Gold is trading up by over 5% since the start of the month

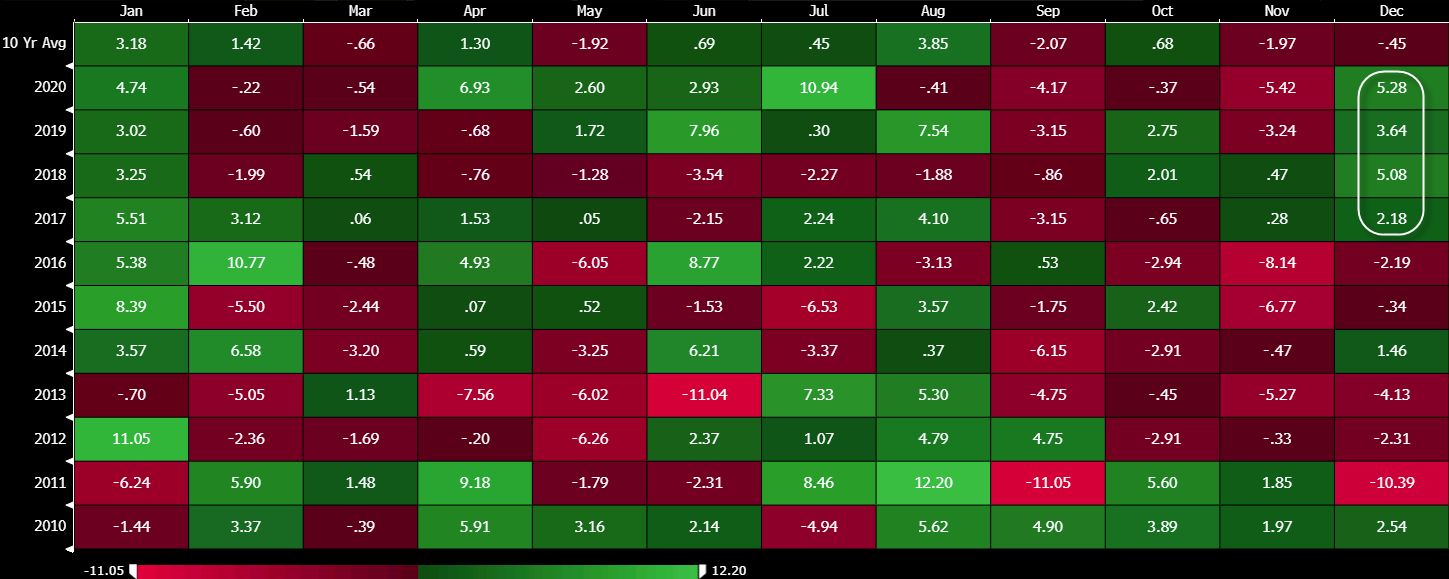

As things stand, gold is up over 5% on the month and hasn’t had a losing December since 2016 as the typical January buying has started to spill over into December in recent years. The seasonal chart shows gold has not had a losing January since 2013:

However, as we drill down to the charts:

The pullback in gold from earlier in the week comes as we see price action test $1,900 and the 100-day moving average close to $1,904 at the time.

The drop was rather quick on Monday but buyers held on to the 200-hour moving average before price consolidated between that and $1,880 levels for the time being.

Of note, buyers are still defending the key near-term level since overnight trading with price action now resting in between the key hourly moving averages.

That hints the near-term bias is more neutral for now as the year starts to wind down.

Although gold has had a stellar month so far, there are key levels that it needs to break in order to extend the upside momentum currently.

A push back above the 100-hour moving average (now @ $1,878.80) will see buyers seize near-term control but the key level they need to break will be the $1,900 handle as well as the 100-day moving average (now @ $1,901.45).

That sort of momentum might not come until we get into January trading, which looks promising for gold (⬆). But with some “front running” on the seasonals already taking place, can gold make it eight years in a row that it starts off with a win?

Buyers are certainly not giving up hope just yet as seen by the near-term price action but we’ll see once the market gets back into full swing in two weeks’ time.