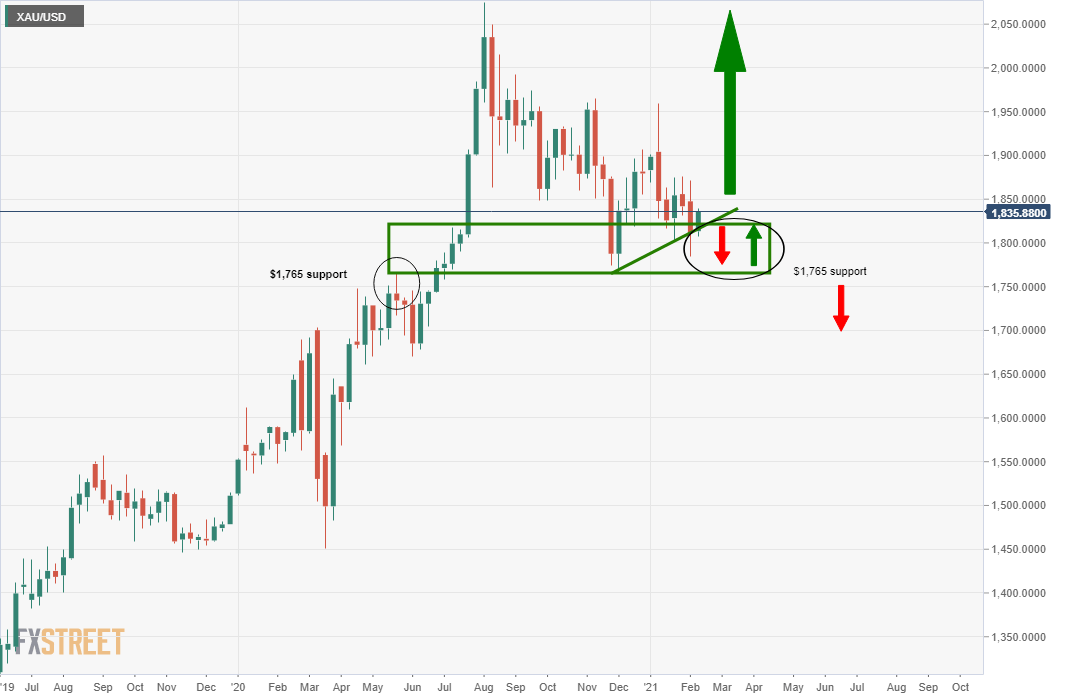

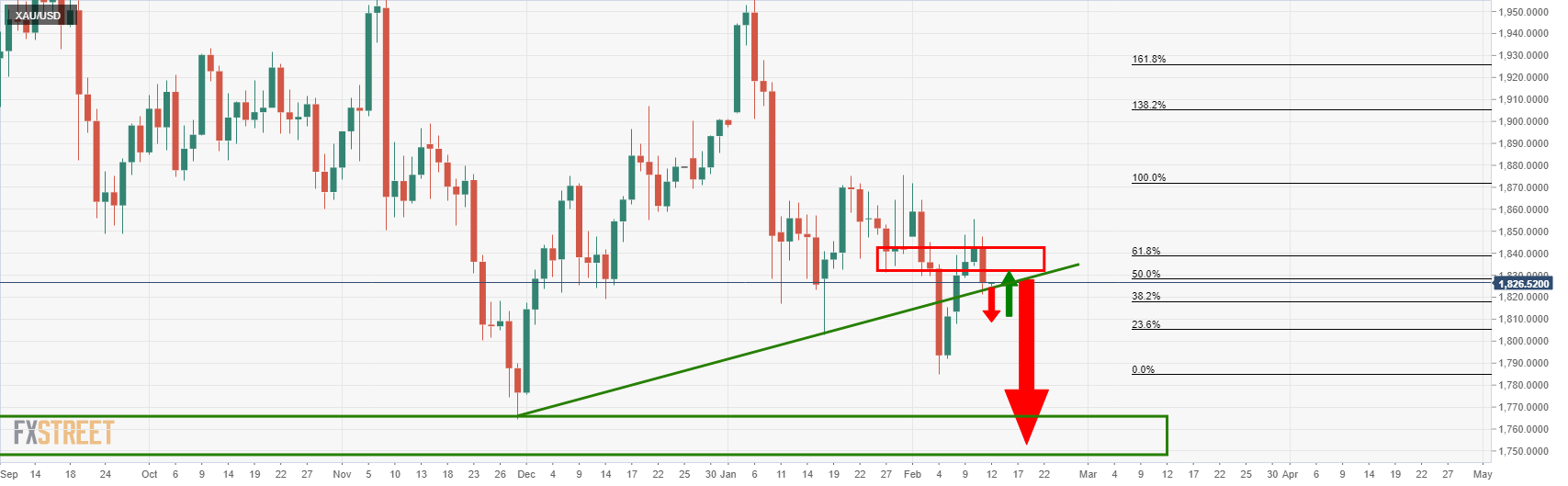

- Gold bulls are making hard work of a tough resistance area.

- The focus is on the downside to weekly support on a hold below resistance.

