GBP/USD sees 100 pip spike on UK PM’s “last ditch” push for a Brexit deal

Reports from Bloomberg that the UK PM Boris Johnson is making a final “last-ditch” push for a Brexit with a new compromise on the issue of fisheries has spurred significant GBP upside in recent trade. GBP/USD spiked as high as 1.3496 from below 1.3400 prior to the news breaking. The pair still trades lower by around 0.4% or 60 pips on the day, however, as markets wait to see how the Europeans respond to this offer.

At around 19:30GMT, Bloomberg reported that the EU is considering a new offer on fishing rights from the UK as PM Johnson reportedly looks to secure an “11th-hour” trade deal with the bloc. Under the new UK offer, EU would reduce the value of fish caught in UK waters by 35% over a five-year transition period, a big drop from demands last week that the EU reduce the value of their catch by 60%.

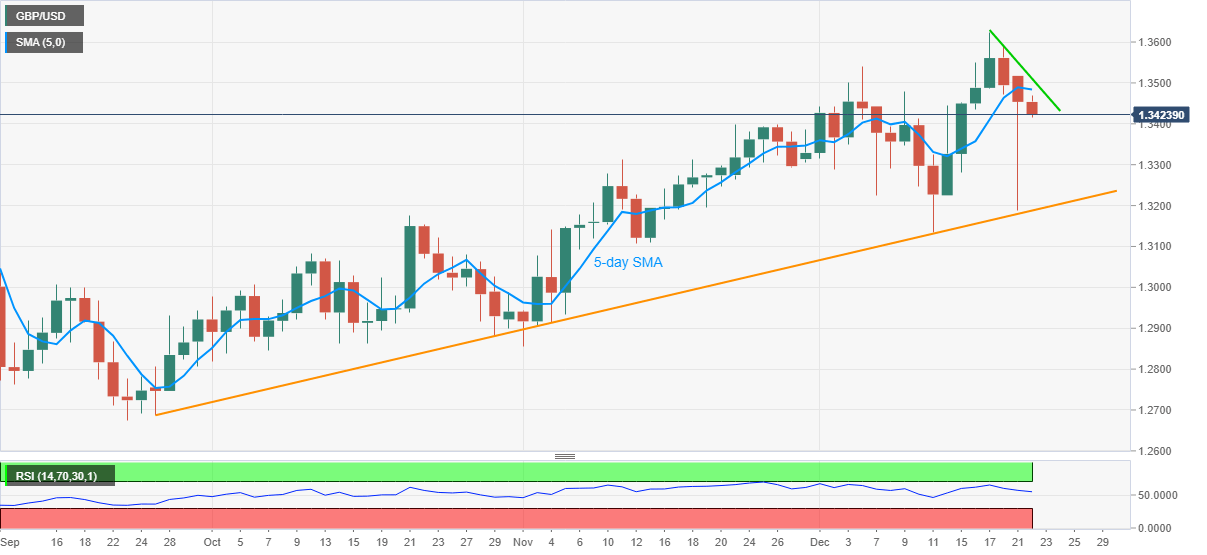

GBP/USD Price Analysis: Sellers attack 1.3400 with eyes on three-month-old support line

GBP/USD refreshes intraday low to 1.3415, down 0.28%, during early Tuesday’s trading. The pair dropped to the lowest since December 11 the previous day before bouncing off an ascending trend line from the late-September. Though, a daily closing below 5-day SMA backs the recent lower high pattern to favor the bears.

As a result, the early November high near 1.3315 is likely returning to the chart while the stated support line, at 1.3187 now, can please GBP/USD bears afterward.