Sterling appears to be one of the stronger after data showed larger than expected GDP growth in December and Q4. But for now. Mean while Dollar and Euro are following as the next better performer. The greenback attempted for a recovery earlier today. But apparently, there is now follow through buying so far. Commodity currencies are the weaker ones for today, except the Canadian. Bitcoin steals the show in making a record high, but there is also no follow through buying.

Technically, EUR/USD is holding above 1.2087 minor support, AUD/USD above 0.7681 minor support, USD/CHF below 0.8945 minor resistance and USD/CAD below 1.2781 minor resistance. So, Dollar is still vulnerable to another round of selloff, any time soon.

In Europe, currently, FTSE is up 0.11%. DAX is down -0.49%. CAC is up 0.15%. Germany 10-year yield is up 0.012 at -0.444. Earlier in Asia, Nikkei closed down -0.14%. Japan 10-year JGB yield dropped -0.0158 to 0.064. Hong Kong, China, and Singapore were on holiday.

UK GDP grew 1.2% mom in Dec, 1% qoq in Q4

UK GDP grew 1.2% mom in December, above expectation of 1.0% mom rise. Index of services rose 1.7% mom. Index of production rose 0.2% mom. Manufacturing rose 0.3% mom. Construction dropped -2.9% mom. Agriculture rose 0.3% mom.

For Q4, GDP grew 1.0% qoq, well above expectation of 0.5% qoq. Index of services rose 0.6% qoq. Index of production rose 1.8% qoq. Manufacturing rose 3.3% qoq. Construction rose 4.6% qoq. Agriculture rose 0.7% qoq.

For 2020, annual average GDP contracted -9.9%, largest yearly fall on record. Services dropped -8.9%. Production dropped -8.6%. Construction dropped -12.5%. Agriculture dropped -9.4%.

Also released, UK trade deficit narrowed to GBP -14.3B in December, below expectation of GBP -15.5B. Swiss CPI came in at 0.1% mom, -0.5% yoy in January.

New Zealand BusinessNZ manufacturing rose to 57.5, encouraging with new orders leading the way

New Zealand BusinessNZ Performance of Manufacturing jumped a notable 9.2 pts to 57.5 in January. Looking at some details, Production rose from 52.3 to 59.1. Employment rose from 50.2 to 55.4. New Orders rose from 50.3 to 62.4. Finished stocks rose from 47.8 to 52.5. Deliveries also improved from 45.0 to 48.7.

BusinessNZ’s executive director for manufacturing Catherine Beard said that the January result was a welcome start to 2021, with the result clearly above the long term average of 53.0 for the Index.

BNZ Senior Economist, Craig Ebert said that “the 3-month average to January was 53.6, slightly above the long-term norm of 53.0. Also, January’s improvement was encouraging in its composition, with New Orders leading the way”.

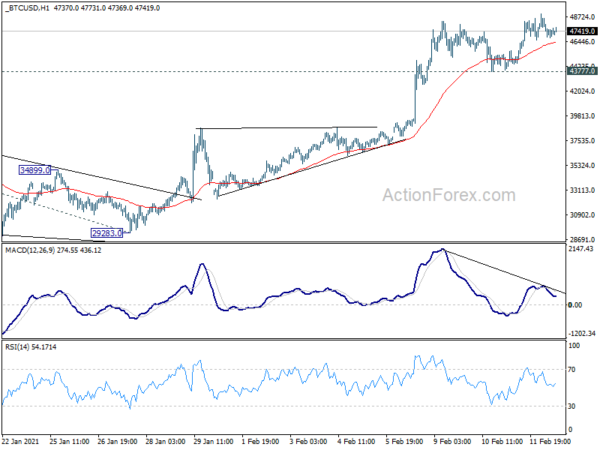

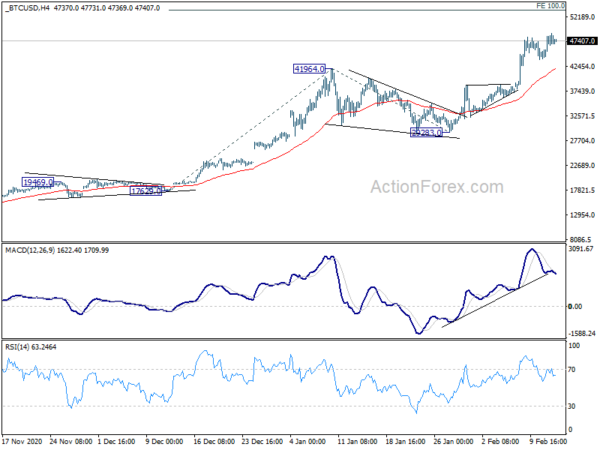

Bitcoin hits new record but lacks follow through buying, more consolidations likely

