Daily thread to exchange ideas and to share your thoughts

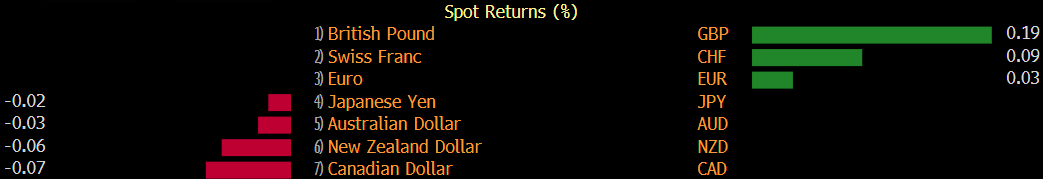

Major currencies are mostly little changed so far on the day, with the pound sitting a little higher after a rebound from key support in trading yesterday.

We’re still awaiting more concrete news from London but price action reaffirms that this is a market itching to buy up the pound. Barnier and Frost’s respective briefings today may offer something for traders to work with later on in the day.

The dollar continues to keep weaker across the board, with AUD/USD breaching above 0.7400 and more notably EUR/USD climbing above 1.2100 and blowing past any talk of trying to sustain above the 1.2000 handle.

That allows the pair to roam between current levels and 1.2500, although year-end rebalancing flows may have the potential to temper with the run in the coming weeks.

Elsewhere, oil is still trading more sideways this week as we await the OPEC+ meeting later today while gold is keeping some slight upside momentum since climbing back above $1,800 with the dollar keeping weaker in general.

The bond market is also an interesting spot to watch as 10-year Treasury yields starts to near 1% amid stimulus and vaccine optimism. But as long as yields don’t threaten to run too far, too fast, then equities can still benefit from a broader risk-on narrative as well.

RULE-BASED Pocket Option Strategy That Actually Works | Live Trading

RULE-BASED Pocket Option Strategy That Actually Works | Live Trading