Return of risk-on markets, after some solid economic data, pushed S&P 500 and NASDAQ to new record highs overnight. Yen and Swiss Franc trade broadly lower naturally but Euro was not far behind. Commodity currencies, while firm, are so far overwhelmed by Sterling and Dollar. In particular, the greenback will look into today’s non-farm payroll report to solidify its near term rally.

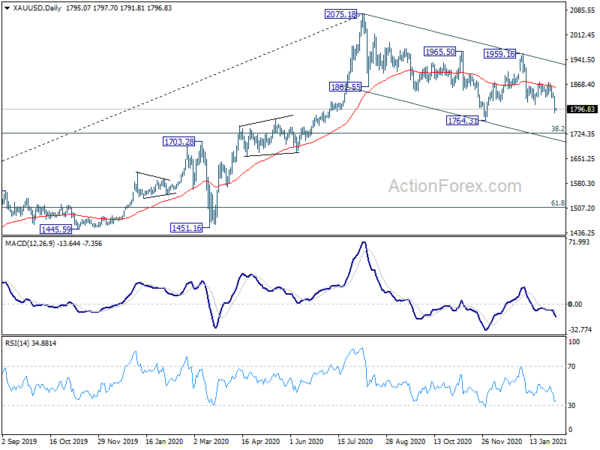

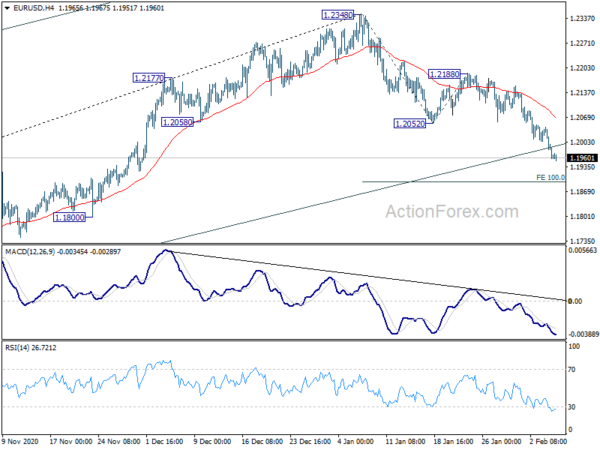

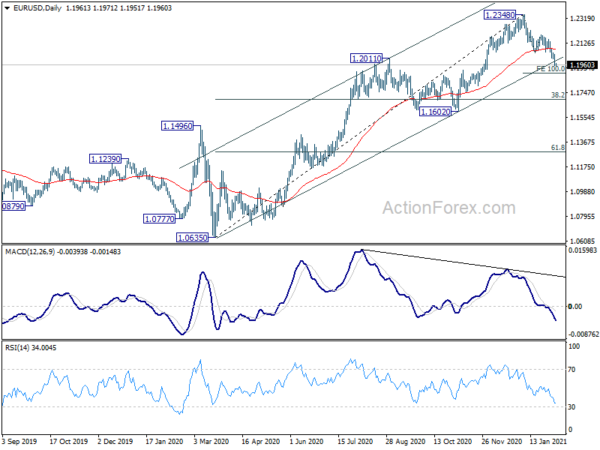

Technically, EUR/USD’s break of the medium term channel support suggests that it’s already corrective the up trend from 1.0635. USD/CHF and USD/JPY are also both extending near term rally. A focus today will be on 1764.31 support in Gold. Firm break there will confirm resumption of the correction from 2075.18. That, if happens, would likely be accompanied by some upside acceleration in Dollar.

In Asia, currently, Nikkei is up 1.27%, Hong Kong HSI is up 0.55%. China Shanghai SSE is up 0.15%. Singapore Strait Times is up 0.11%. Japan 10-year JGB yield is down -0.0012 at 0.058. Overnight, DOW rose 1.08%. S&P 500 rose 1.09%. NASDAQ rose 1.23%. 10-year yield rose 0.008 to 1.139.

RBA Lowe: Interest rates to be low for quite a while yet

RBA Governor Philip Lowe told a parliamentary committee that the central bank was committed to do “everything it reasonably can” to to push the unemployment rate lower and drive wages growth higher. However, even in the most optimistic scenario, inflation won’t be back to its target band before 2023.

“The cash rate will be maintained at 10 basis points for as long as is necessary,” Lowe added. “Interest rates are going to be low for quite a while yet.”

