- NZD/USD broke above a key downtrend on Thursday, though is back of 0.7240 highs now.

- The US dollar weakened predominantly against its more risk-sensitive G10 peers on Thursday, including the kiwi.

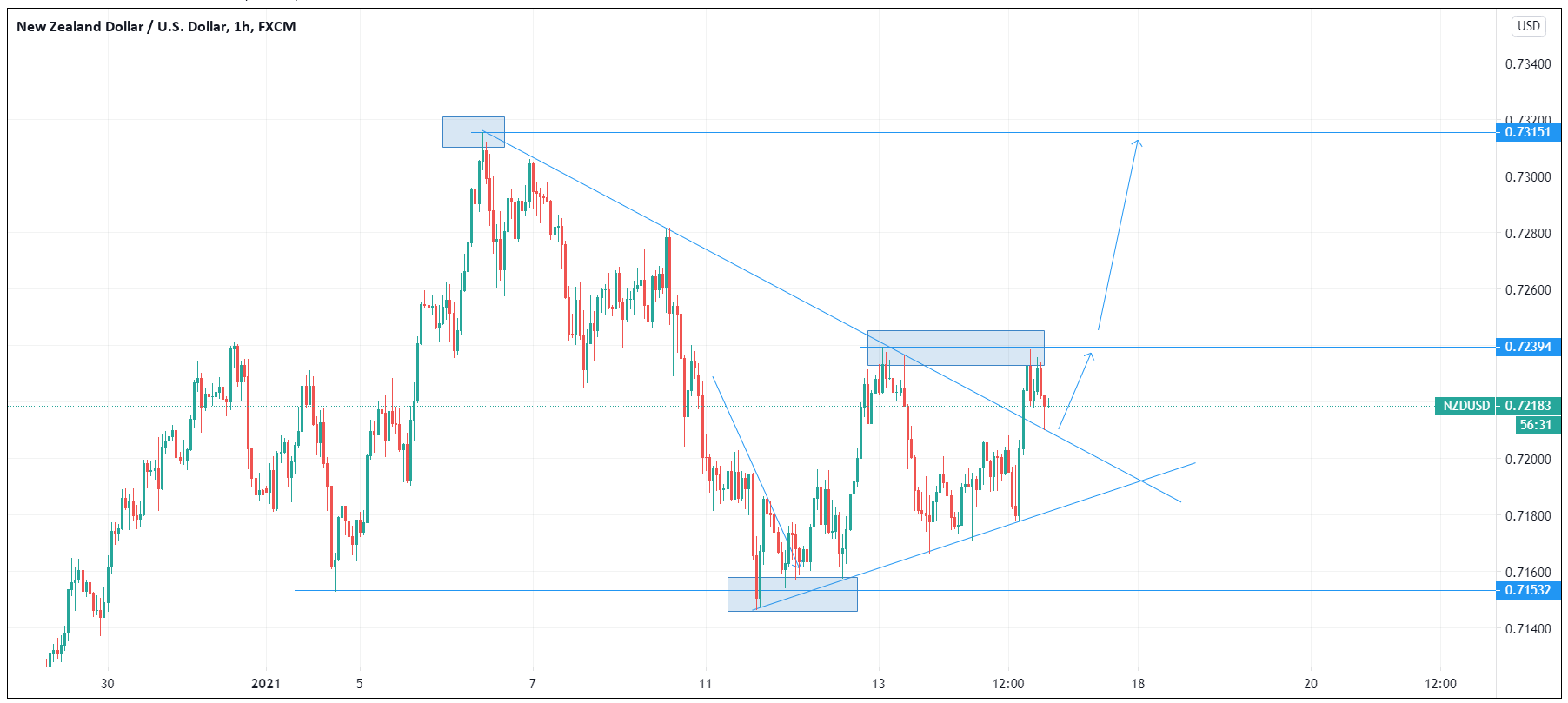

- The pair now appears to be in the early stages of forming an ascending triangle.

NZD/USD has been somewhat on the back foot in recent trade, dropping back from close to session highs in the upper 0.7230s to current levels around 0.7220 and remaining well supported above 0.7200. The pair closed Thursday FX trade with decent gains amid a broadly softer US dollar, rising 0.6% or 46 pips.

The US dollar weakened predominantly against its more risk-sensitive G10 peers on Thursday in the run-up to comments from the Chairman of the Federal Reserve Jerome Powell, who largely stuck to the usual dovish script on Fed policy and on the topic of asset purchase programme tapering, pushed back against the notion that this is going to happen, or indeed should be talked about, soon.

Soft weekly jobless claims data out of the US might have also contributed to weakness in the currency; in the week ending on the 9 January, 965K American signed up for unemployment insurance, a significant spike from the week prior’s 784K reading and well above expectations for 795K. The numbers show that after a rough December for the US labour market (as indicated in last week’s official NFP report), weakness has spilled over to January, which is unsurprising given the rate at which Covid-19 is spreading in the country is yet to relent and many industries (namely hospitality and leisure) are still locked down.

Market participants await to hear from incoming US President Joe Biden on the fiscal stimulus plan he will push for once he gets into office, though many details have now been released.

Biden stimulus plan

Much of the details of this plan have already been leaked. Reuters recently reported that Biden is calling for a $1.9T Covid-19 rescue package, which will include more than $400B to directly bolster the Covid-19 response, $1T in direct relief for household and $440B for businesses and the most-affected communities.

Biden is calling to top up the latest $600 in direct stimulus payments by a further $1400 and also wants to raise the supplemental unemployment benefit to $400 per week from its current $300 per week levels, as well as extending the payments until December. Biden is also calling for a $15/hour minimum wage to be implemented.

NZD/USD breaks above key downtrend, now in ascending triangle

NZD/USD broke above key trendline resistance on Thursday; the pair broke above a downtrend linking the 6, 8 and 13 January highs to rally back to match the previous weekly high at 0.7240. The pair has now retraced for a retest of this downtrend and it is holding up as support for now.

Having set a double top at 0.7240, the pair now appears to be in the early stages of forming an ascending triangle; to the downside, an uptrend links this week’s lows and to the upside, there is, of course, this week’s double top at 0.7240. Ascending triangles typically break to the upside and, if this is the case, a gradual move back towards recent 2021 highs above the 0.7300s.

NZD/USD hourly chart