Price is trying to stay above the 100/200 hour MAs

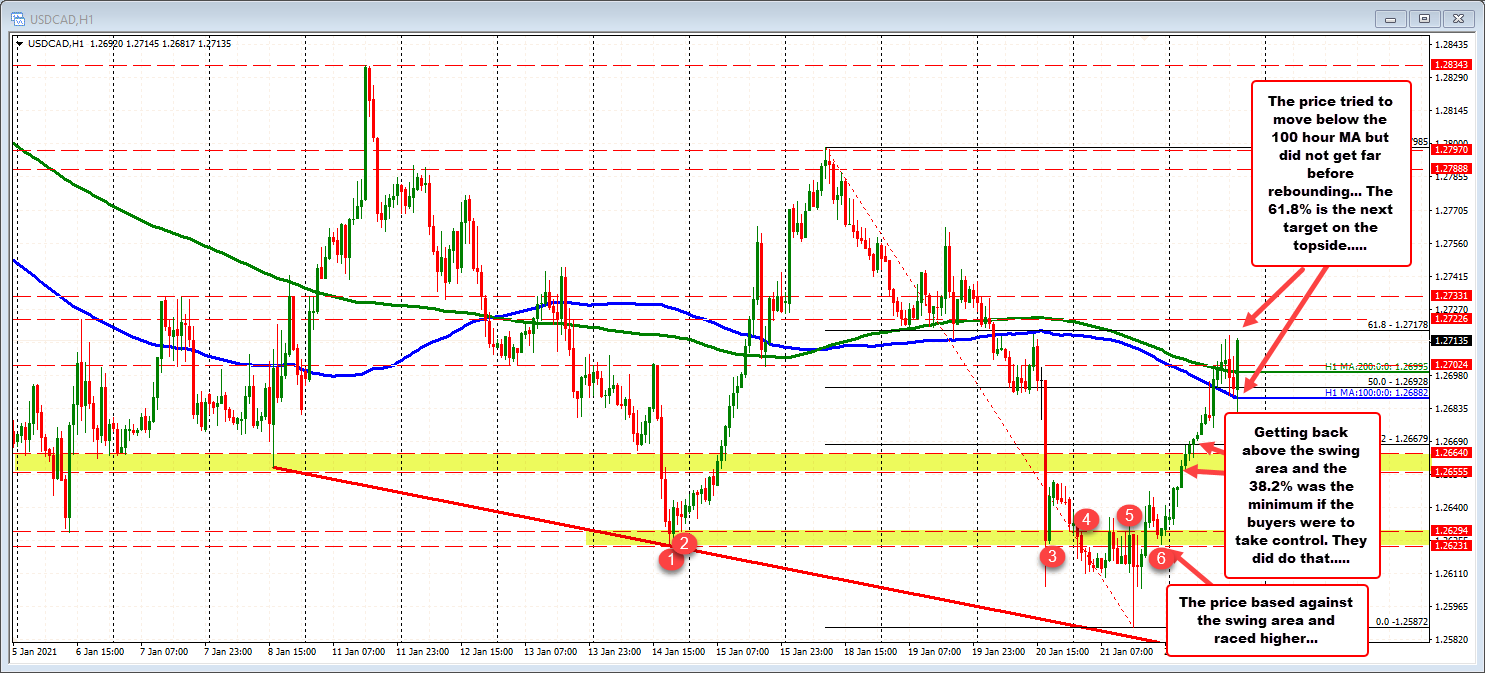

Yesterday, the USDCAD moved to in another low going back to 2018 but in the New York afternoon session was able to extend back above a swing area between 1.2623 and 1.26294. In a post yesterday afternoon, I outlined that if the price could stay above that level, there could be more upside probing, but ultimately the price needed to get back above the 38.2% retracement as a minimum.

The pair did move back down to retest the swing area, based and then raced to the upside. The 38.2% retracement was broken, as was the 100 and 200 hour moving averages (blue and green lines currently at 1.2688 and 1.2699) and the 50% retracement level (at 1.26928). The 61.8% retracement of the week’s trading range at 1.27178 could not be broken. That is the next target if the buyers are to continue to push to the upside (and continue the trend today). Get and stay above should lead to more upside probing.

The pair in the current hourly bar tried to move back below the 100 hour moving average, only to rebound back higher. The buyers remain in control.

This article was originally published by Forexlive.com. Read the original article here.