Overall, the financial markets are mixed as investor sentiment stabilized. European indices are already reversing initial losses while US futures point to higher open. Commodity currencies are staying generally weak. But buying focus is turning away from Dollar and Yen, to Euro. At the time of writing, the common currency is already the best performing one for the day. There is some upside prospect for the rest of the week.

Technically, EUR/USD managed to defend 1.2052 support so far, providing no additional bearish signal. Focus could be back on 1.2188 minor resistance for indication of stronger rebound. On the other hand, EUR/JPY already breaks 126.39 resistance to resume the rebound from 125.07. A focus now is whether EUR/CHF would break through 1.0798 resistance to solidify upside momentum.

In Europe, currently, FTSE is down -0.62%. DAC is down -0.08%. CAC is up 0.53%. Germany 10-year yield is up 0.0030 at -0.541. Earlier in Asia, Nikkei dropped -1.53%. Hong Kong HSI dropped -2.55%. China Shanghai SSE dropped -1.91%. Singapore Strait Times dropped -1.30%. Japan 10-year JGB yield dropped -0.0056 to 0.037.

US GDP grew 4% annualized in Q4, missed expectations

According to advance estimate, US GDP grew at an annual rate of 4.0% in Q4, below expectation of 4.2%. BEA said: “The increase in real GDP reflected increases in exports, nonresidential fixed investment, personal consumption expenditures (PCE), residential fixed investment, and private inventory investment that were partly offset by decreases in state and local government spending and federal government spending. Imports, which are a subtraction in the calculation of GDP, increased”.

US initial jobless claims dropped to 847k, continuing claims down to 4.77m

US initial jobless claims dropped -67k to 847k in the week ending January 23, below expectation of 875k. Four-week moving average of initial claims rose 16.3k to 868k. Continuing claims dropped -203k to 4771 in the week ending January 16. Four-week moving average of continuing claims dropped -106.8k to 4998k.

Good trade deficit narrowed to USD -82.5B in December, versus expectation of USD -83.4B.

ECB Rehn: Eurozone inflation outlook is too low for my taste

ECB Governing Council member Olli Rehn said an a Bloomberg TV interview, that Eurozone’s inflation outlook is “too low for my taste, and more importantly, too low for our aim”.

But, “I would not enter into a speculation on one or another instrument in our monetary toolbox. I would just say we are indeed ready to use and adjust all our instruments as appropriate,” he said.

“We are closely monitoring developments in the exchange rate, especially regarding the inflation outlook,” he added.

Eurozone economic sentiment dropped to 91.5, led by retail trade

Eurozone Economic Sentiment Indicator dropped to 91.5 in January, down from 92.4, above expectation of 88.7. The ESI’s decrease was driven by sliding confidence in retail trade and smaller losses in services and consumer confidence. Amongst the largest euro-area economies, the ESI dropped in France (-2.6) and Germany (-2.3), while it improved in Spain (+2.4), the Netherlands (+0.6) and Italy (+0.4)

Look at some details, services confidence dropped from -17.1 to -17.8. Consumer confidence dropped from -13.8 to -15.5. Retail trade confidence dropped sharply from -12.9 to -18.9. Construction confidence improved slightly from -8.0 to -7.7. Employment Expectations Indicator dropped from 90.4 to 88.8.

From Germany, CPI rose 0.8% mom, 1.0% yoy in January, above expectation of 0.5% mom, 0.7% yoy.

From Swiss, trade surplus narrowed to CHF 2.88B in December, smaller than expectation of CHF 4.23B.

New Zealand exports dropped -2.7% yoy in Dec, imports rose 4.2% yoy

New Zealand goods exports dropped -2.7% yoy or NZD 149m to NZD 5.3B in December. Imports rose 4.2% yoy or NZD 213m to NZD 5.3B. Monthly trade surplus came in at NZD 17m, well below expectation of NZD 800m.

Exports to China was down NZD -97m, up to USA, EU, Australia and Japan. Imports from China was up NZD 273m, from AU was up NZD 81m, but down from EU, USA and Japan.

From Australia, import price index dropped -1.0% qoq in Q4, versus expectation of -0.9% qoq. From Japan, retail sales dropped -0.3% yoy in December, versus expectation of -0.4% yoy.

