Euro’s rally is a focus in rather quiet markets today. Clearance of no-deal Brexit risk was a positive for the common currency. There’s additional boost from rumors that a EU-China investment deal is likely this week. However, we’d like to point out that European Commission formally (in a statement) criticized China’s “torture” and “ill-treatment” of the arrested citizen journalist, who reported the coronavirus outbreak in Wuhan which started the this year’s pandemic. It’s unsure whether China would politicize trade and investment relationship for political retaliation. We’ll see if the investment deal would really come through soon. Meanwhile, Yen and Dollar are the weaker ones. Yen’s selloff in in tandem with the strong upside breakout in Nikkei today.

Technically, immediate focus is on 1.2272 resistance in EUR/USD. Break there would further affirm EUR/JPY’s broad based strength. Separately, we’d also keep an eye on 0.8822 support in USD/CHF. Break will resume the larger down trend, and could prompt deeper decline is Dollar elsewhere.

In Europe, currently, FTSE is up 2.03%. DAX is up 0.23%. CAC is up 0.46%. Germany 10-year yield is down -0.011 at -0.565. Earlier in Asia, Nikkei rose 2.66%. Hong Kong HSI rose 0.96%. China Shanghai SSE dropped -0.54%. Singapore Strait Times rose 0.28%. Japan 10-year JGB yield rose 0.0052 to 0.027.

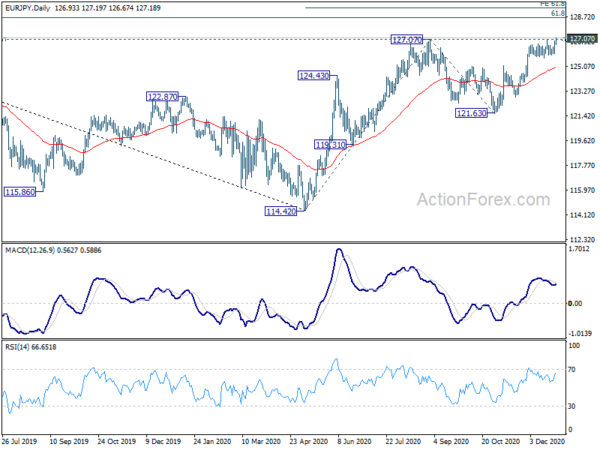

EUR/JPY upside breakout, EUR/USD to follow?

EUR/JPY’s rally accelerates today and break of 127.07 resistance confirms resumption of whole rise form 114.42. Next target should be long term fibonacci level of 61.8% retracement of 137.49 (2018 high) to 114.42 at 128.67.

Focus should also be on 1.2272 resistance in EUR/USD. Firm break there would affirm underlying strength in Euro. EUR/USD should then target 61.8% projection of 1.0635 to 1.2011 from 1.1602 at 1.2452. That could also bring stronger rise in Euro elsewhere.

Nikkei hit new 30-yr high, up trend back in force

After a few weeks of consolidation in tight range, Nikkei finally followed strong global risk appetite and staged an upside break out today. It closed up 714 pts, or 2.66%, at 27568.15, a new 30-year high. Next near term target is 100% projection of 16358.19 to 23178.10 from 21710.00 at 28529.91.

Much more importantly, it has now taken out a key multi-decade fibonacci level. That is 61.8% retracement of 39260 (1989 high) to 6994.89 (2009 low) at 26934.72. The long term up trend from 6994.89 should now have the potential to extend to a new record high, in medium term long term. Japan is heading back to its glory days, after a few lost decades.

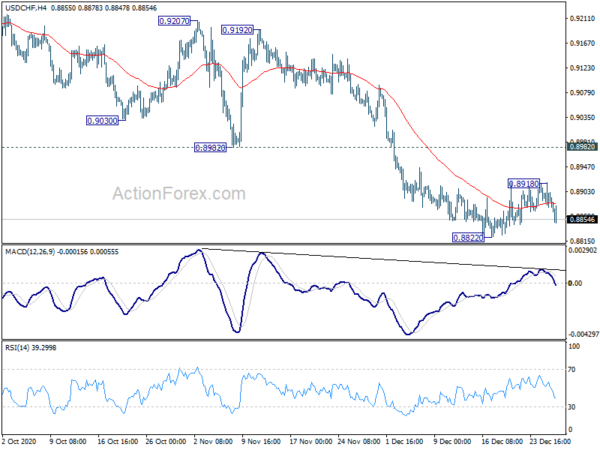

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.8869; (P) 0.8894; (R1) 0.8912; More….

USD/CHF is still holding above 0.8822 temporary low despite today’s decline. Intraday bias remains neutral first. In case of another recovery, upside should be limited by 0.8982 resistance to bring fall resumption. On the downside, break of 0.8822 will resume larger down trend for 61.8% projection of 0.9901 to 0.8998 from 0.9304 at 0.8746 next.

In the bigger picture, decline from 1.0237 is seen as the third leg of the pattern from 1.0342 (2016 high). There is no clear sign of completion yet. Next target will be 138.2% projection of 1.0342 to 0.9186 from 1.0237 at 0.8639. In any case, break of 0.9304 resistance is needed to signal medium term bottoming. Otherwise, outlook will remain bearish in case of rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 14:00 | USD | S&P/Case-Shiller Home Price Indices Y/Y Oct | 6.90% | 6.60% |