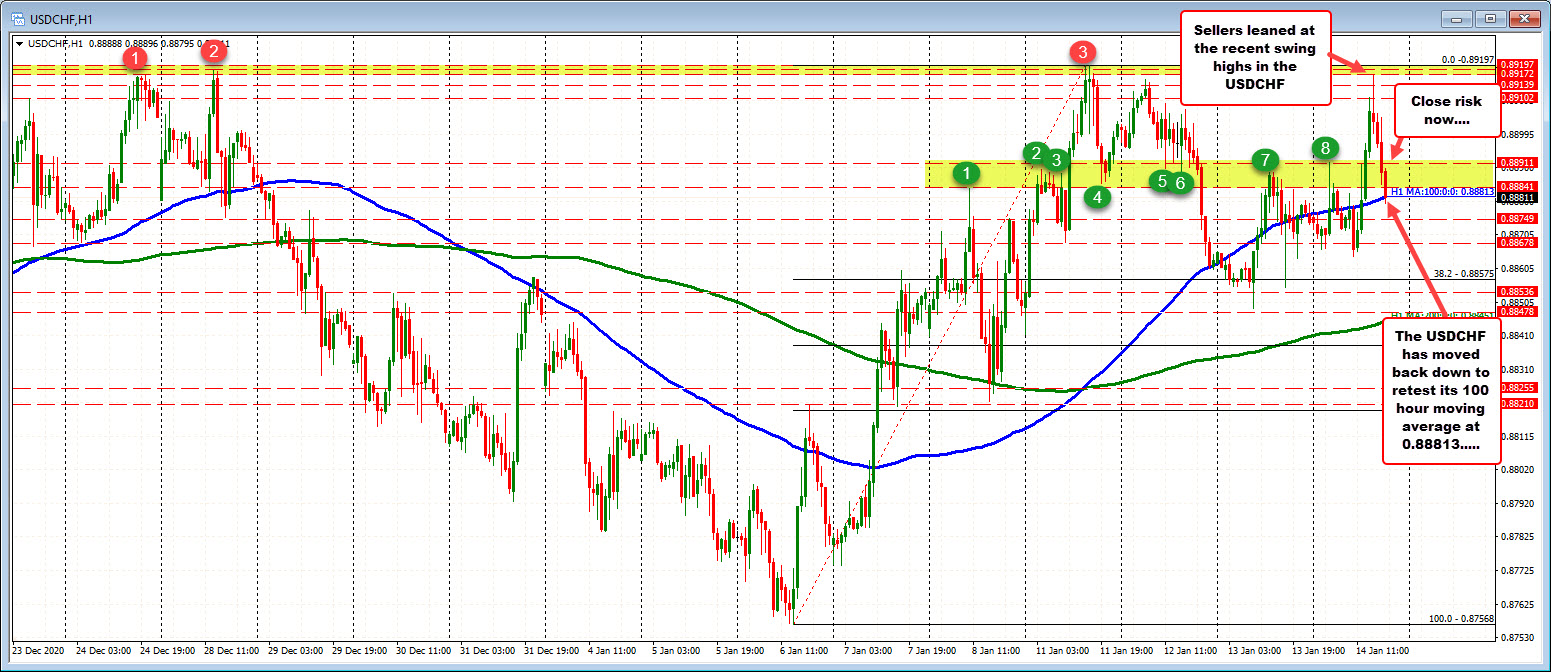

Price has trading above and below the 100 hour MA over the last 2 trading days

The USDCHF is following the USD lower. For this pair, the price high today reached up to the low end of a swing area near recent highs between 0.89172 and 0.89197. The high price today reached 0.89167 and reversed lower. The last 4 hourly bars have seen declines.

The move lower has pushed the price back to retest its 100 hour moving average at 0.88813. Admittedly over the last few days, the price has chopped up and down above and below that moving average line. So I can say traders are hinged on it as a key borderline.

Nevertheless, a break below should be more bearish. As a close risk level now, watch the swing area between 0.88841 and 0.88911 as short-term resistance. That area is home to a number of swing levels over the last 5 trading days (see green numbered circles). Stay below keeps the sellers more in control.

On the downside, the close from yesterday was at 0.8875 is a level to target. The low price today reached 0.8864. Getting below both those levels would have traders looking toward the 38.2% retracement of the move up from the January 6 low at 0.88575. The low from yesterday (0.8849), and the rising 200 hour moving average at 0.88451 would also be eyed.