Australia AiG services rose to 54.2, strongest since Nov 2019

Australia AiG Performance of Services rose to 54.2 in February, up from 52.9, highest since November 2019. Ai Group Chief Executive, Innes Willox, said: “With a considerable way to go before a full recovery can be claimed, the more convincing lift in new orders is an encouraging pointer to continuing recovery over coming months. Sales also grew strongly – in part reflecting a release of pent-up demand and higher levels of confidence and employment as the sector continued to recover.”

Also released, retail sales dropped -4.1% yoy in December.

Fed George and Bostic talked down tapering QE this year

Kansas Fed President Esther George said yesterday that the central bank was still “far away” from meeting its objectives. It’s “too soon to try to speculate about” scaling back the asset purchase program. “Until we see the path to getting past this virus, it will be difficult to make any prognosis about when that time might come.” she added.

Separately, Atlanta Fed President Raphael Bostic said, based on his modal economic forecasts, “that’s not my expectation” for Fed to start tapering the asset purchases at the end of this year. “But I will be open to any possibility,” he added. “And that can go in either direction. I think that’s the most important message to come out of this.”

Dollar index eyes 91.74 resistance as NFP awaited

Dollar is currently trading as the strongest one for the week and stays firm, as focus turns to non-farm payrolls report from the US. Markets are expecting 85k job growth in January, while unemployment rate would stay at 6.7%.

Looking at some employment related data, ADP private job growth surprised well to the upside with 174k. ISM manufacturing employment rose modestly from 51.7 to 52.6. ISM services employment, however, staged an impressive turn around, rose form 48.7 to 55.2. Four-week moving average of initial jobless claims, on the other hand rose 11k to 848k. All in all, there is prospect of some upside surprise in today’s NFP report.

Dollar index’s rally this week confirmed short term bottoming at 89.20. Immediate focus is now on 91.74 support turned resistance. Decisive break there will indicate that rise from 89.20 is at least a correction to the down trend form 102.99. In this case, we’d likely see some more upside acceleration in DXY towards 38.2% retracement of 102.99 to 89.20 at 94.46 next.

Elsewhere

Germany factor orders, France trade balance, Swiss foreign currency reserves and Italy retail sales will be released in European session. Later in the day, US NFP and trade balance, Canada employment, trade balance and Ivey PMI will be featured.

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.1932; (P) 1.1988; (R1) 1.2017; More…

EUR/USD’s decline extends to as low as 1.1951 so far. The break of channel support suggests that fall from 1.2348 is correcting whole up trend from 1.0635. Intraday bias stays on the downside for 100% projection of 1.2348 to 1.2052 from 1.2188 at 1.1892 first. Break will target 38.2% retracement of 1.0635 to 1.2348 at 1.1694. For now, risk will stay on the downside as long as 1.2052 support turned resistance holds, in case of recovery.

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally could be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516). This will remain the favored case as long as 1.1602 support holds. We’d be alerted to topping sign around 1.2516/55. But sustained break there will carry long term bullish implications.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | AUD | AiG Performance of Services Dec | 54.2 | 52.9 | ||

| 23:30 | JPY | Overall Household Spending Y/Y Dec | -0.60% | -1.50% | 1.10% | |

| 0:30 | AUD | Retail Sales M/M Dec | -4.10% | -4.20% | ||

| 0:30 | AUD | RBA Monetary Policy Statement | ||||

| 5:00 | JPY | Leading Economic Index Dec P | 94.9 | 95.1 | 96.4 | |

| 7:00 | EUR | Germany Factory Orders M/M Dec | -1.20% | 2.30% | ||

| 7:45 | EUR | France Trade Balance (EUR) Dec | -3.6B | |||

| 8:00 | CHF | Foreign Currency Reserves (CHF) Jan | 891B | |||

| 9:00 | EUR | Italy Retail Sales M/M Dec | 3.20% | -6.90% | ||

| 13:30 | USD | Nonfarm Payrolls Jan | 85K | -140K | ||

| 13:30 | USD | Unemployment Rate Jan | 6.70% | 6.70% | ||

| 13:30 | USD | Average Hourly Earnings M/M Jan | 0.30% | 0.80% | ||

| 13:30 | USD | Trade Balance (USD) Dec | -66.0B | -68.1B | ||

| 13:30 | CAD | Trade Balance (CAD) Dec | -3.3B | |||

| 13:30 | CAD | Net Change in Employment Jan | -62.6K | |||

| 13:30 | CAD | Unemployment Rate Jan | 8.60% | |||

| 15:00 | CAD | Ivey PMI Jan | 46.7 |