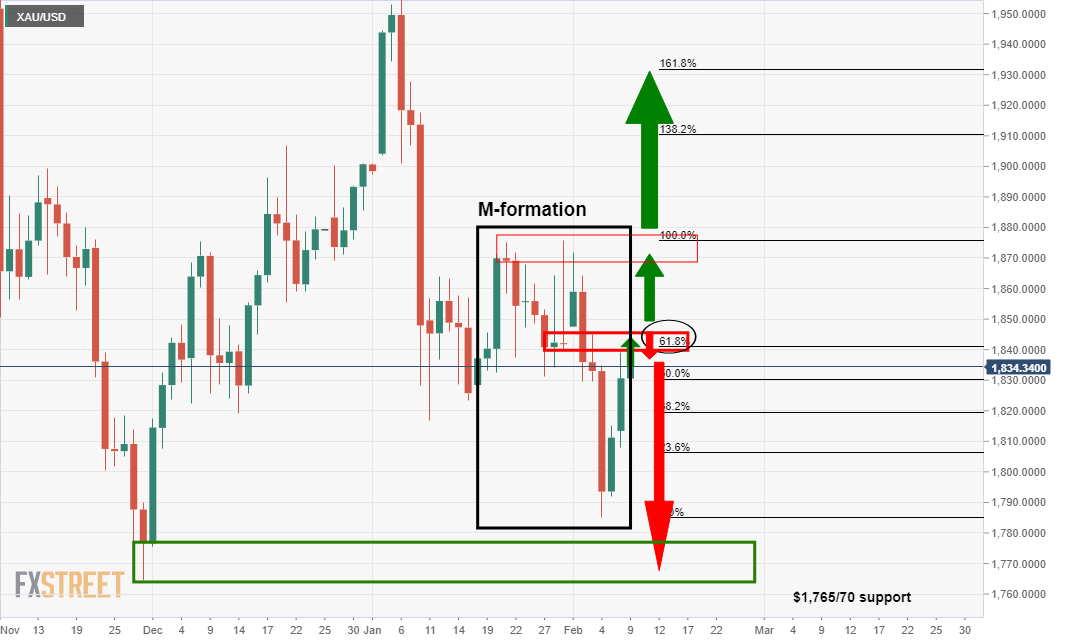

Further to the prior analysis, Gold Price Analysis: USD bears sink their teeth, gold breaks resistance, the break was only partial and the price has subsequently been knocked back below the structure.

The following illustrates where the bias now sits if a retest of the resistance holds.

Prior analysis, Gold

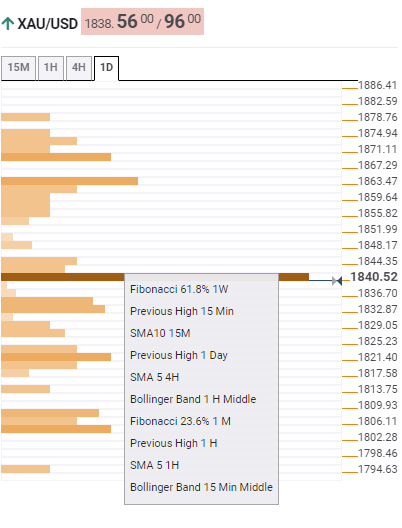

The structure was identified with the FXStreet Confluence Detector as a strong area of resistance:

What is the Technical Confluence Detector?

The FXS Technical Confluence Detector is an in-house tool, developed by FXStreet experts, that allows you to identify those price levels where congestion of indicators like moving averages, Fibonacci levels, Pivot Points occurs. Knowing where these congestion points are located is very helpful as it allows the trader to see these areas of support and resistance easily.

This tool is customizable so you can choose the asset selectors and the time frame that is more suitable for your trading operations.

Live market, Gold

On a restest of the structure, bears will be looking for a downside extension of the bearish trend.

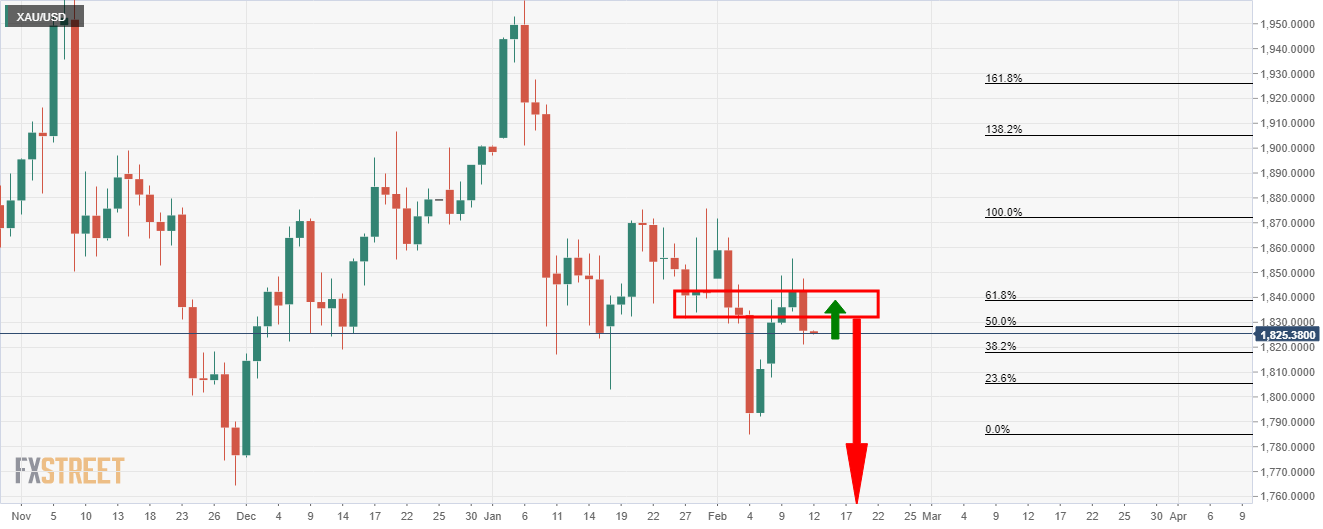

In prior analysis, the downside target was identified as follows and bears will want to now see a break of the dynamic trendline support:

From a daily perspective, this may play out as follows:

RULE-BASED Pocket Option Strategy That Actually Works | Live Trading

RULE-BASED Pocket Option Strategy That Actually Works | Live Trading