The USD is weaker

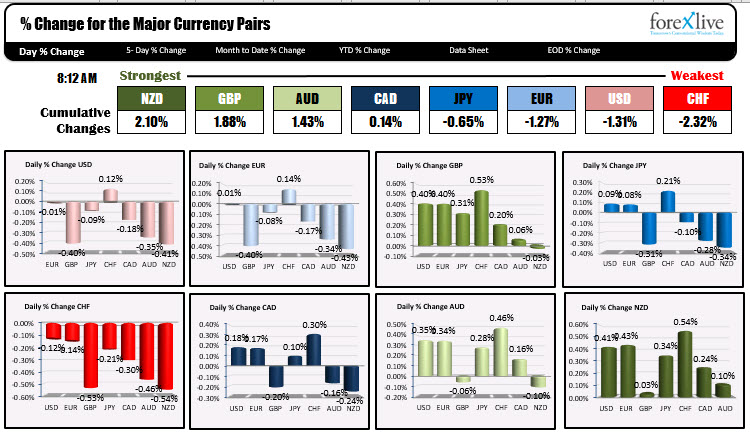

As the North American session begins the NZD is the strongest and the CHF is the weakest. The USD is weaker as the market prepares for the last batch of data today including Durable goods, Initial jobless claims, personal income and spending, PCE deflator data and Canada GDP. All will be released at 8:30 AM ET/1330 GMT. Later at 10 AM ET, the Univ of Michigan final sentiment indicator will be released along with US new home sales. At 10:30 the weekly energy data will be released and that will do it for the Christmas week. Ho! Ho! Ho! (and we need it).

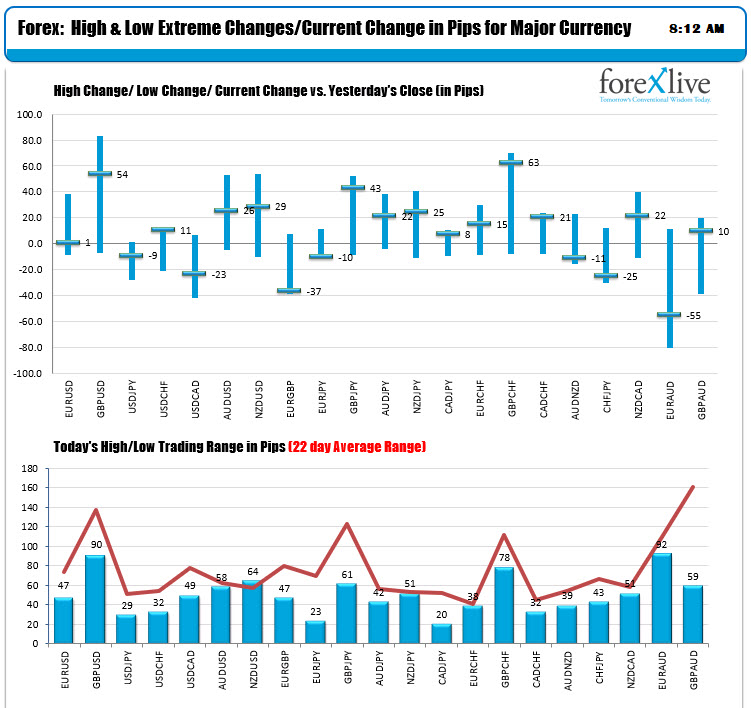

The ranges and changes are showing modest ranges relative to the 22 day averages. The major currency pairs ranges are mostly off extremes (the USDCHF is at the highs though after falling earlier). JPY pairs are mixed.

In other markets:

- spot gold is trading up $3 or 0.16% $1863.92

- spot silver is trading up $0.24 or 0.99% at $25.44

- WTI crude oil futures are trading unchanged $47.01

in the US premarket for stocks, the major indices are modestly higher

- Dow Jones up 65 points

- NASDAQ up 4 points points

- S&P index up 7 points

European shares are higher:

- German DAX, +0.7%

- France’s CAC, +0.6%

- UK’s FTSE 100, unchanged

- Spain’s Ibex, +0.7%

- Italy’s FTSE MIB, +0.6%

in the US debt market, yields are little changed

- 2 year 0.116%, +0.4 basis points

- 5 year 0.360%, unchanged

- 10 year 0.916%, unchanged

- 30 year 1.652%, +0.4 basis points