UK FTSE 100 near unchanged for the week. Other indices lower

The European shares are ending the week on a sour note with all the major indices lower. For the week, apart from the UK FTSE 100 which is near unchanged, the major indices all fell.

The provisional closes are showing:

- German DAX, -1.37%. This was the worst session since late October

- France’s CAC, -0.72%

- UK’s FTSE 100, -0.73%

- Spain’s Ibex, -1.4%

- Italy’s FTSE MIB, -0.86%

For the week:

- German DAX, -1.39%

- France CAC, -1.8%

- UK’s FTSE 100, unchanged

- Spain’s Ibex, -3.1%

- Italy’s FTSE MIB, -2.1%

in other markets as London/European traders look to exit:

- spot gold is trading up $6.39 or 0.35% at 1843

- spot silver is trading unchanged at $23.99

- WTI crude oil futures are trading down $0.19 -0.41% of $46.59

in the US stock market, the NASDAQ index is trading near lows and continues to lead the downside:

- S&P index -26 points or -0.72% at 3642

- NASDAQ index -112 points or -0.90% at 12293.42

- Dow industrial average -108 points or -0.36% at 29891

in the US debt market, yields are lower:

- 2 year 0.119%, -1.7 basis points

- 5 year 0.352%, -3.3 basis points

- 10 year 0.876%, -3.0 basis points

- 30 year 1.605%, -2.2 basis points

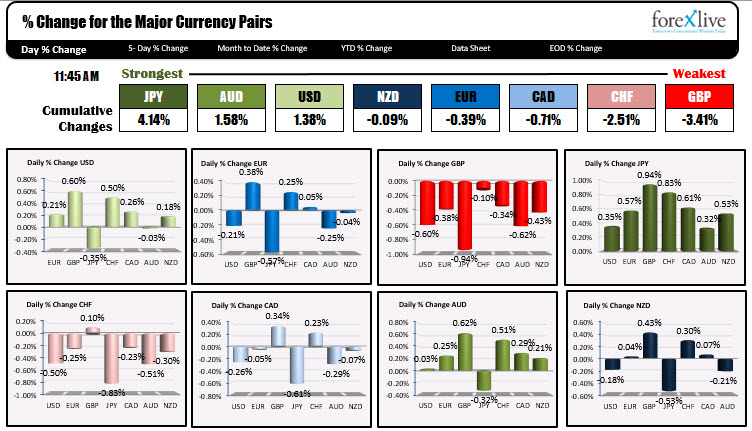

In the forex, the JPY remains the strongest of the majors and the GBP is still the weakest. However the GBP has seeing a rebound from early NY session lows. The USD is higher but off higher levels from earlier in the session. The USD has lost some of the earlier gains vs the GBP, and fell vs the JPY as well. The greenback has risen vs the EUR and CHF, and is near early NY levels vs the CAD, AUD and NZD.