EUR/USD Mid-Day Outlook

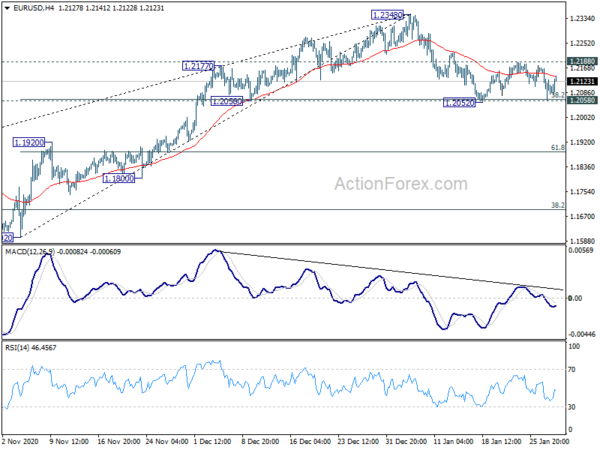

Daily Pivots: (S1) 1.2057; (P) 1.2114; (R1) 1.2168; More…

EUR/USD recovers ahead of 1.2052 support but stays below 1.2188 minor resistance. Intraday bias remains neutral first. On the downside, firm break of 1.2052 will will resume whole correction from 1.2348. Intraday bias will be turned back to the downside for 61.8% retracement of 1.1602 to 1.2348 at 1.1887. On the upside, though, break of 1.2188 resistance will turn bias back to the upside for retesting 1.2348.

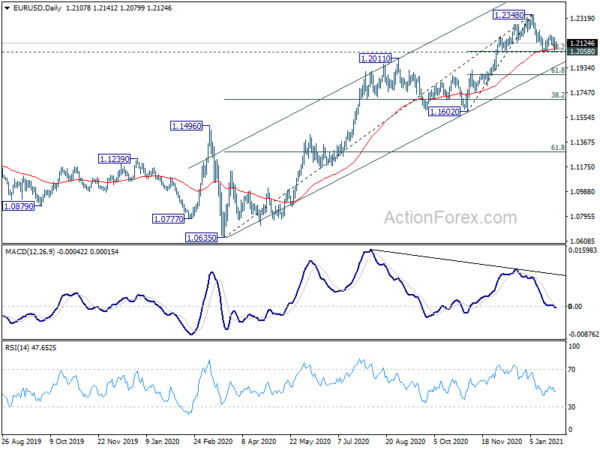

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally could be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516). This will remain the favored case as long as 1.1602 support holds. We’d be alerted to topping sign around 1.2516/55. But sustained break there will carry long term bullish implications.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Trade Balance (NZD) Dec | 17M | 800M | 252M | 290M |

| 23:50 | JPY | Retail Trade Y/Y Dec | -0.30% | -0.40% | 0.60% | |

| 00:30 | AUD | Import Price Index Q/Q Q4 | -1.00% | -0.90% | -3.50% | |

| 07:00 | CHF | Trade Balance (CHF) Dec | 2.88B | 4.23B | 4.46B | 4.48B |

| 10:00 | EUR | Eurozone Economic Sentiment Indicator Jan | 91.5 | 88.7 | 90.4 | 92.4 |

| 10:00 | EUR | Eurozone Services Sentiment Jan | -17.8 | -17.7 | -17.4 | -17.1 |

| 10:00 | EUR | Eurozone Industrial Confidence Jan | -5.9 | -7.2 | -7.2 | -6.8 |

| 10:00 | EUR | Eurozone Consumer Confidence Jan F | -15.5 | -15.5 | -15.5 | |

| 10:00 | EUR | Eurozone Business Climate Jan | -0.27 | -0.41 | -0.4 | |

| 13:00 | EUR | Germany CPI M/M Jan P | 0.80% | 0.50% | 0.50% | |

| 13:00 | EUR | Germany CPI Y/Y Jan P | 1.00% | 0.70% | -0.30% | |

| 13:30 | CAD | Building Permits M/M Dec | -4.10% | -4.90% | 12.90% | |

| 13:30 | USD | Initial Jobless Claims (Jan 22) | 847K | 875K | 900K | 914K |

| 13:30 | USD | GDP Annualized Q4 P | 4.00% | 4.20% | 33.40% | |

| 13:30 | USD | GDP Price Index Q4 P | 2.00% | 2.30% | 3.70% | 3.50% |

| 13:30 | USD | Wholesale Inventories Dec P | 0.10% | 0.50% | 0.00% | |

| 13:30 | USD | Goods Trade Balance (USD) Dec P | -82.5B | -83.4B | -84.8B | -85.5B |

| 15:00 | USD | New Home Sales Dec | 860K | 841K | ||

| 15:30 | USD | Natural Gas Storage | -140B | -187B |