Bitcoin hits new record high at 48944 earlier today but lags follow through buying so far. Upside momentum is also unconvincing with bearish divergence condition in hourly MACD. For now, we’d continue to expect some strong resistance around 50k psychological level to limit upside and bring near term correction first.

But near term outlook will stay bullish as long as 43777 support holds. We’d expect current up trend to target 100% projection of 17629 to 41964 from 29283 at 53618 next, after completing the envisaged consolidations.

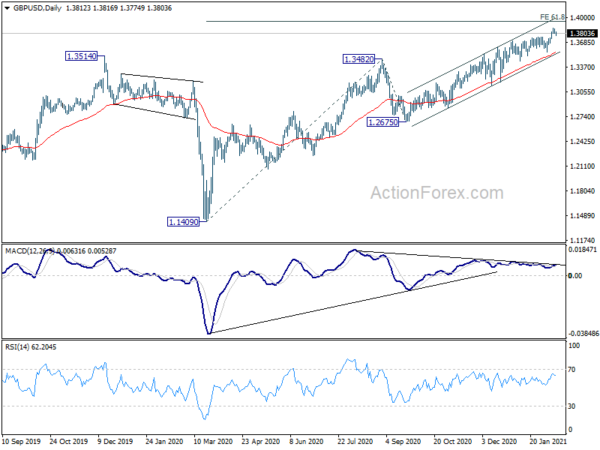

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.3792; (P) 1.3825; (R1) 1.3850; More….

Outlook is GBP/USD remains unchanged. Intraday bias stays neutral and more consolidation could be seen below 1.3865 temporary top. But downside should be contained well above 1.3964 support to bring another rally. On the upside, break of 1.3865 will resume the up trend from 1.1409 to 61.8% projection of 1.1409 to 1.3482 from 1.2675 at 1.3956 next.

In the bigger picture, rise from 1.1409 medium term bottom is in progress. Further rally would be seen to 1.4376 resistance and above. Decisive break there will carry larger bullish implications and open the case of long term up trend. On the downside, break of 1.2675 support is needed to indicate completion of the rise. Otherwise, outlook will stay cautiously bullish even in case of deep pullback.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | NZD | BusinessNZ Manufacturing Index Jan | 57.5 | 48.7 | ||

| 21:45 | NZD | Food Price Index M/M Jan | 1.30% | 0.10% | ||

| 7:00 | GBP | GDP M/M Dec | 1.20% | 1.00% | -2.60% | -2.30% |

| 7:00 | GBP | GDP Q/Q Q4 P | 1.00% | 0.50% | 16.00% | 16.10% |

| 7:00 | GBP | Industrial Production M/M Dec | 0.20% | 0.50% | -0.10% | 0.30% |

| 7:00 | GBP | Industrial Production Y/Y Dec | -3.30% | -4.20% | -4.70% | -3.90% |

| 7:00 | GBP | Manufacturing Production M/M Dec | 0.30% | 0.90% | 0.70% | 1.10% |

| 7:00 | GBP | Manufacturing Production Y/Y Dec | -2.50% | -3.80% | -2.60% | |

| 7:00 | GBP | Index of Services 3M/3M Dec | 0.60% | -0.10% | 3.70% | 4.10% |

| 7:00 | GBP | Goods Trade Balance (GBP) Dec | -14.3B | -15.5B | -16.0B | -14.8B |

| 7:30 | CHF | CPI M/M Jan | 0.10% | -0.20% | -0.10% | |

| 7:30 | CHF | CPI Y/Y Jan | -0.50% | -1.00% | -0.80% | |

| 10:00 | EUR | Eurozone Industrial Production M/M Dec | 2.50% | |||

| 13:30 | CAD | Wholesale Sales M/M Dec | 1.00% | 0.70% | ||

| 15:00 | USD | Michigan Consumer Sentiment Index Feb P | 80.8 | 79 |