- Spot silver prices are off highs set during Asia Pacific trade and thus trade lower on the day.

- The technical picture looks bullish, however, though further gains are likely to wait until January.

- Spot silver was the best performing precious metal in 2020 after years of underperformance.

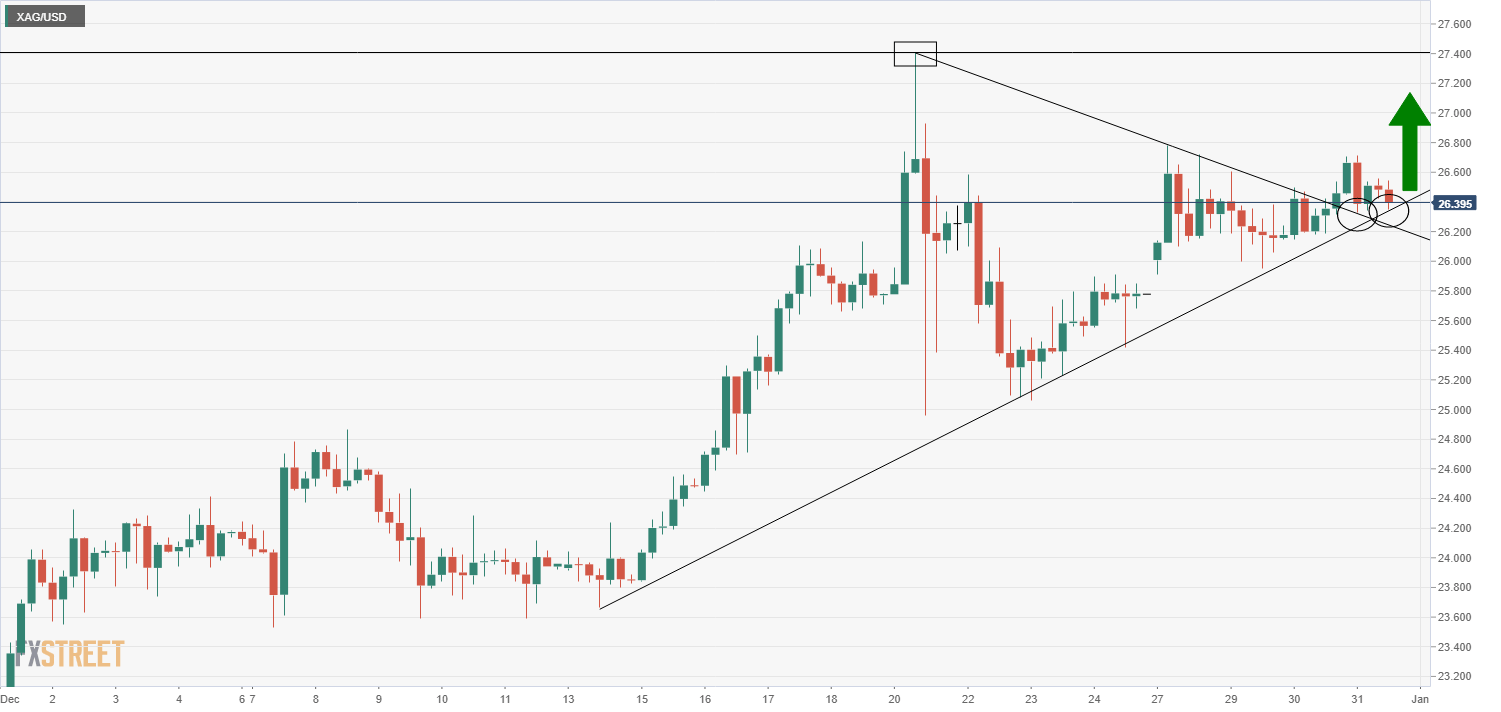

Spot silver (XAG/USD) prices broke to the upside of a short-term bull flag and longer-term pennant structure flagged in an article on Wednesday, with prices rallying as high as $26.70 in early Thursday Asia session trade before sliding back to current levels around $26.50. With the metal off its Asia Pacific highs, it currently trades with losses on the day of more than 1% or around 30 cents. However, note that prices found support at $26.30 upon the retest of the previously broken above the short-term bull flag and longer-term pennant, implying that further upside from current levels is likely.

However further upside might have to wait until January; markets have been incredibly quiet on the final trading day of the year, with much of Europe shut for Christmas Eve holidays and many market participants on both sides of the Atlantic away on vacation anyway. Year-end portfolio rebalancing flows have been distorting trade this week and have generally worked against the favour of the US dollar (and in favour of precious metals such as gold and silver) and there could be some fireworks at the final 4pm London Fix of the year (when global financial institutions will take the average over exchange rates over a two-minute window in order to value their international portfolios, hence why the time period can see some manipulation).

2020: Silver’s year…

Spot silver was the best performing of the four major precious metals and looks set to finish the year with gains of around 56.5%, significantly outstripping spot palladium’s gains of just over 30%, spot gold’s gains of just under 30% and spot platinum’s gains of around 19.5%. An unprecedented expansion of the money supply by major central banks across the globe (most notably, the Fed) amid the Covid-19 crisis was the main factor behind the impressive gains seen across precious metals markets. In terms of the reason behind silver’s outperformance, it seems as though some catch up following years of underperformance was at play.

At the start of the year, spot silver prices were over 60% down from their all-time highs set back in 2011. Meanwhile, spot gold was around 28% below its all-time highs set back in 2011. Of course, spot gold went on the smash through its 2011 highs and cross above the $2000 mark for the first time by Q3 2020. Whether spot silver can match this feet in 2021 seems unlikely, given it would need to appreciate more than 80% from current levels in the $26.00s to break above all-time highs close to $48.00. So while 2021 might not see new all-time highs for silver, if precious metals continue to do well, there is every chance that XAG/USD continues to be the best performer out of the bunch as it continues to unwind that prolonged period of underperformance seen throughout the 2010s.

XAG/USD four hour chart

#shorts #crypto #forex #trading #patterns

#shorts #crypto #forex #trading #patterns