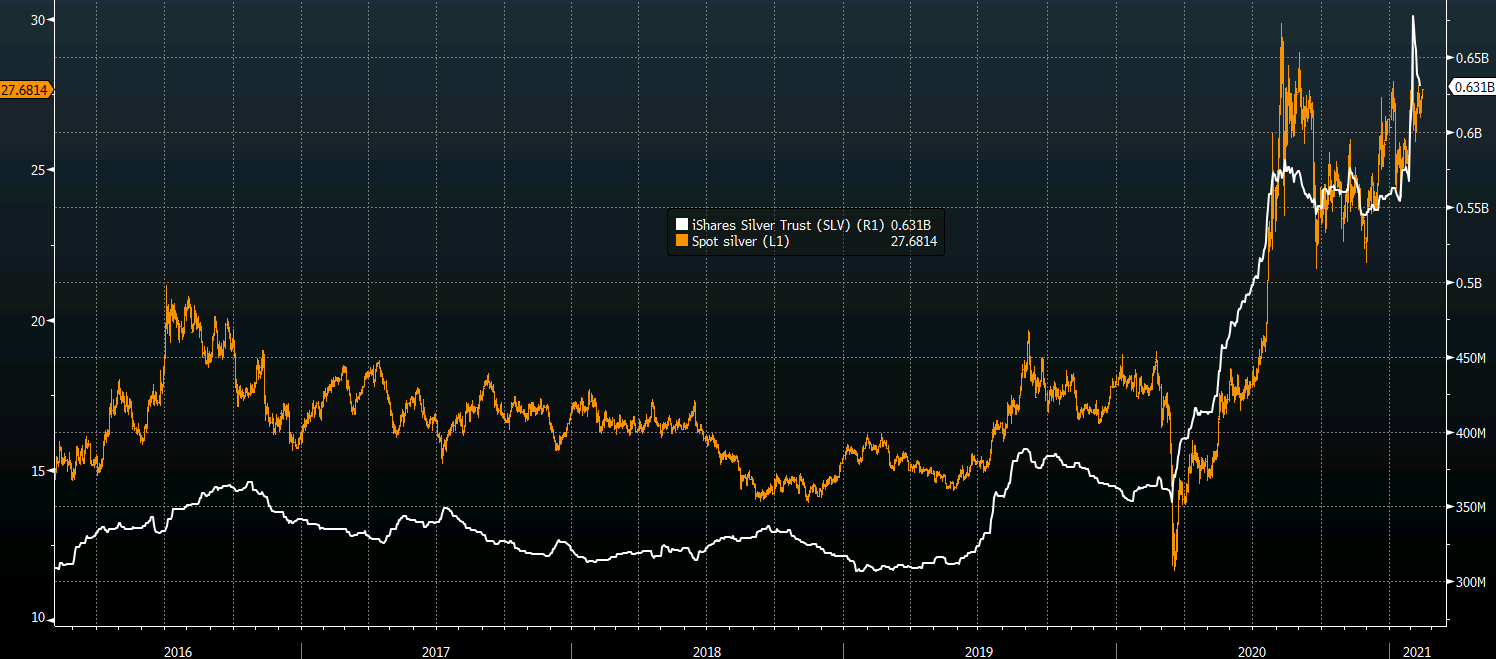

With gold looking rather underwhelming to start the year, plenty of attention in the precious metals space has turned to silver (and platinum) – especially with the recent run in the former towards $30 to kick start the new year.

While that may have been largely driven by speculative positions capitalising on the hype from the retail trading frenzy, it also serves as an acknowledgment for underlying sentiment in silver i.e. market still looking for bullish bets.

Drilling into price action, buyers are in near-term control as long as price holds above the key hourly moving averages @ $27.03-22. Further support is then seen closer to $26.70-82 from the lows last week.

Meanwhile, last week’s highs near $27.80 and the $28.00 level (50.0 retracement level) are key resistance points to focus on if the upside move extends this week.

The contrast between gold and silver is rather evident from the year-to-date performance. While gold is down 4%, silver is up by nearly 5% as the rally in the commodities space continues – helped by the return of the reflation narrative this year as well.

Regardless, I would argue that any dip back towards $25 to $26 is one to buy into as long as the current set of fundamentals remain in play for silver. The 100-day moving average also provides some support closer to $25, if one is looking for technical comfort.