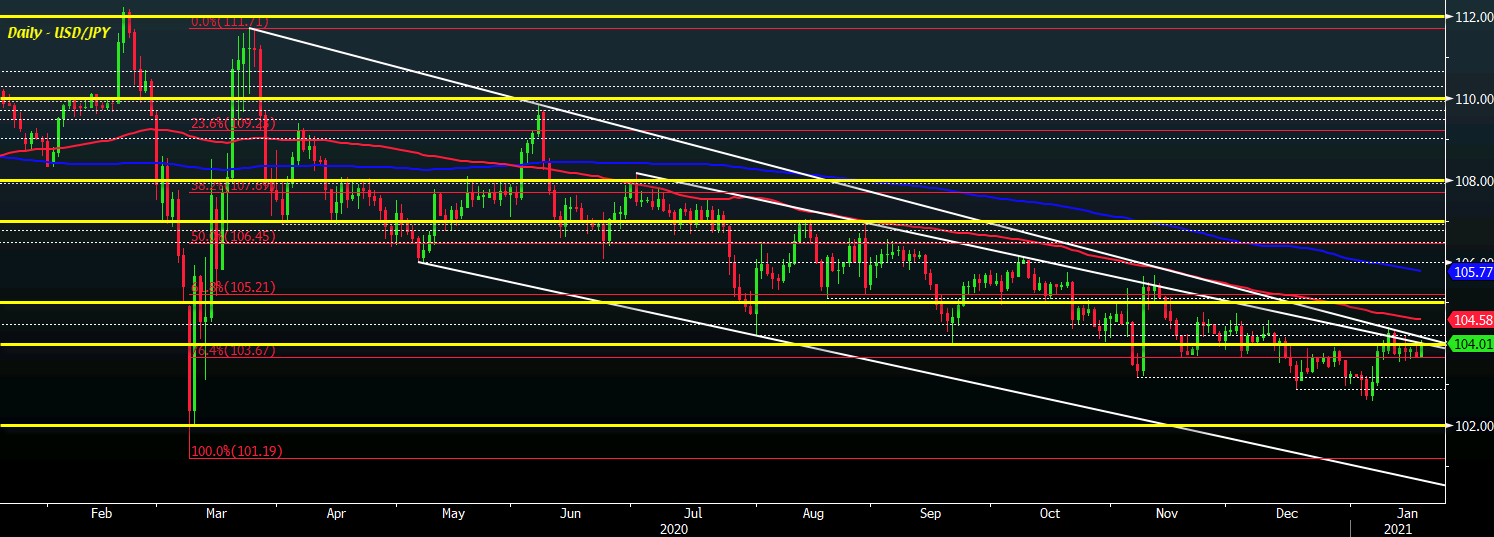

USD/JPY trades higher but runs into key trendline resistance levels once again just above 104.00 currently

The pair is benefiting from a more risk-on start to the day, with Treasury yields also climbing upon the return from the long weekend. 10-year yields are up 2.4 bps to 1.107% and that is keeping added pressure on the yen across the board.

As such, USD/JPY has pushed back up to the 104.00 handle but again, this is where the real challenge lies for buyers in pushing for further upside momentum.

The key trendline resistance levels stretching back to March and June last year sits @ 104.16 and 104.01 respectively, keeping a lid on gains for the time being.

That area remains the key line in the sand that buyers must break above in order to be able to chase any further potential upside, though there is also key resistance at the 100-day moving average (red line) nearby @ 104.58 as well.

Put together, those are the key levels that are keeping sellers “in the game” in arguing for a continued downside push in the pair ever since the retreat in late March last year.

I would say that the bond market remains a key spot to watch in all of this, so we’ll have to see how much gas is still left in the tank in chasing the reflation narrative after a bit of a breather since the end of trading last week.